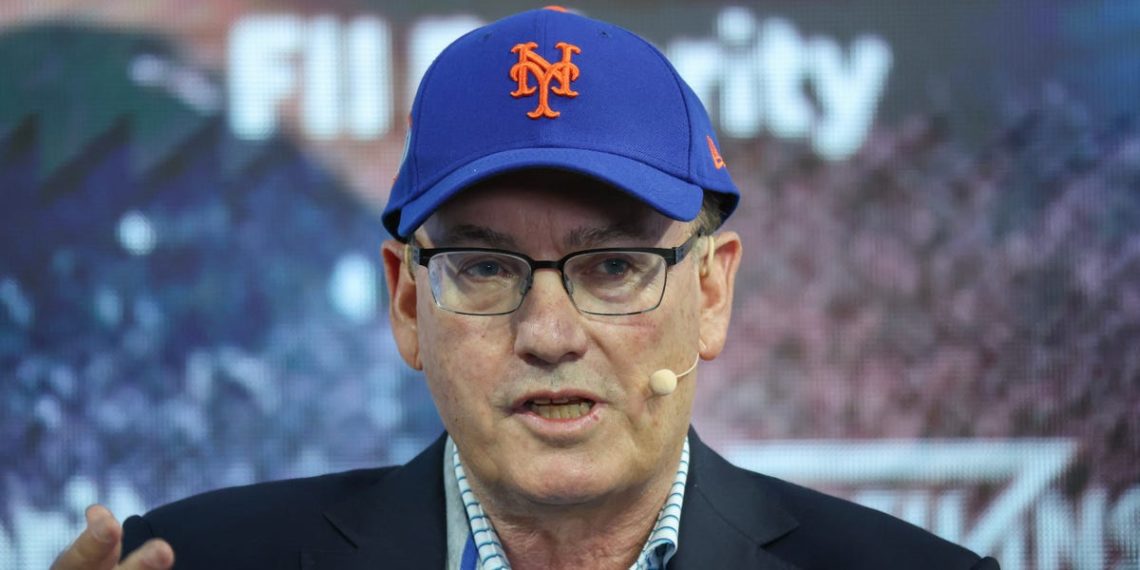

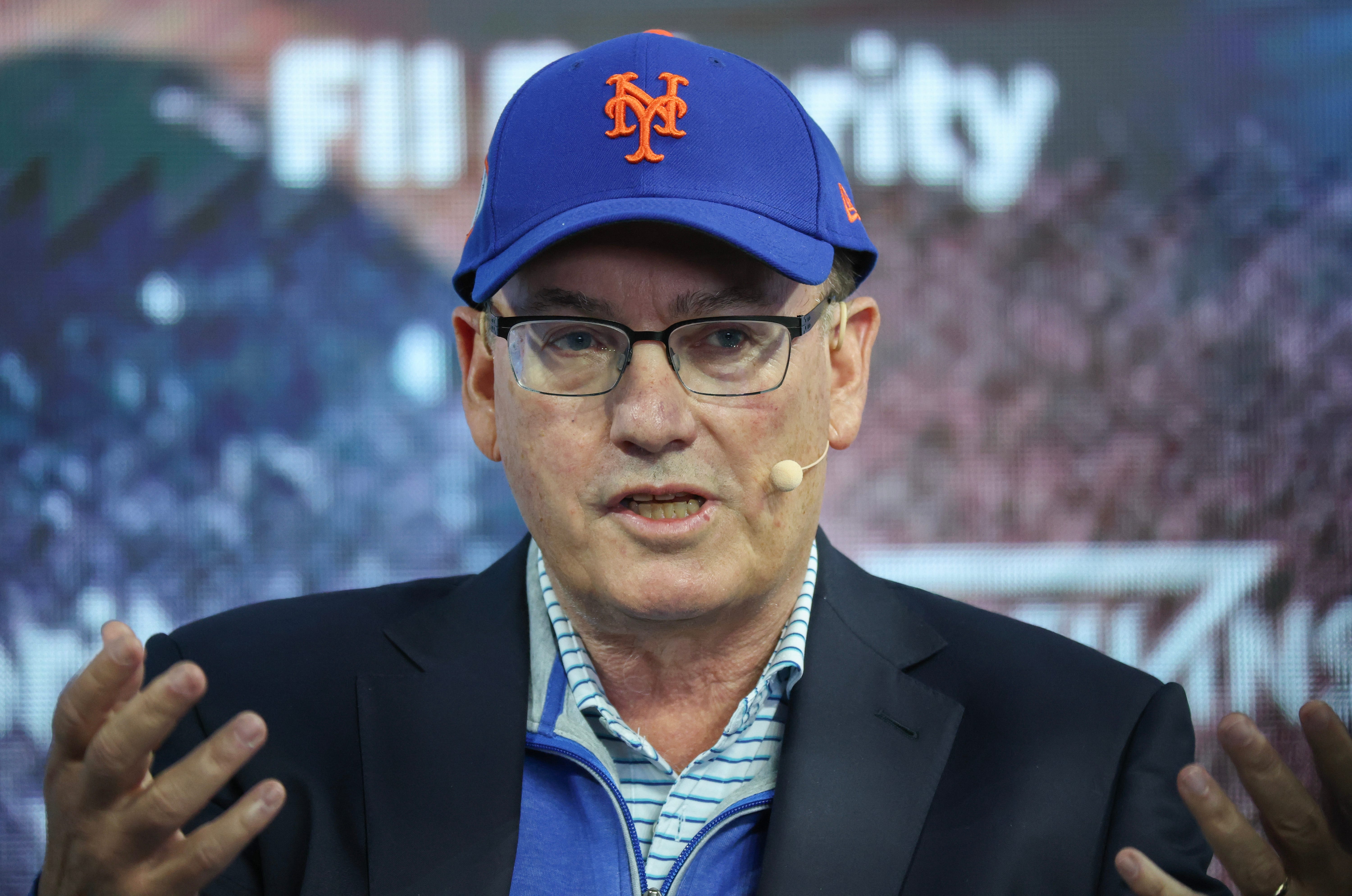

Joe Raedle/Getty Images

- Point72 will have two equities units starting in 2026, according to a company memo.

- The two brands will be Point72 Equities and Valist, the memo notes.

- The two brands will have different sell-side coverage and work on different floors.

Steve Cohen’s $41.5 billion firm will break its fundamental stock-picking unit into two separate brands starting in January.

Point72 is launching two new brands — Point72 Equities and Valist — according to an internal memo from Steve Cohen and Harry Schwefel, the firm’s co-chief investment officer, seen by Business Insider. Valist, trademarked last month, will start with about a dozen investing teams across various sectors, the memo said.

The two units will report to the same leadership, helmed by Schwefel, and “will share the same best-in-class resources and collegial culture,” the memo, which went out to employees Monday, said. Where the two brands will differ will be where they sit in the office — a person close to the firm said they’ll operate from different floors — and their relationships with Wall Street banks.

Point72 declined to comment.

A driving factor in the creation of Valist is sell-side coverage, the memo notes. As Business Insider previously covered, the growth of multistrategy funds like Point72 and its peers such as Millennium and Citadel has changed the relationship between investment bank counterparts and buy-side firms, in particular around corporate access.

With a separate brand and commercial relationship with Wall Street, portfolio managers operating under different names will be able to gain more access to CEOs of companies they trade and research, as well as receive insights from bank analysts, despite still working for the same fund.

Point72’s main peers in the industry have structured their stockpickers in a similar fashion.

At Ken Griffin’s $69 billion Citadel, for example, the firm has four different fundamental equities units: Global Equities, Surveyor, Ashler, and International Equities. Balyasny has PMs operating under its Corbets brand and, soon, Peter Goodwin’s Longaeva Partners in addition to its main equities unit, for which a majority of stockpickers work.

The two brands at Point72 will “position ourselves for further growth,” Cohen and Schwefel wrote.

“Our fundamental equities strategy has been the flagship of our firm for over 30 years, and we look forward to building on that foundation,” the memo notes.

Read the original article on Business Insider

The post Steve Cohen’s Point72 is splitting its equities branch into two brands appeared first on Business Insider.