Hebbia

- Hebbia, a 5-year-old startup, offers a glimpse at where the AI-powered future of banking is headed.

- I got an exclusive demo of the product and spoke with company execs about how it really works.

- Will it supercharge Wall Street, or fundamentally change it? Here’s my take.

Artificial intelligence is coming for investment banking, and when I heard that there was a startup generating buzz throughout Silicon Valley for streamlining the day-to-day tedious work in fields like finance, consulting and law — I had to see it with my own eyes.

The company, Hebbia, offers financial services firms a variety of AI-enabled tools designed to deepen and speed up their work. Founded in 2020, it’s gone on to pick up clients like KKR, T. Rowe Price, and Permira, the New York-based operation says on its website.

As a reporter who’s covered how AI is reshaping finance, I’ve mostly focused on what banks are building in-house, such as Goldman Sachs’ internal AI assistant, for instance. I hadn’t gotten an up-close look at a third-party tool.When I got access to a one-hour live Hebbia demo I hoped it would give me insight into how investment banking could change in the coming years.

Hebbia’s big bet is that many institutions will decide to buy access to such tools rather than exclusively incubate them in-house. Tom Reeson Price, vice president of sales, told me that “hundreds” of Hebbia seats are held by sell-side bankers, though the buy side remains its largest market. Hebbia declined to share which banks are using its tools.

“It doesn’t make sense for every firm to spend $10 to $20 million, or even $5 million, on an internal build when you have venture-backed startups that are serving 150 clients like ourselves,” founder Geroge Sivulka told me in an interview.

Sivulka left a Ph.D. program at Stanford to launch the startup five years ago. In 2024, it raised $130 million in a Series B round from Andreesen Horowitz, Google Ventures, and billionaire investor Peter Thiel.

Wall Street is already feeling the effects. Once upon a time, showing up with knowledge of Excel meant you were up to speed on the latest and greatest tech. Now, banking neophytes are becoming proficient in Hebbia. “They are like Hebbia analysts,” Sivulka sad.

A “Hebbia analyst”? As opposed to a burned-out analyst with rings under their eyes from the third consecutive all-nighter? I had to know: Could this tool actually usher in an age when investment-banking toil becomes a thing of the past — or will it simply help dealmakers squeeze more from their teams?

Here’s what I learned through my demo as I explored whether this product could really shake up how Wall Street works.

Freeing bankers up ‘to do the last mile’

