“I’m a big fan of tactile, old school ways of communicating,” said Olivia Kim, the senior vice president of creative for Nordstrom.

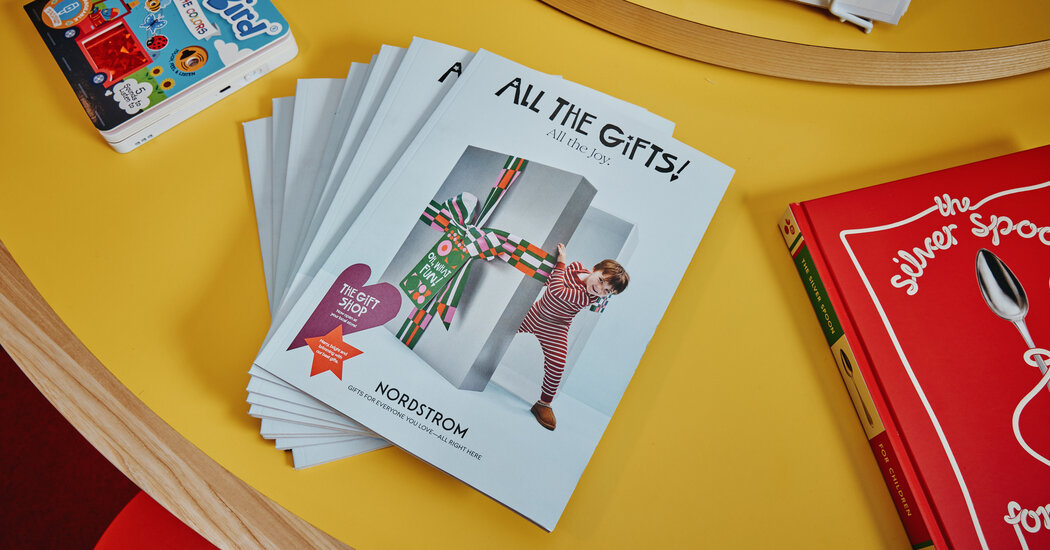

So this year, in addition to the retailer’s commercials on Netflix and Hulu, and their “Gift Expert in Training,” which is an A.I.-enabled advice tool, Ms. Kim and her team will rely on a hallmark of the past. In what has become an increasingly scarce practice among retailers, Nordstrom will use snail mail to send out a 100-page print catalog — the kind of glossy brochure that used to land in mailboxes each holiday season.

“Catalogs are having such a moment,” Ms. Kim said. “So it’s nice to reimagine what they could be.”

This year’s edition will be filled with more than 800 suggestions that include everything from budget stocking stuffers to luxury indulgences. There will be stickers to help organize picks (labeled “give it” and “get it”) and the company is offering customizable tags for gift-wrapping.

“I love the idea of reaching customers in their home,” Ms. Kim said. “It lands in a different way, it’s more emotionally connective.”

Ms. Kim found inspiration in the catalogs of her youth, which came from companies like the teen retailer Delia’s and J. Crew. “For us, it’s about how do we make it more joyful? It’s not only transactional and about product.”

Nordstrom seems to be trying new tactics — or, more aptly, reviving old ones — as the broader retail landscape continues to fracture with competition from e-commerce, the growth of secondhand shopping, and a period of intense uncertainty. Saks Fifth Avenue — the flagship brand under Saks Global, which now owns Neiman Marcus and Bergdorf Goodman — is struggling to pay vendors. The trendy, youth-focused Canadian e-commerce company Ssense filed for bankruptcy protection earlier this year. Tariffs, meanwhile, are creating a challenging environment for small businesses. In light of that, Nordstrom, which struck a deal to go private earlier this year, is seemingly trying to fill a void left by others.

In its last publicly available earnings report, from Q4 of 2024, the retailer disclosed a 2.5 percent increase in net sales over the previous year. Since taking the company private, a representative said that sales for the first half of 2025 were up 4.1 percent from the year prior. The holiday season remains important to its bottom line, though, accounting for roughly 30 percent of its annual sales, according to the retailer.

“It’s not like we didn’t know holiday was a big deal to our customers,” said Jamie Nordstrom, the retailer’s chief merchandising officer and a member of the family that founded the company and reasserted control in the move to go private. “What’s changed is some of the capabilities that we could bring to our customers, to make what can be a stressful time just a little easier — and that’s largely around gifting.”

Mr. Nordstrom and his team found, not surprisingly, that price is a top concern for shoppers this year, so there is an emphasis on wallet-friendly items. Still, the addition of a print catalog may be less of a direct business play and more of an attempt to create an ineffable halo effect around the retailer.

At the brand’s New York flagship, Nordstrom has carved out a two-story section designed to carry mostly small giftable items that cost less than $100, including classic toys like Barbie dolls and Lego sets alongside snow globes, candles and pajamas.

Mr. Nordstrom also said that the ability to reach customers in a variety of different places — online, at home, on their phones, on TV, in physical stores — is important, but that it’s one final thing that really counts: the sale. “We have long been ambivalent about how a customer wants to shop,” he said. “As long as they’re shopping with us.”

“One of the big things that I hope feels different about what we do versus what some of our competitors — or our friends — do is the connection back to our stores,” said Ms. Kim. “That’s different from our digital peers that don’t have a natural storefront.”

Mr. Nordstrom notes that even direct-to-consumer brands that made their name being digitally-native have since embraced timeworn retail traditions.

“Look at the Warby Parkers of the world,” he said. “They opened a bunch of stores — because stores matter. They did direct mail. They do some of the ‘old-fashioned’ stuff because customers are looking for a deeper level of meaning behind this stuff.”

The post A Big Department Store Pivots to a Catalog appeared first on New York Times.