Ann Wang/REUTERS

Nvidia exceeded expectations once again in its second quarter of 2025, but China remains a question mark.

On Wednesday, the chipmaking giant reported $46.74 billion in revenue and adjusted earnings per share of $1.05, both beating analyst estimates. The company also forecast third-quarter sales of about $54 billion.

Despite the upbeat earnings, Nvidia shares slipped in extended trading as data center revenue fell short of forecasts for a second straight quarter, and as signs of slowing growth began to show.

From the uncertainties around the H20 chips’ shipment to China to the spending on AI infrastructure, here are the main takeaways from the chipmaking giant’s earnings call.

1. H20 shipments to China remain uncertain

CFO Colette Kress said Nvidia has yet to ship any H20 chips to China this quarter, despite some customers recently receiving licenses.

In the earnings call, she said that shipments worth $2 to $5 billion could flow if restrictions ease, but the company has excluded that revenue from its third-quarter forecast. The company has also floated a 15% remittance to the US government on licensed sales, though no rule has been finalized.

“We just have to keep advocating,” CEO Jensen Huang said during the call with investors.

“It is the second-largest computing market in the world, and it is also the home of AI researchers. About 50% of the world’s AI researchers are in China,” Huang added. “So it’s fairly important, I think, for the American technology companies to be able to address that market.”

David Wagner, head of equity at Aptus Capital Advisors, wrote in a note to Business Insider that the negative stock reaction feels like an “incorrect knee-jerk reaction,” and that the company’s current growth rate is still “remarkable.”

“I actually thought the best part of the report was the gross margin guidance of 73.5% showing resilience in profitability, even without any China H20 revenue,” Wagner said.

2. The sales outlook is tepid

Nvidia projected its Q3 revenue at $54 billion with a 2% margin, exceeding the analyst expectation of $53.4 billion.

However, the company said its projections didn’t include H20 sales to China, which are still uncertain. It also approved an additional $60 billion in stock buybacks.

Brian Mulberry, Senior Portfolio Manager at Zacks Investment Management, told BI that he sees some parallels between Nvidia’s current shares and times when Tesla would have strong financials but slowing guidance, which slows the growth in share prices.

“Now NVDA is ‘only’ growing at 50-55% and that is much less than the 100%+ revenue growth from last year,” said Mulberry. “As that momentum slows, so does the energy in the stock.”

3. Ramping up AI infrastructure spending

Nvidia expects $3 to $4 trillion in AI infrastructure spending by 2030, CFO Colette Kress said, calling it a “significant long-term growth opportunity.”

Her comments come as Big Tech ramps up capital spending in AI and fuels GDP growth, though some tech leaders, like OpenAI CEO Sam Altman, have warned that some investors may be overhyping the sector.

Earlier this week, JPMorgan wrote in a note that the high capex spending points to strong growth forecasts in AI.

“We believe near-term AI fundamentals are strong, driven by strong hyperscale capex spending,” the bank wrote. “This trend is evident in the upward revision in capex during the Q2 2025 earnings season by the cloud/hyperscale companies, and the strong results/guidance telegraphed by other AI beneficiaries.”

4. Robotics could soon power growth

The build-out of AI models has powered Nvidia’s growth in the last several years. Now comes robotics.

“Robotic applications require exponentially more compute on the device and in infrastructure, representing a significant long-term demand driver for our data center platform,” Kress said during the call.

Robotics remains a small part of Nvidia’s business, but Huang and Kress said they’re seeing signs of growth.

Jetson AGX Thor, Nvidia’s latest robotics computing platform or “robot brain,” was released earlier this week. Kress said the adoption of Thor “is growing at rapid rate,” with more than 2 million developers taking the platform to market.

The CFO also said automotive revenue increased 69% year-over-year to $586 million, primarily thanks to self-driving cars.