Courtesy of Hebbia

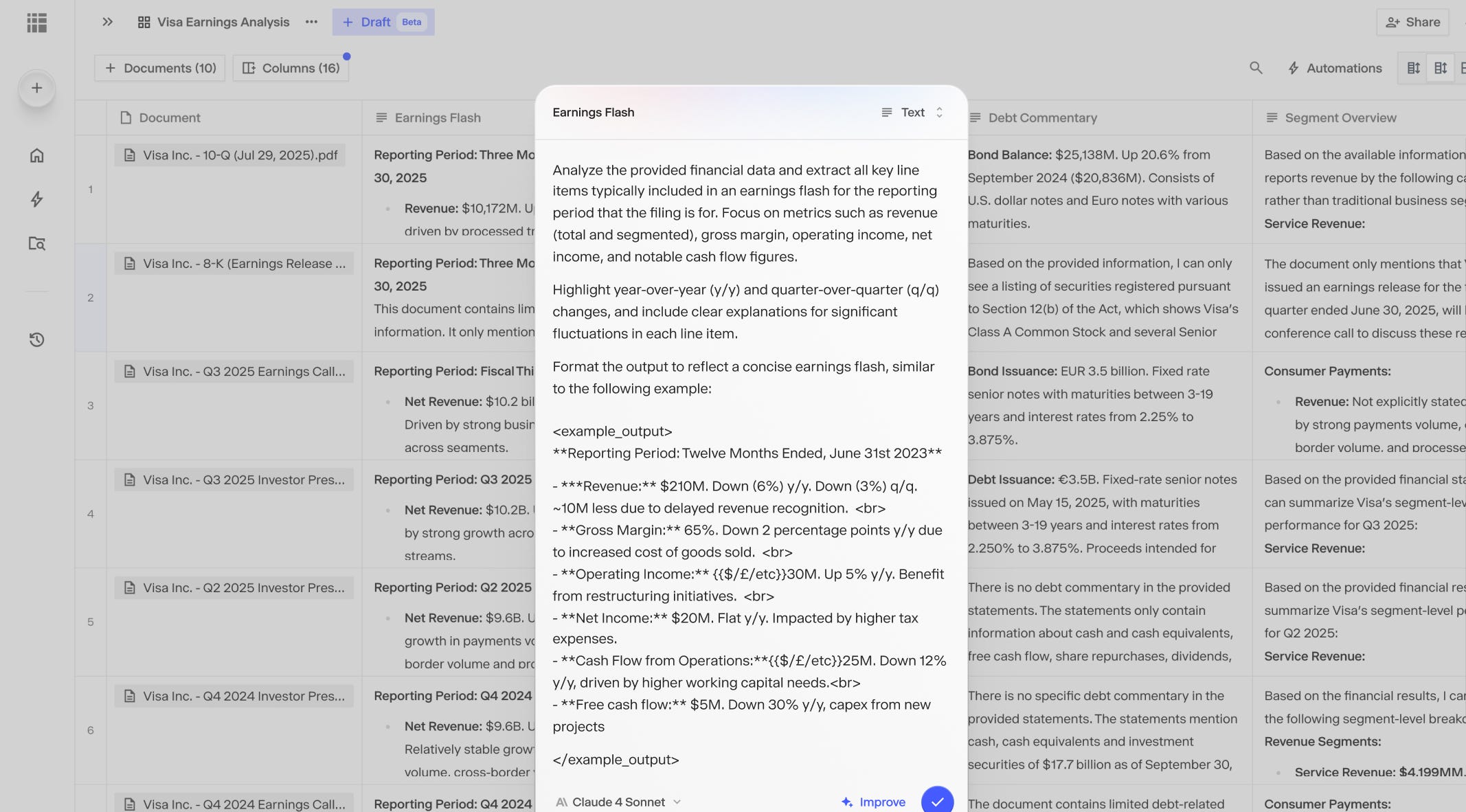

Divya Mehta, a Hebbia exec who spearheads product development, began the demo by showing me a spreadsheet-style screen filled with rows of past, open, or even prospective deals and columns for questions. You can query the same dataset multiple different ways, adjusting your wording or criteria to run multple simulations, generating a spectrum of insights from the same raw information.

I could imagine how that could help dealmakers think more creatively about acquisition targets or potential buyers for a company, for instance.

The system was designed to enhance the work bankers and investors already do, paving the way for faster dealmaking and speedier task completion. “They want to take analysts from zero to 90% and free them up to do the last mile,” Tom Reeson Price, Hebbia’s head of sales, told me, describing what Wall Street clients are after.

Stepping into the ‘Matrix’

