Weeks after Nvidia struck a deal with the Trump administration to pay for clearance to ship semiconductors to China, the company has started winding down production of a chip designed for Chinese companies and begun work on its more powerful successor.

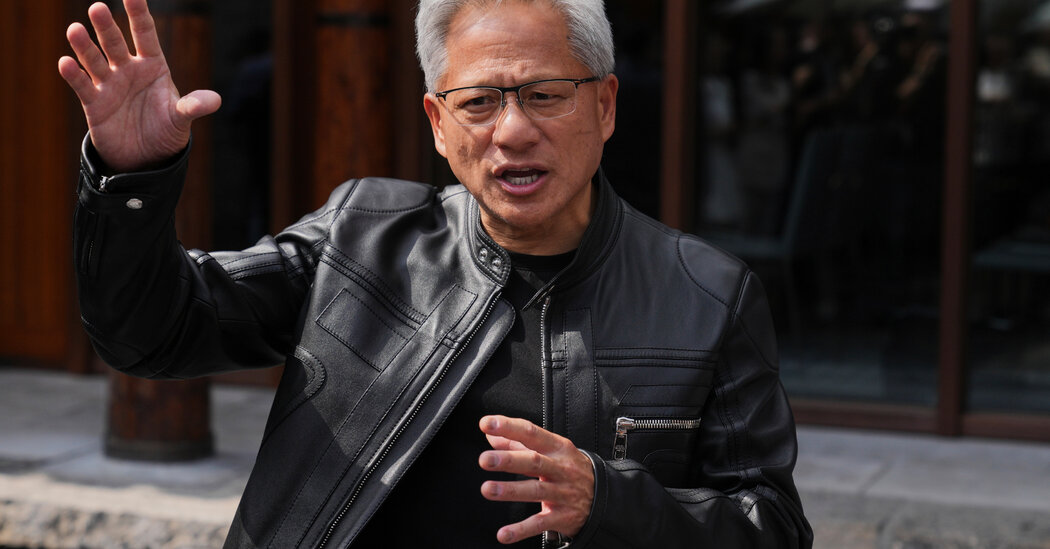

Jensen Huang, Nvidia’s chief executive, said on Friday in Taipei, Taiwan, that the company was offering a “new product for A.I. data centers,” which would be a version of its most cutting-edge chips that would be modified to reduce some of its performance, as required by the United States. He said he was seeking the Trump administration’s approval to sell the chip.

“It’s up to, of course, the United States government,” Mr. Huang said. “And we’re in dialogue with them, but it’s too soon to know.”

Mr. Huang’s comments came as Nvidia asked suppliers to wind down production of its current chip designed for China, the H20, said two people familiar with the company’s strategy. Beijing has discouraged Chinese companies from buying the H20 chips, with administrators warning that the chips could have “backdoor security risks.”

“We constantly manage our supply chain to address market conditions,” said Mylene Mangalindan, an Nvidia spokeswoman.

The Information previously reported on Nvidia winding down production of its H20 chip.

Nvidia’s plans for China have divided Washington, where the Trump administration and some Congressional leaders are at odds over global A.I. chip sales. Because the chips are used to build artificial intelligence systems, the U.S. government has weighed whether to limit sales so that U.S. companies can stay ahead of China in the A.I. race, preventing the Chinese military from using them to coordinate attacks or develop weapons.

In April, Mr. Trump blocked sales of the H20 to China, but reversed that decision in July and later struck a deal to take a 15 percent cut of sales of the chips. Last week, Mr. Trump said he was open to cutting a deal to permit Nvidia to sell a successor to the H20, provided it was “somewhat enhanced — in a negative way.” “In other words, take 30 percent to 50 percent off of it,” Mr. Trump said.

A chip that is 50 percent less powerful than the H20 would still have better performance than the chips that companies like OpenAI used to train chatbots as recently as last year, according to Lennart Heim, an information scientist at RAND, the think tank. It would exceed the performance thresholds set by the Biden administration for chips sold to China.

Some Congressional leaders have criticized the Trump administration’s policy change and expressed alarm that Mr. Trump would approve selling a more powerful chip than the H20.

On Friday, Representative Raja Krishnamoorthi, a Democrat from Illinois on the House Select Committee for China, introduced a bill to require presidential and congressional approval of A.I. chips for China. Senator Jim Banks, Republican of Indiana, has also questioned Mr. Huang’s push to sell chips to China.

Nvidia faces separate challenges in Beijing. In July, China’s internet regulator, the Cyberspace Administration of China, said it had summoned Nvidia to explain “backdoor” functions that would allow the chips to be tracked or shut down remotely. The regulator cited information “revealed by U.S. artificial intelligence experts.”

China has stepped up its pressure on Nvidia as Chinese media has reported that Huawei, the country’s tech giant, has improved the capabilities of its own chips. On Thursday, the South China Morning Post reported that DeepSeek, China’s leading A.I. company, said the country would soon have a next-generation A.I. chip.

Mr. Huang’s travel schedule testifies to the geopolitical tightrope his company is walking. He is scheduled to travel from Asia, where he’s visiting suppliers this week, to Washington, where he has meetings on Monday.

On Friday in Taipei, Mr. Huang said he was in talks with Chinese officials to ease their concerns about security risks. He said he had made “very clear” to Chinese officials that Nvidia’s A.I. chips have no security back doors.

“There are no such things,” he said. “There never has been. And so hopefully, the response that we’ve given to the Chinese government will be sufficient.”

Mr. Huang added that he was “surprised” by the questions, given Beijing’s eagerness to acquire the chips for advanced A.I systems.

“As you know, they requested and urged us to secure licenses for the H20 for some time, and I worked quite hard to help them secure the licenses,” he said. “Hopefully this will be resolved.”

Nvidia is set to report quarterly earnings on Wednesday, which traders expect to be a major market-moving event. Last month, Nvidia became the first public company to reach $4 trillion in market value.

Xinyun Wu contributed reporting.

Tripp Mickle reports on Apple and Silicon Valley for The Times and is based in San Francisco. His focus on Apple includes product launches, manufacturing issues and political challenges. He also writes about trends across the tech industry, including layoffs, generative A.I. and robot taxis.

Lily Kuo is a China correspondent for The Times, reporting from Taipei.

The post Nvidia Readies New China Chip as Washington Debates A.I. Exports appeared first on New York Times.