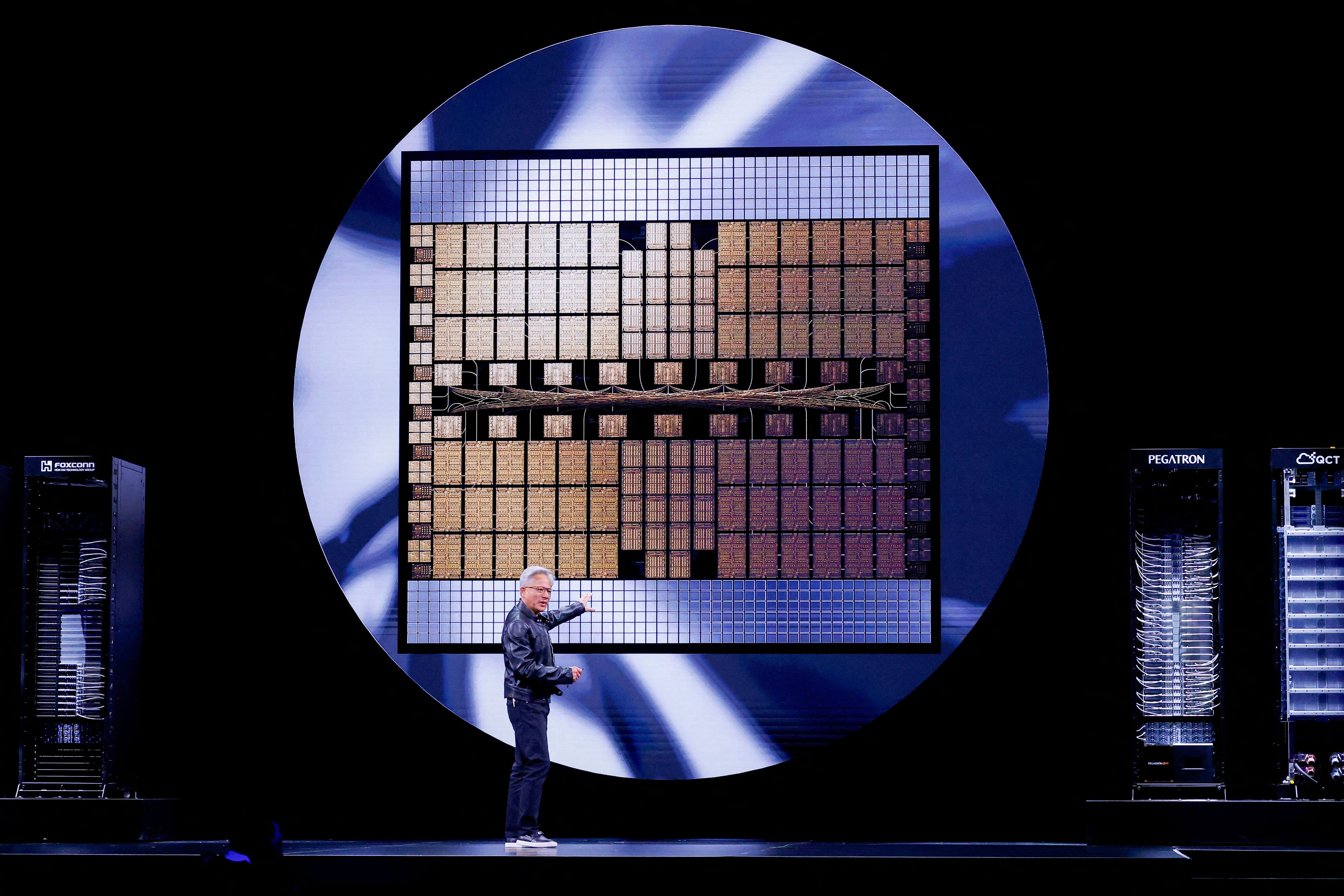

5. Hyping up the next-gen Rubin chips

Kress said Nvidia’s successor to its popular Blackwell chip architecture, Rubin, is on track for volume production in 2026, giving investors the innovation, predictable product cycle, and revenue generator they like to see.

While the earnings call didn’t provide too many details around the next-generation chip, Kress said the chips are “in fab,” meaning that the manufacturing process has begun.

“This keeps us on track with our pace of an annual product cadence and continuous innovation across compute, networking, systems, and software,” Kress said.

Huang said during the call that Rubin will pave the way for a “$3 trillion to $4 trillion AI infrastructure opportunity.”

The post 5 biggest takeaways from the Nvidia Q2 earnings call appeared first on Business Insider.