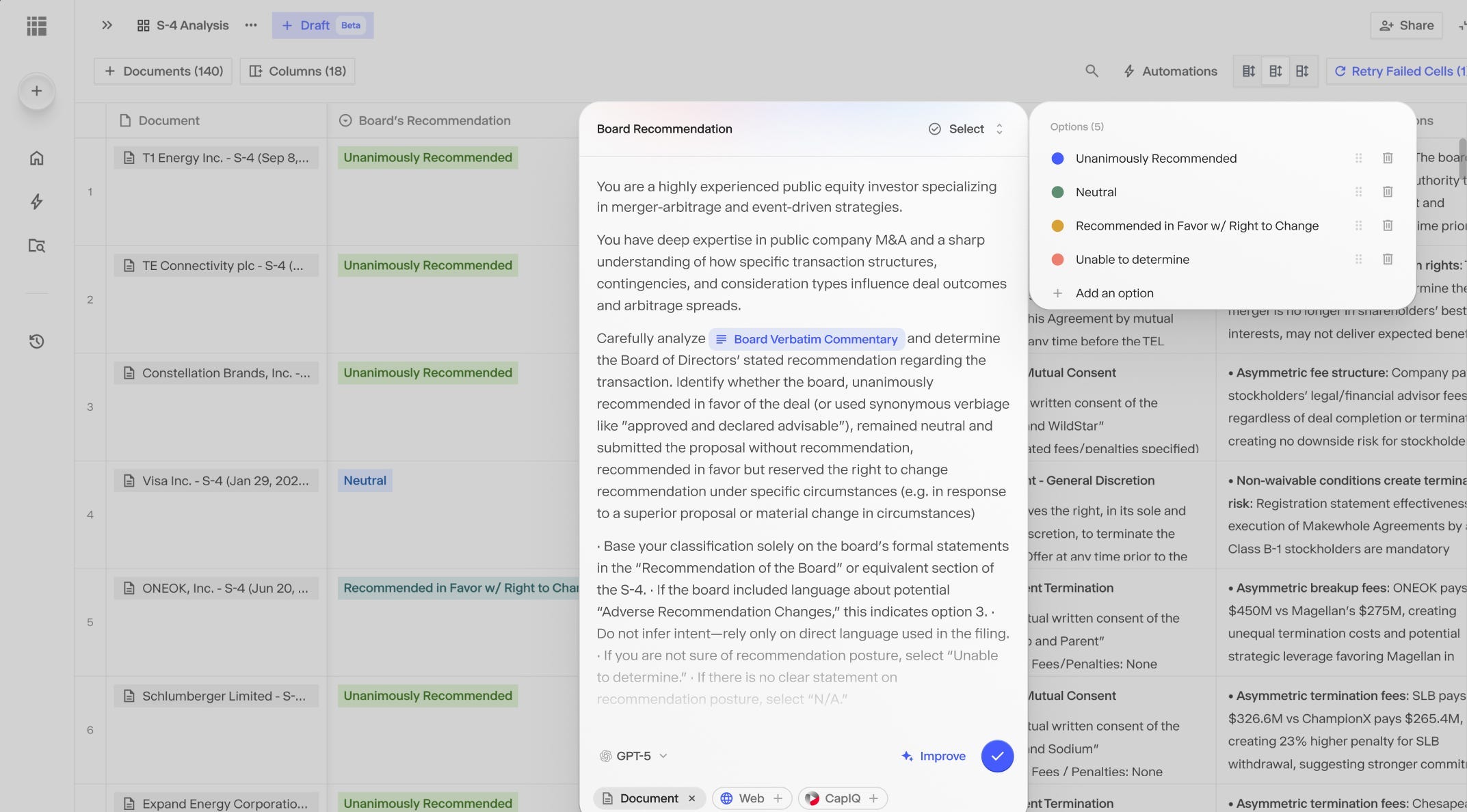

Courtesy of Hebbia

Next, Mehta showed me the heart of the Hebbia platform, what it calls its “Matrix.” It’s the main workspace where users can present complex questions and watch the system riddle through them using massive collections of information ranging from spreadsheets and corporate filings to PDFs and decks.

Rather than typing in one question and getting one answer back at a time, Matrix operates like a live research assistant, poring over documents, pulling out essential points, and assembling them in a way that’s meaningful for users.

Each column represents a query — such as “earnings flash” or “debt commentary,” categories by which users can analyze multiple companies’ activities. Each row represents a deal or document. Matrix pulls the relevant information from all these filings and compiles them into a simple table filled with custom outputs. Now, analysts can scan hundreds of filings at once and understand why the system arrived at its conclusions.

