Billionaire Elon Musk has begged investors to give him his $1 trillion dollar bonus, despite Tesla suffering a 37 percent drop in profits this quarter.

The world’s richest car salesman has had the huge stock-based pay package dangled in front of him by the board if he meets specific criteria. That criteria centers on profit, stock valuations, and sales, and it is due to be voted on on Nov. 6.

Musk, the man who led Trump’s Department of Government Efficiency cost-cutting drive, commandeered the end of a Tesla. Inc earnings call to plead with investors to make sure that happens.

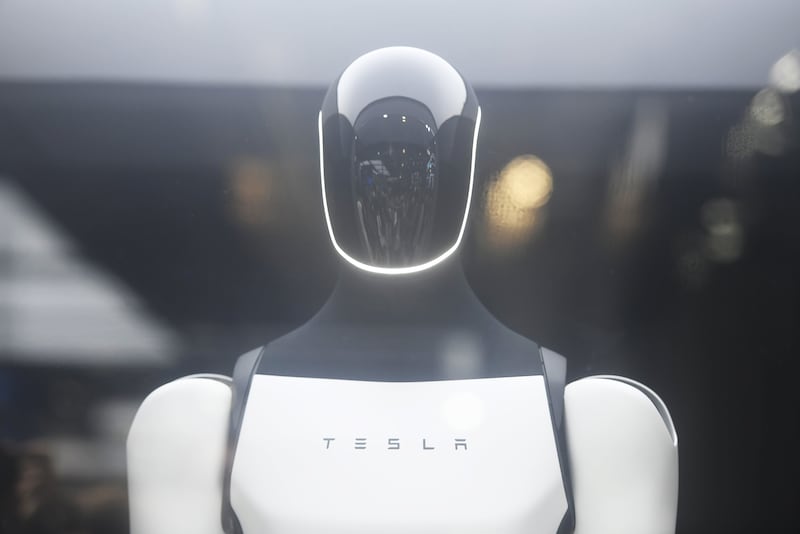

He wants them to give him more control of the company ahead of the delivery of key projects, including the rollout of Optimus humanoid robots and driverless cars. Musk’s plan would see him with voting control of 29 percent of company shares.

“I just think that there needs to be enough voting control to give a strong influence,” Bloomberg reported him as saying. He interrupted his CFO to add, “But not not so much that I can’t be fired if I go insane.”

It comes after advisory firm Glass Lewis joined with the Institutional Shareholder Services (ISS) to encourage board members not to vote in favor of the chief executive’s unprecedented pay package.

Musk, however, claims it isn’t about money, but control, according to The New York Times.

“I just don’t feel comfortable building a robot army here and then being ousted because of some asinine recommendations from ISS and Glass Lewis who have no freaking clue,” Musk said during the meeting.

His supporters on the board feel that the company’s success isn’t about the money he earns them, but rather about delivering the projects he has promised.

It might be just as well. This quarter’s earnings report was always likely to strike an upbeat tone ahead of the vote, but the numbers involved won’t make for pleasant reading for investors.

Profits on the previous year had plummeted to $1.4 billion, down 37 percent, despite a 12 percent rise in revenue to $28.1 billion.

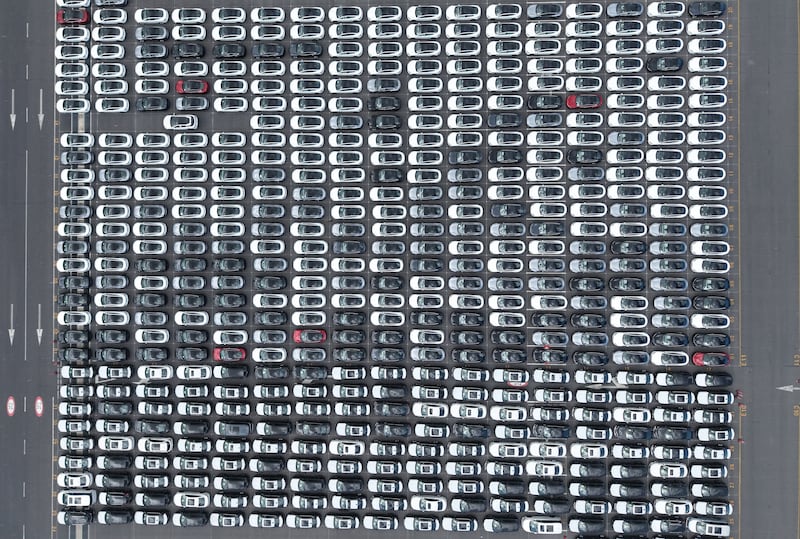

The Times reported that was due to Tesla lowering their prices. July to September saw more cars sold, but a combination of low-interest loans and slashed prices ensured profits sank.

Among the changes to its price structure were versions of its cars with lower spec, which retailed for up to $5,000 less than the previous lowest point on the range.

Donald Trump’s administration has also ransacked the clean air credit system in another major blow to the electric car company.

Tesla also cited the impact of tariffs on its profits, having been affected by the increased cost of importing materials.

Competition from abroad, especially China, has also played its part.

Despite the grim numbers, Musk said during the meeting he wants the company to expand. A number of the business’s flagship projects now have short timeframes including driverless taxis which have been touted for the end of the year.

“I feel like we’ve got clarity, and it makes sense to expand production as fast as we can,” he said.

Tesla has hit back at the Glass Lewis recommendations, which expressed “significant concern” over shareholder value and the structure of the deal, Reuters reports.

In a post on X, Tesla claimed the recommendations “attempt to override the mandate our shareholders delivered to Elon and ignore the staggering financial results delivered under Elon’s leadership, elevating their rigid policies over shareholder value.”

The Daily Beast has contacted Tesla for comment.

The post Musk Pleads for His $1 Trillion Pay Package as Tesla Profits Plummet appeared first on The Daily Beast.