Araya Doheny/Getty Images for Gold House

- AI search engine startup Perplexity has been raising back-to-back funding rounds.

- The startup got fundraise offers at valuations from $14 billion to $50 billion in just a few months.

- Some investors worry that the startup is getting ahead of itself as the market fears an AI bubble.

In the new AI gold rush, startups aren’t raising money every year; they’re raising massive rounds every month. Perplexity, the buzzy AI search challenger to Google, has become the poster child for back-to-back fundraising, facing investor demand at valuations from $14 billion to as high as $50 billion in just a few months, Business Insider has learned.

The frenzy is fueling investor FOMO — and fears of a modern-day bubble.

Perplexity and its peers are buoyed by AI juggernauts like OpenAI and Anthropic, which continue to raise money at eye-popping valuations. OpenAI was most recently valued at $500 billion in a secondary deal, according to Bloomberg, a rising tide that’s lifting other AI boats.

Business Insider reported in August that Perplexity was raising more money at a $20 billion valuation, just a month after the startup had grabbed fresh funding at an $18 billion valuation, according to Bloomberg. Two months before that, Perplexity had raised at a $14 billion valuation, according to The Wall Street Journal.

Two people close to the company said Perplexity has recently fielded offers from outside investors at valuations as high as $50 billion. Those people didn’t say how serious the offers were or whether Perplexity engaged them.

“The demand to invest in that company is beyond anything that we’ve seen in our history,” one Perplexity investor said.

Perplexity’s head of communication, Jesse Dwyer, said Perplexity doesn’t comment on its fundraising efforts or valuation, but said the company has a “crystal-clear view of its value.”

“We have never considered any numbers other than the ones we know to be true,” he said in an email to Business Insider.

The constant comparison with other top AI companies and the endless stream of investor excitement may be both a blessing and a curse for surging startups like Perplexity.

The startup faces outsize demand from both primary and secondary markets — Perplexity ranked #7 on Forge Global’s list of companies attracting the most secondary investor interest on its platform in the third quarter, just behind Anthropic at #5, OpenAI at #2, and xAI at #1. Its fundraising pace is dizzying, and its valuation sizable, given Perplexity’s age and revenue — Perplexity is three years old and was bringing in over $150 million in annual recurring revenue by mid-2025, Business Insider previously reported.

“The benchmarking inevitably takes place in founders’ minds and in investors’ minds, and it’s kind of hard to escape that,” said Kevin Spain, a partner at Emergence Capital, of top AI startups in general. “If other comparable companies are raising at a certain price, that is going to be the expectation.”

At the same time, more investors have been sounding alarm bells about a bubble amid rising revenue multiples and circular AI deals. Another Perplexity investor said that as Perplexity’s valuation rises, its chances of being acquired or going public at that new price appear slimmer.

That creates a dilemma for investors in startups like Perplexity that raise back-to-back rounds, which open opportunities for early investors to sell some of their shares while simultaneously intensifying their FOMO: What if Perplexity’s valuation actually makes sense in an age where AI could rewrite entire economic playbooks?

Repeated markups can be especially conflicting for growth-stage investors, said Terrence Rohan, the managing director of Otherwise Fund, which invested early in Figma and Vanta.

“It can create internal debate and dialogue, 100%, if a startup is getting marked up beyond the firm’s internal conviction,” Rohan said. “It’s like, hey, they’re raising again. We need to commit another $50 million just to hold our ownership. We don’t quite have conviction here yet, but these other guys do. And if we don’t, we could look silly.”

Raising for name recognition

As constant fundraising pads AI companies’ balance sheets, it’s also helping them build brand power.

OpenAI’s recent fundraises have sent shockwaves across the tech ecosystem. Startups next in line are watching their valuations climb as OpenAI raises the ceiling.

“The zeitgeist right now is more about raising aggressively,” Rohan said. “That’s seemingly creating reputation and brands in itself, as opposed to raising just on the traction or the business case.”