Speeding through questions and slide decks

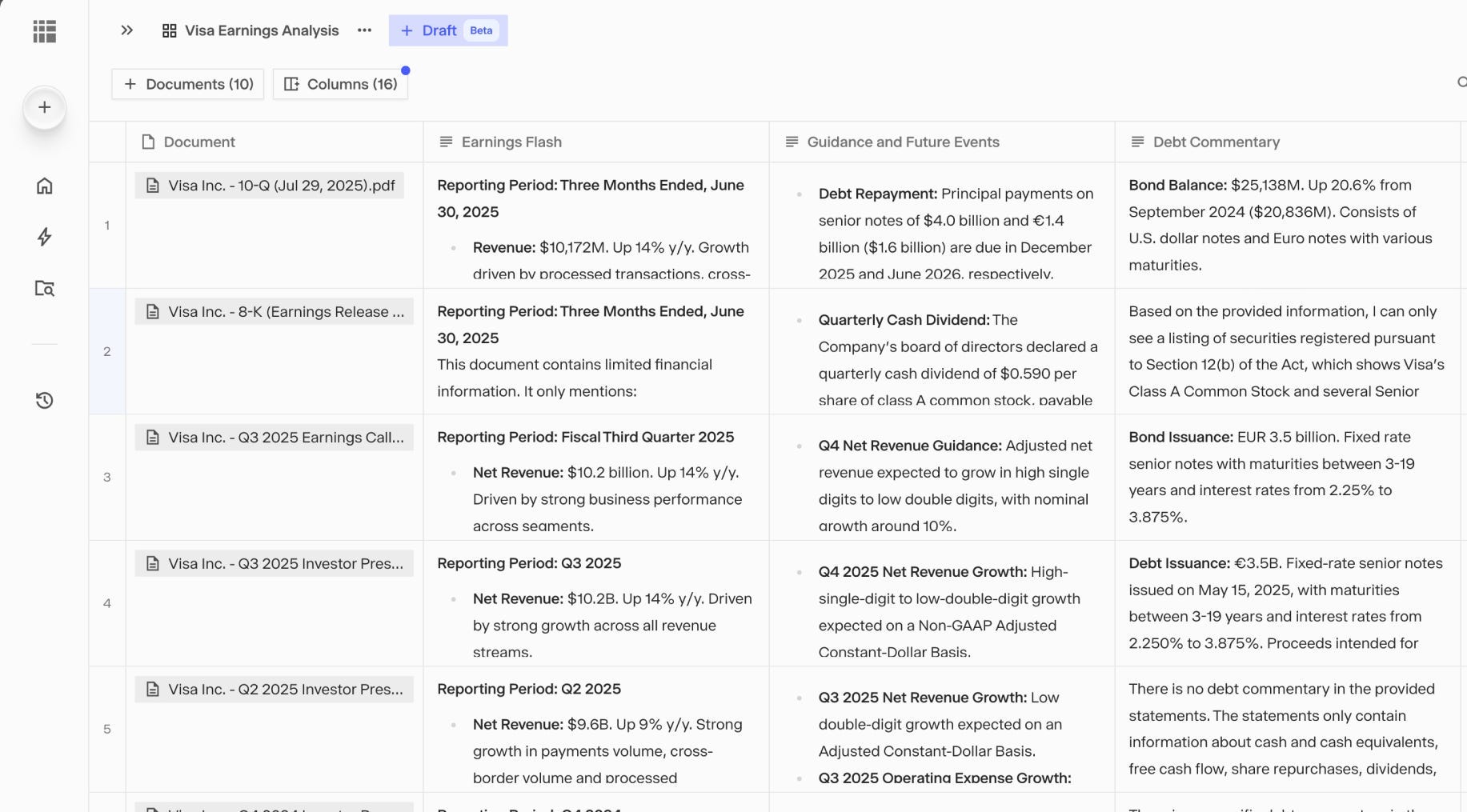

Hebbia

Here’s a look at one of Hebbia’s prompts — you can see how it’s structured and could be applied to different companies.

One of the features sure to delight younger professionals is the ability to supercharge the creation of memos and presentations, potentially alleviating all-night grunt work on documents for clients that often end up in the trash before they’re read. The work can be soul-crushing.

“You can actually build the entire slide deck in Hebbia based on the output that the agent or the grid has created for you,” Mehta said. Hours of work are compressed into minutes.

In another example, she described how the system can identify potential acquirers for a company by analyzing historical deal data and prior buyer behavior — a task that would be nearly impossible to perform manually. Law firms and consultants, she added, use similar processes to review large volumes of documents.

