Courtesy of Jeff White and Suleyka Bolaños

- Savvy investors use 1031 exchanges to defer capital gains taxes by reinvesting in like-kind properties.

- Successful 1031 exchanges can increase cash flow and strengthen investment portfolios.

- Sign up for Business Insider’s daily markets newsletter here.

When you sell a property for more than you purchased it, you’ll typically owe capital gains tax.

The amount depends on factors like how long you owned the property and your taxable income, but it could be as high as 37% if you sell within a year and trigger short-term capital gains.

However, IRC Section 1031 provides an exception, allowing investors to postpone paying tax on the gain if they reinvest the proceeds in similar property. Commonly known as a 1031 exchange, investors use the strategy to reinvest in more profitable properties and grow their wealth.

There are a few rules to consider: 1031 exchanges are intended for investment properties, not primary homes; you must exchange for another property that is similar or “like-kind,” which the IRS defines as “the same nature or character”; and you have a limited amount of time to complete the exchange.

As soon as you sell, the clock starts: You must identify your replacement property or properties (you can identify as many as three like-kind properties) in writing within 45 days of selling the first property. Then, you must close on the replacement property within 180 days of your initial property sale.

One investor BI spoke with attempted a 1031 exchange but ultimately abandoned it because he couldn’t meet the 180-day deadline.

While his failed 1031 experience may be “rare,” he said, “there are so many things that could delay a closing.”

BI spoke with three investors who successfully executed 1031 exchanges and have stronger portfolios as a result.

Jeff White and Suleyka Bolaños exchanged their worst-performing property and quadrupled their cash flow

The first property Jeff White and Suleyka Bolaños bought — a fourplex in Denver — was a piece of work.

Looking back, “we could have done a lot better,” said the couple, who retired in their 40s by buying one rental property a year.

Thanks to a 1031 exchange, they were eventually able to swap it for two better-performing assets.

“We listed the fourplex for sale, found a buyer, and then went under contract on that single-family large house and a condo,” said White. “We closed on the same day — three transactions — paid zero tax, and got rid of our worst property that only cash flowed, at that time, $400 a month maximum, to those two other properties.”

They rented each individual room in the single-family home and rented the condo to a Section 8 tenant, which more than quadrupled their cash flow, said White: “We went from $400 to $1,700 overnight.”

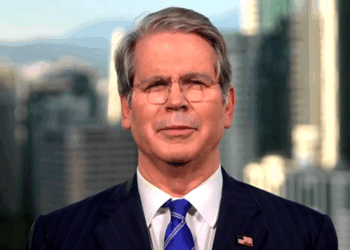

Nicole Shirvani traded in a duplex for two properties

Courtesy of Nicole Shirvani

Nicole Shirvani, a full-time psychiatrist, is using real estate to boost her savings and give herself the option to eventually scale back at work.

When she moved from Oregon to Florida in 2022 for a new job, the single mom swapped her Oregon duplex for two different properties closer to her new home: a beachside condo and a single-family home.

She started looking at exchange properties before listing the duplex to give herself plenty of time.

“Before you sell, try to have the replacement properties identified and line everything up,” she advised. “You don’t want to sell a house, not be able to find suitable properties, and be stuck, unable to invest that money into something.”

Shirvani, who has since added two short-term rentals in the Shenandoah Valley and a triplex in Lakeland, Florida, to her portfolio, plans to use the same strategy as she continues scaling.

Zeona McIntyre upgraded from a small property to a multifamily that produced stronger cash flow

Courtesy of Zeona McIntyre

Zeona McIntrye is financially independent thanks to her real estate portfolio, but when she first started investing in her 20s, she couldn’t qualify for a mortgage. She didn’t have strong savings or a consistent income to show a mortgage lender.

It forced her to get creative for her first purchase — a one-bedroom condo in Boulder, Colorado that she financed with private lending — and introduced her to numerous nontraditional real-estate strategies. She used a home equity line of credit to buy her second property, which she later traded in for a quadplex using a 1031 exchange.

“A 1031 exchange allows you to defer your tax burden; a lot of people think, ‘Oh, I don’t pay any taxes,’ but you’re technically kicking the can down the road,” she explained. “The cool thing, though, is that you can do unlimited 1031 exchanges and infinitely kick it down the road. And then when you pass away, if you pass that on to someone else, like your children or a family member, the inherited home does not have the tax burden anymore. So it dies with you.”

Read the original article on Business Insider

The post 4 real estate investors explain how they’re capitalizing on an IRS rule to avoid capital gains tax and scale their portfolios appeared first on Business Insider.