Consumers make up the foundation of Perplexity’s business. The company’s consumer-facing search engine offers both free and $20-a-month tiers, and it’s begun branching into e-commerce, launching a shopping feature in November. Perplexity has multiple enterprise deals, too, selling its premium search engine to companies like Zoom (which also offers a Perplexity-powered AI companion to Zoom business customers) and Nvidia (an investor in Perplexity).

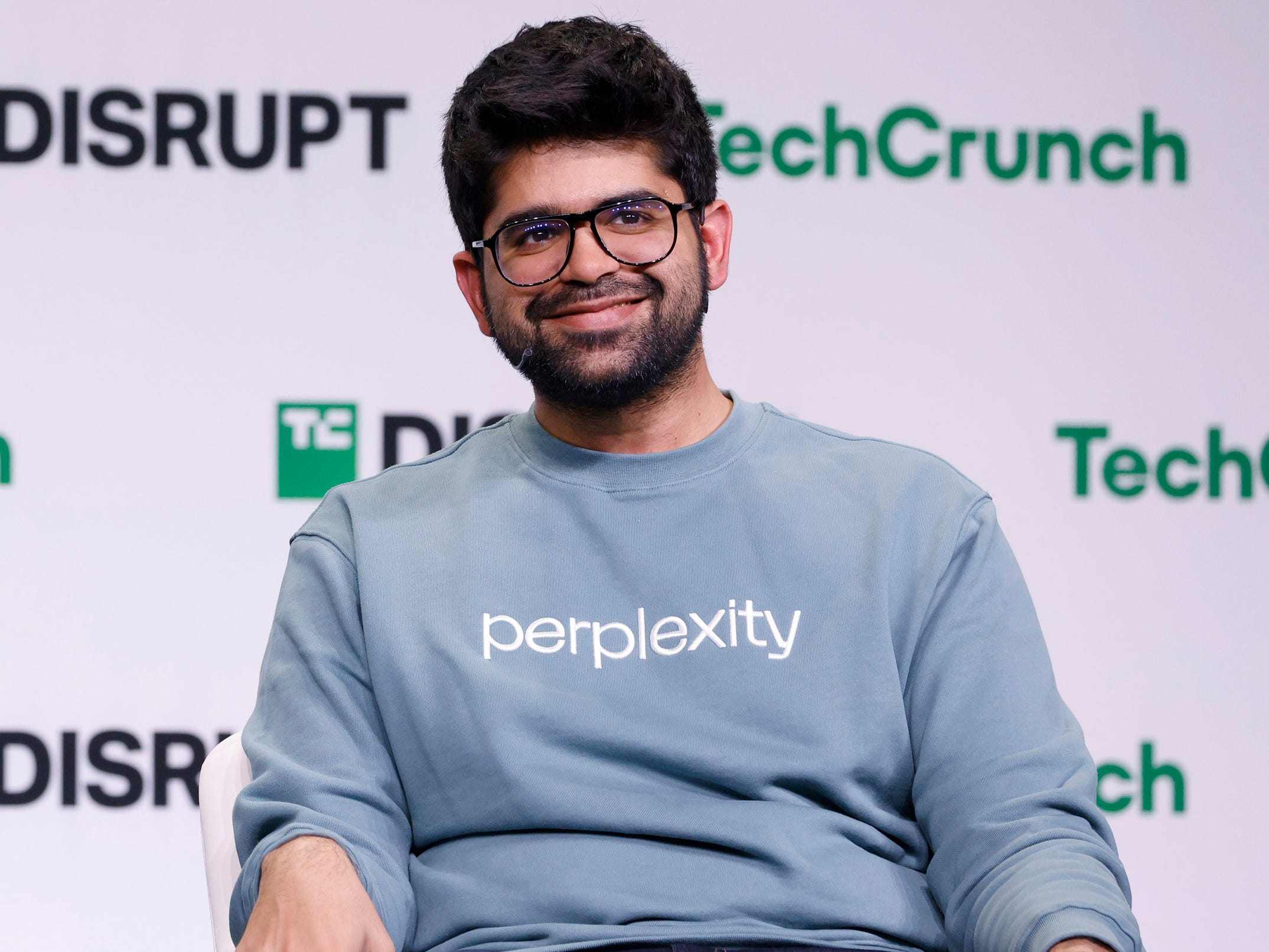

Kimberly White/Getty Images for TechCrunch

Perplexity also drew attention this year for making multiple public offers to acquire or merge with assets bigger than Perplexity itself. In July, the startup announced a $34.5 billion bid to buy Google’s Chrome browser in the midst of the tech giant’s antitrust brawl with the Justice Department. Earlier, in January, Perplexity submitted a bid to merge with ByteDance’s TikTok.

Wall Street analysts and investors largely viewed Perplexity’s Chrome bid as a publicity stunt, with some criticizing the move and others lauding it as marketing genius.

Dwyer rejected the idea that the Google Chrome bid was a stunt. “As much as I’d love to take credit for a publicity stunt, the reality is this was a very serious offer, he said. “Due to the ongoing trial, our role in it, and the centrality of Chrome to the upcoming ruling, it would have been inappropriate NOT to transparently share the offer with the press. It wasn’t publicity, it was integrity.”

When asked about criticisms from Perplexity’s investors on the bid, Dwyer said, “[existing] investors who consider our Chrome offer a publicity stunt are either miffed that they weren’t asked to participate in funding it, or they simply don’t understand the new importance of the browser layer in the age of AI (which would also explain why we didn’t ask them to help us fund it).”

Srinivas has further eschewed VC formalities by ditching pitch decks altogether, he said in an interview with Berkeley Haas earlier this month.

“I just write a memo and I tell them you can do a Q&A and ask whatever you want,” Srinivas said of potential investors. “Anything else that is not internal data, you can ask Perplexity. Like, it already knows everything.”

AI rewrites investing rules

Ballooning valuations with little accompanying revenue growth have become a particular concern for some bubble-wary investors.