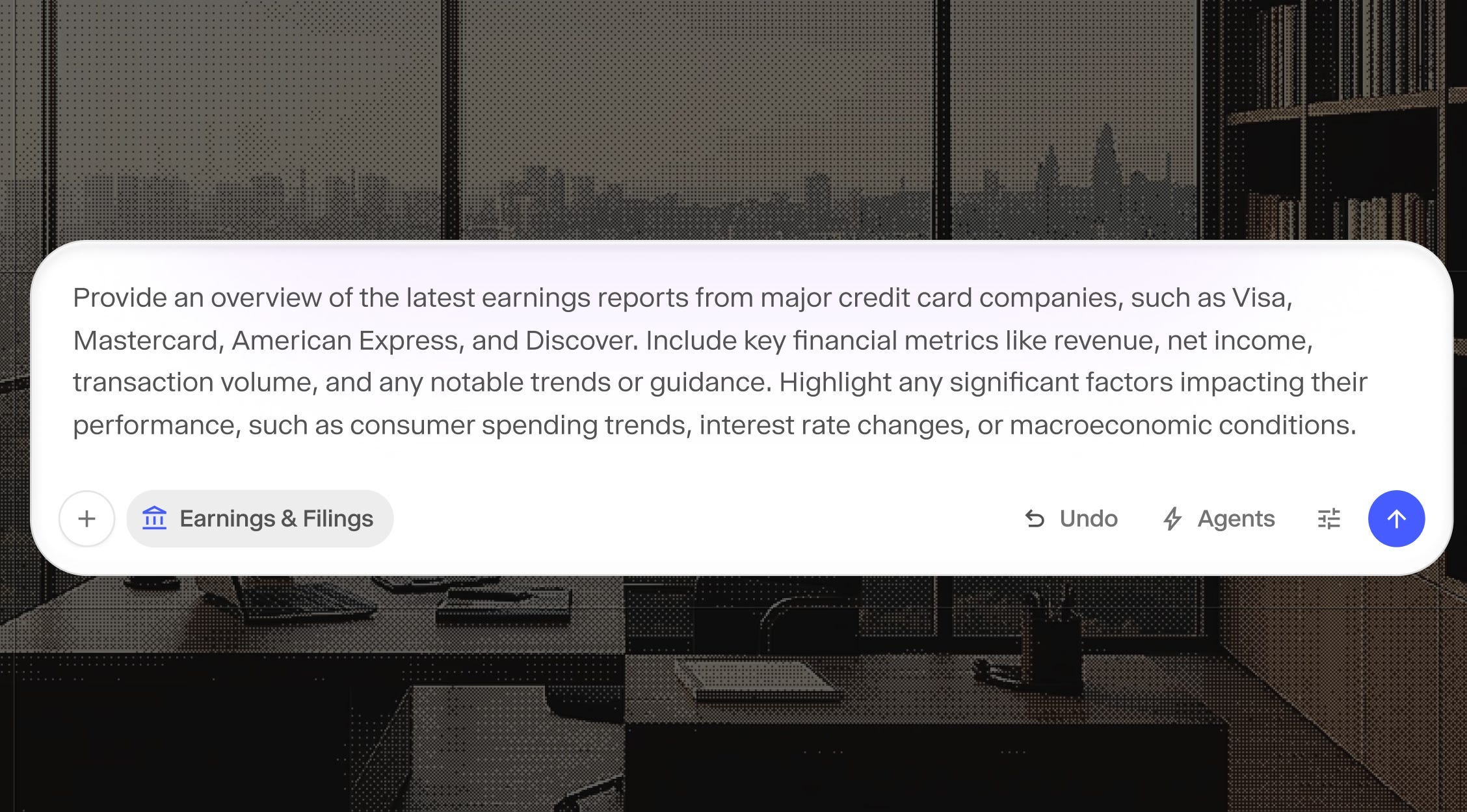

Writing better questions on the fly

Courtesy of Hebbia

Mehta said Hebbia’s prompt development team refines the pre-generated prompts, across thousands of examples. It’s an iterative process and after figuring out a prompt’s weak points, the team sharpens the query until it’s ready to be shipped to customers.

Hebbia’s prompt-building assistant stood out to me, perhaps because it felt kind of meta. It’s an AI tool that helps users craft their own instructions… to feed back into the AI system. Even if someone doesn’t know where to start, or how to phrase their question, the system has a feature that can refine what users are trying to ask.

In other words, technology that’s able to teach people how to communicate with technology. It made me wonder whether this will soon shape how professionals in other industries learn.

Deal language, side by side

Courtesy of Hebbia

Mehta loaded another example built from corporate earnings reports. Such reports are often dense and unpleasant to wade through.

This screen synthesizes a variety of companies’ earnings performance, debt load, and other relevant information. Seeing these metrics enables the detection of subtle patterns that have gone unnoticed, such as recurring themes in management commentary or shifts in dealmaking trends.

Hebbia maintains a library of reusable prompts for common financial tasks while giving clients the option to build their own. Some clients view their custom prompts as proprietary intellectual property from which they gain an edge. Sivulka told me it shows Hebbia’s working as intended.

“It’s actually eerie,” he said. “They use the software, but they don’t want us to know their use cases because they’re such revenue-generating alpha.”

