President Donald Trump’s radical new tariff regime has generated a surge in revenue from importers that must pay higher duties — and the United States has now generated 174.2% more revenue from them so far this year compared with last year.

But is it enough to replace the income tax as the main source of funding for the federal government, as Trump administration officials have argued?

Treasury Department data shows that will be a massive stretch.

Tariff revenues have been growing for months, and the latest data shows that the U.S. has collected $223.9 billion from them as of Oct. 31 — $142.2 billion more than the same time last year. But that’s still far short of the $2.4 trillion federal income taxes brought in last year.

The current difference in tariff revenue year-on-year is just part of the story. High levies can cause huge surges in revenue that later level off as trade patterns shift and businesses seek to lower costs along their supply chains.

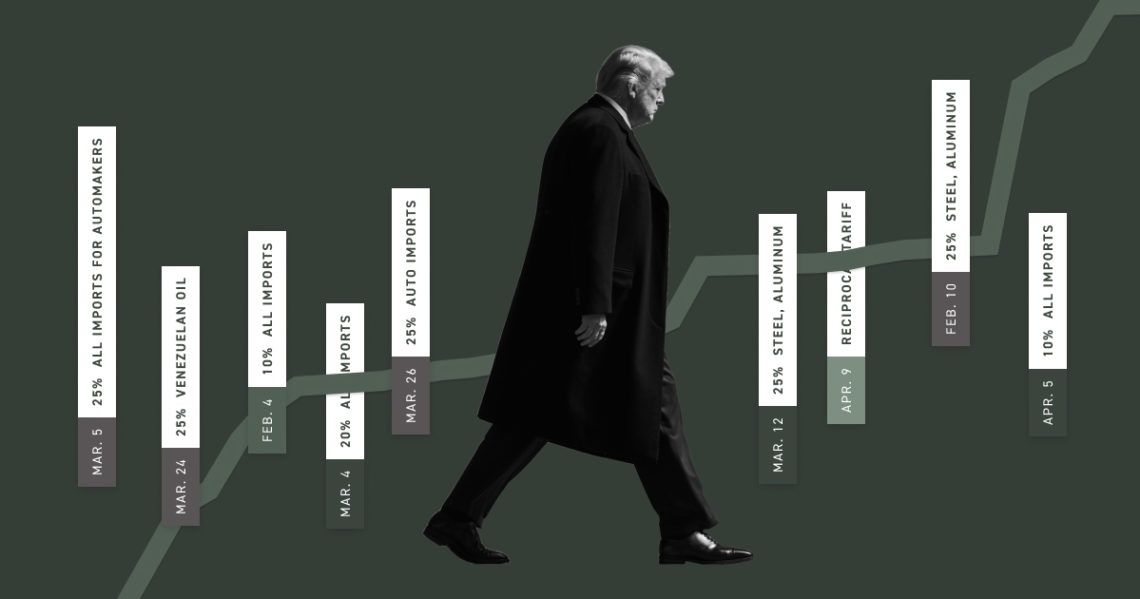

But with Trump trying to undo the global status quo, there’s a lot to watch for. Even though plenty of attention has been put on the president’s gambit to impose — and then pause — a series of steep “reciprocal” tariffs against dozens of countries, the trade barriers he’s kept in place haven’t been this high in a century. Matters are even more complicated after Trump’s tit-for-tat escalation with China, America’s No. 3 trading partner.

Tracking the fluctuations in revenue over the coming weeks and months will help give a sense of what’s happening.

The University of Pennsylvania’s Penn Wharton Budget Model makes that easy to do, cleaning up and analyzing raw data the Treasury Department releases each weekday. As that data fills in this chart, it creates a staircase we can search for clues to how Trump’s tariffs are reshaping trade flows and how much money they are bringing into U.S. coffers.

See the charts here.

The post Are Trump’s tariffs making money? Watch this chart. appeared first on Politico.