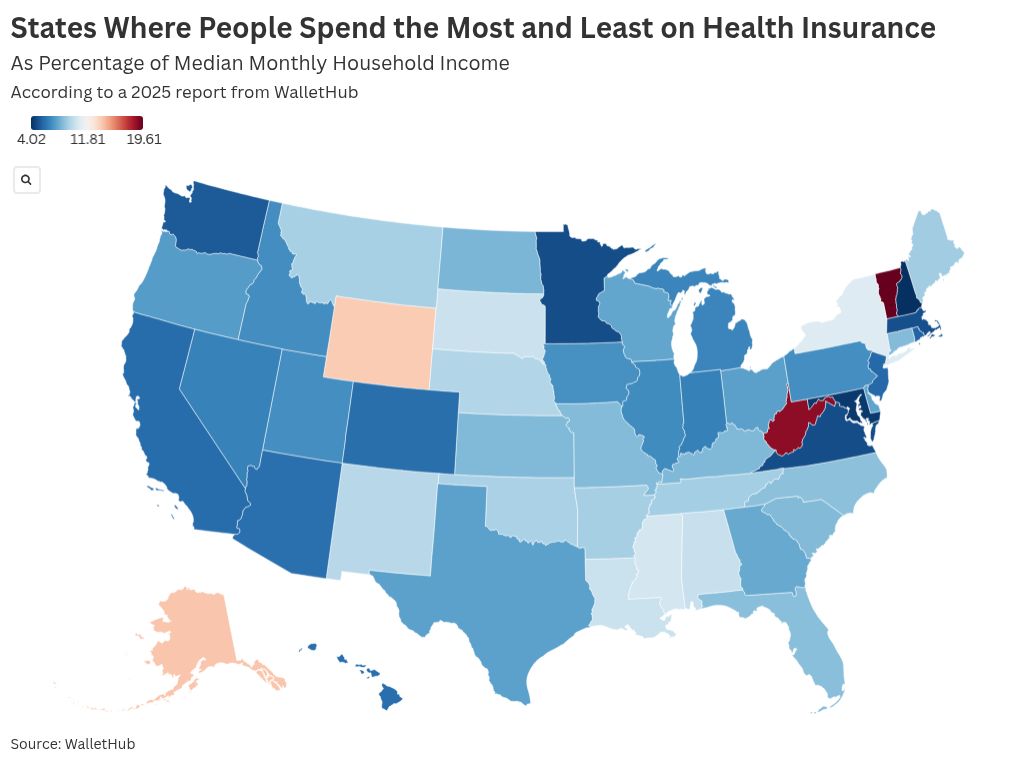

As health insurance premiums continue to climb across the country, a new report from WalletHub highlights which states are shouldering the heaviest burdens—and which are paying relatively little.

Why It Matters

The analysis compared the average monthly cost of a silver health insurance plan to the median monthly household income in each of the 50 states. Silver plans are known for offering moderate deductibles and relatively low premiums, making them a common choice among Americans. However, the share of income dedicated to these plans varies significantly by state, according to WalletHub’s report, from a high of nearly 20 percent to as little as 4 percent.

What To Know

Vermont tops the list as the state where residents spend the highest percentage of their income on health insurance. The average monthly premium for a silver plan in Vermont is $1,275—the highest in the nation. Even though Vermont’s median household income ranks 19th nationally at $78,024, that premium represents nearly 20 percent of the average monthly income, WalletHub said.

West Virginia follows close behind. With a median household income of $57,917—the second lowest in the country—and an average monthly premium of $908, residents spend nearly 19 percent of their income on health insurance.

Alaska ranks third, with residents devoting about 14 percent of their monthly income to premiums. Alaska has the second-highest average premium in the country at $1,040, and although its median income of $89,336 is the 12th highest nationwide, this “doesn’t do much to alleviate Alaskans’ struggles,” WalletHub said.

By contrast, states like New Hampshire offer a stark comparison. Residents there spend just 4 percent of their income on health insurance. This places New Hampshire at the bottom of the list in terms of spending burden, despite its proximity to Vermont.

What People Are Saying

WalletHub analyst Chip Lupo said in the report: “Inflation has driven up health insurance premiums significantly in recent years, making it harder and harder for Americans to afford proper health care. Being without insurance is even more dangerous, though, as medical debt is one of the most common reasons people file for bankruptcy.

“People in certain states feel the pressure of high premiums more than others, as they can cost as much as 20 percent of the median income in some states and as little as four percent in others.”

What Happens Next

Newsweek has previously mapped which states have the best—and worst—health care systems, according to a report by the Commonwealth Fund.

The post Map Shows Which States Spend the Most and Least on Health Insurance appeared first on Newsweek.