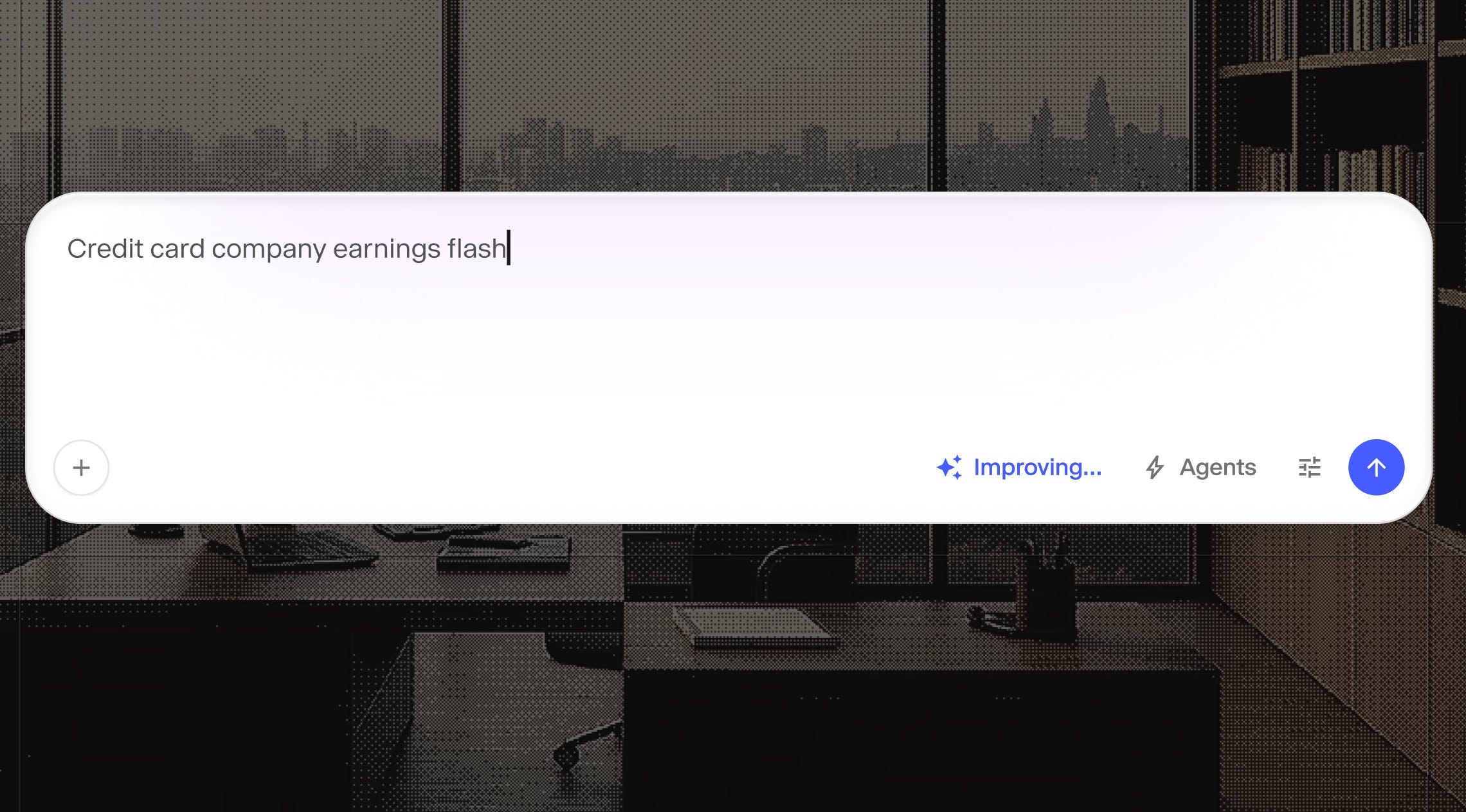

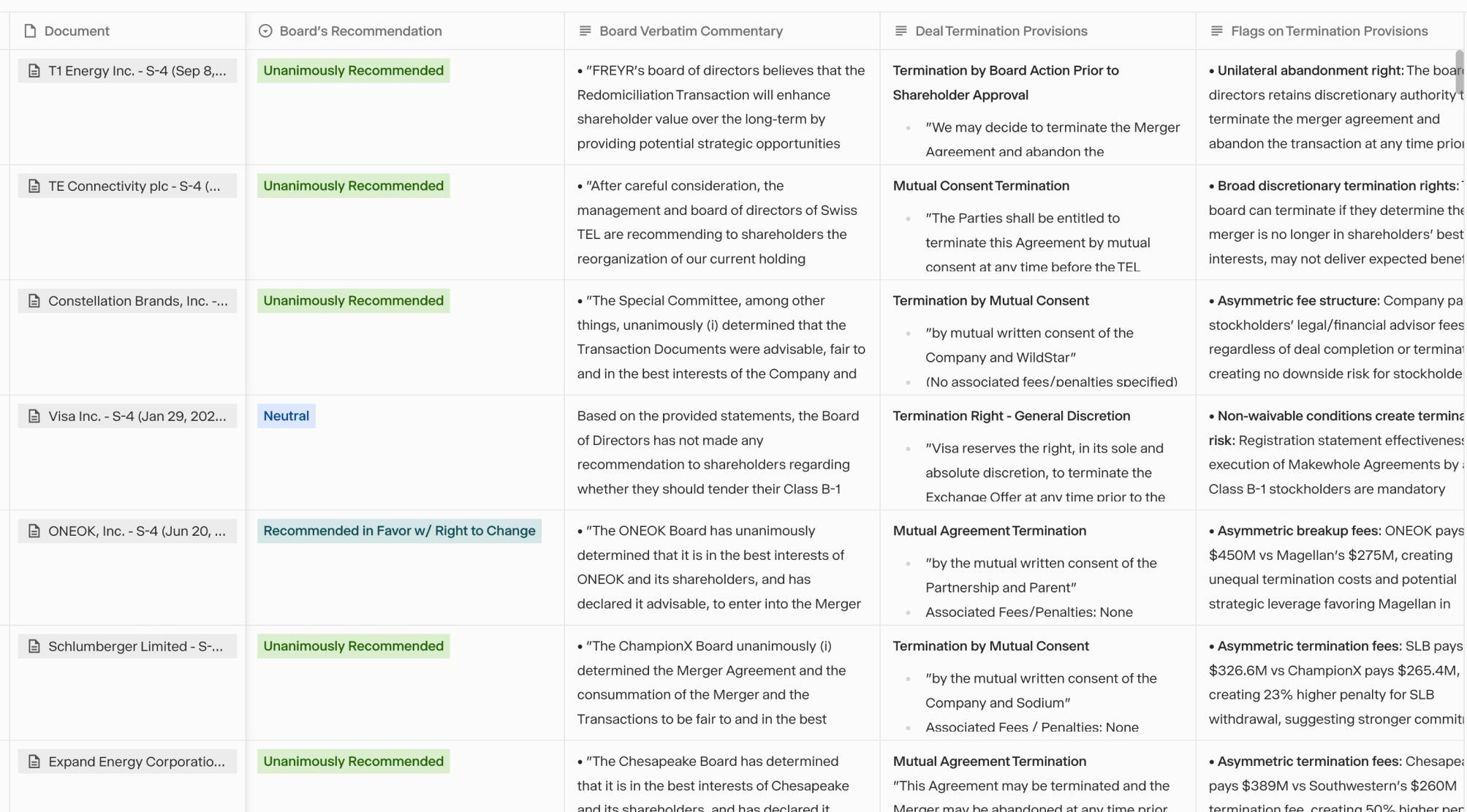

Pattern-spotting at scale

Hebbia

This screen compares regulatory filings and board recommendations about corporate events and shareholder positions. “We build prompt libraries by use case,” Mehta explained. “That’s how we’re able to analyze complex documents like IC memos and credit agreements quickly.”

Reeson Price told me that roughly 60% of Hebbia’s users are on the buy side, with the rest made up of banks, law firms, and insurers.

Mehta added that Hebbia’s search abilities run deeper than a chatbot’s. It can access and compare results generated by multiple large language models including OpenAI’s ChatGPT, Anthropic’s Claude, and Google’s Gemini.