In the wake of the 2021 venture boom, startup valuation-to-revenue ratios fell from triple-digit peaks to single digits. But AI has turned those standards upside down. With over $150 million in annual recurring revenue and a $20 billion valuation, Perplexity’s multiple easily exceeds 100x.

Perplexity also made its AI browser Comet free this month, shortly after pausing new advertising deals to reevaluate how advertising affects its user experience.

Perplexity said making Comet free would help users combat “AI slop” by offering a search tool that prioritizes higher-quality sources. It’s also a clear move to help Perplexity capture more users in its quest to overtake Google Search. Still, any resulting cut to Perplexity’s revenue could stretch its multiple even further.

Spain said high multiples tend to matter more to growth stage investors: “The closer you get to the point of exit, the more you care about the multiple you’re paying.” But at early stages, what matters most is how the startup’s revenue could grow and what valuation those investors believe the company could ultimately achieve, he said.

Perplexity’s proposed exit timeline would give those investors more room to breathe. Srinivas said in a March Reddit post that Perplexity has “no plans of IPOing before 2028.” And Perplexity is growing fast — its $150 million annualized revenue in mid-2025 was more than quadruple its ARR, a projection of a company’s annual revenue, a year prior, Business Insider reported in August. As Perplexity aims to eclipse Google Chrome, which some analysts estimate could be worth hundreds of billions of dollars, its markups aren’t without reason.

Plus, the advent of AI is prompting some investors to reevaluate what a “reasonable” valuation even is.

“In this era, there’s a belief that we might see exit valuations unlike any we’ve ever seen,” Spain said. “If you believe AI is going to be transformative in certain industries, you can see a world where you’re going to have exits that are just abnormally large relative to what we’ve seen historically. I think that’s the right conversation to have as an investor.”

Read the original article on Business Insider

The post Perplexity’s blockbuster investor demand shows just how wild the AI bubble has become appeared first on Business Insider.