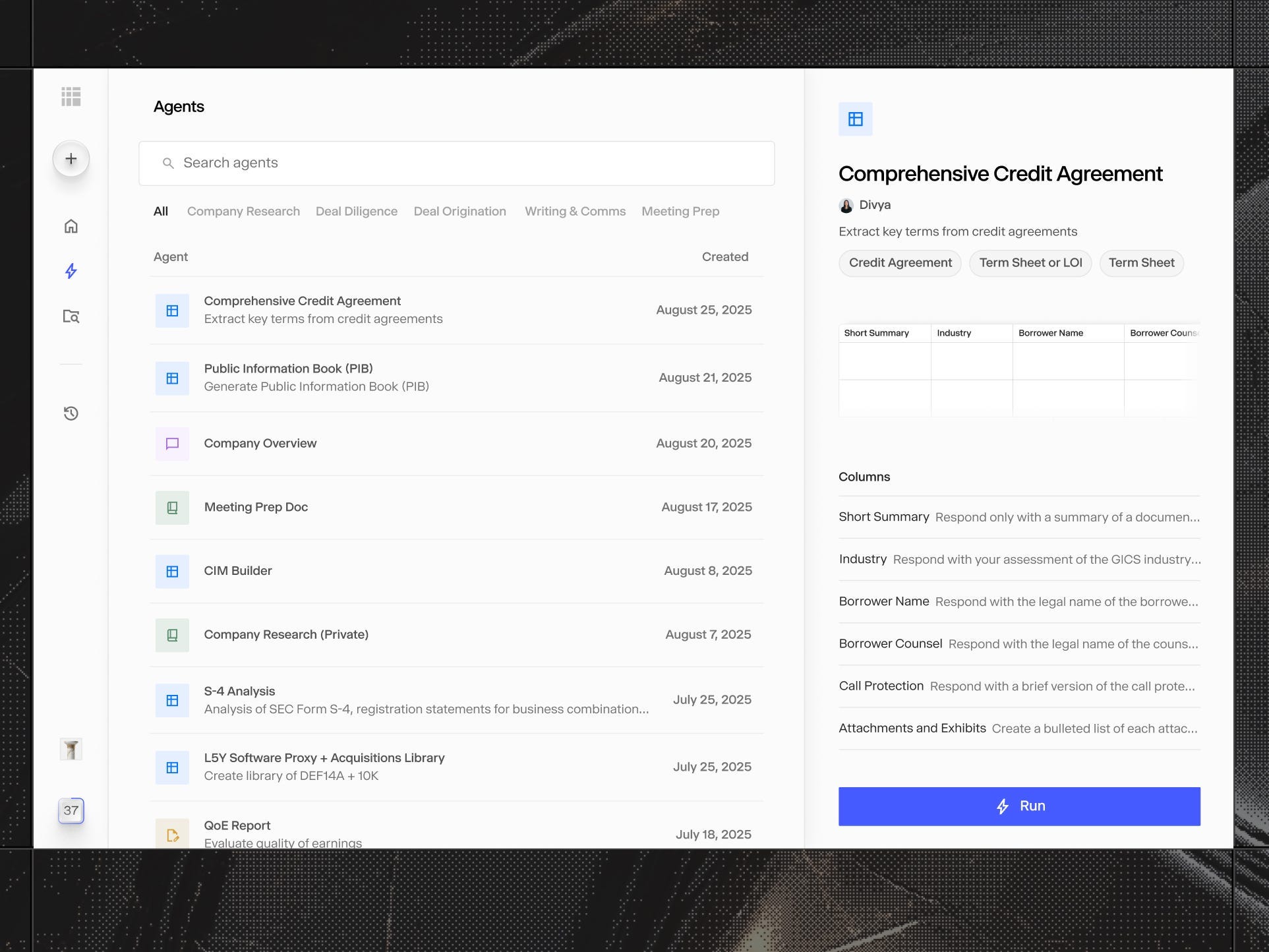

Agentic features

Courtesy of Hebbia

The next frontier of artificial intelligence will be agentic AI, autonomous bots that can execute complex tasks from start to finish with minimal human guidance. Such tools can generate entire documents, like a comprehensive credit agreement, independently.

Hebbia’s prebuilt “agents” — templates for generating deal memos, updating earnings summaries, and reviewing credit agreements and other routine materials — impressed me. Clearly, this is far more than a dressed-up version of ChatGPT.

The product receives regular updates and expanded offerings. Recently, it launched Drafts, a feature that generates Word, PowerPoint, or Excel files in a firm’s template, automating the boring formatting work that can eat up junior bankers’ time.

The big questions

Courtesy of Hebbia

The arrival of tools like Hebbia raises new questions: Are the schools that teach finance ready for what’s coming? What about banks’ analyst programs? The train has already left the station, and they’ll need to catch up fast.

But Mehta says some incoming juniors are ahead of the curve; at an annual workshop she’s conducted for the last few years for early-career investment bankers at a firm using the product, she’s been impressed by the growth in what each progressive class seems to know. “Every single year I see them get more advanced in their learning and their comfort with the tooling,” she said.

To Hebbia founder Sivulka, that’s a must. “If you don’t learn how to use AI, you will necessarily become obsolete,” he told me.

One thing’s for sure: It’s only a matter of time until we all find out if he’s right.

Read the original article on Business Insider

The post I demoed a buzzy AI startup and got a glimpse of what investment bankers’ jobs might start to look like appeared first on Business Insider.