Courtesy of Viviana Vazquez

When my fiancé Xavi and I first started dating, we never talked about money — not because we didn’t want to, but because we didn’t know how.

Like so many first-generation college students, we grew up watching our families survive, not plan. Money was stressful and, oftentimes, shameful.

I also avoided talking about money with Xavi because I was embarrassed about growing up poor. I knew we weren’t on the same socioeconomic level; he went on yearly family vacations while I worked to help my parents with rent.

Courtesy of Viviana Vazquez

When our relationship got serious, though, I knew we had to have the conversations our parents never had and figure out how we, as a team, wanted to manage our money.

Today, between our 9-to-5 tech job salaries and my content creation business, we make over $300,000 a year combined. We’ve built a financial system that supports our shared goals and our individual freedom.

After almost 9 years together, we’re getting married in August and decided to combine our finances at the beginning of this year.

We wanted to give ourselves time to try out this new method and set up the structure we plan to use long-term. Our foundation is already solid; we did the hard part before marriage, which we’re really grateful for.

Here’s exactly how we decided to combine finances, and why it’s one of the best decisions we’ve ever made for our relationship.

We shifted from individual money management to a team approach

Before, we were doing what most couples do by default: splitting shared expenses like rent 50/50. It was functional, especially since we had similar incomes, but it wasn’t future-focused. It felt transactional instead of collaborative.

We realized that if we wanted to grow faster financially, we needed to shift from individual money management to a team approach.

We spent months talking through all the different ways couples handle money:

- Combine everything into one joint checking account and one joint savings account

- Keep everything separate — it’s worked for 8 years, so why not continue?

- Combine some (to cover our shared bills) and keep the rest separate

- Split things based on income instead of 50/50

How our 90/5/5 method works

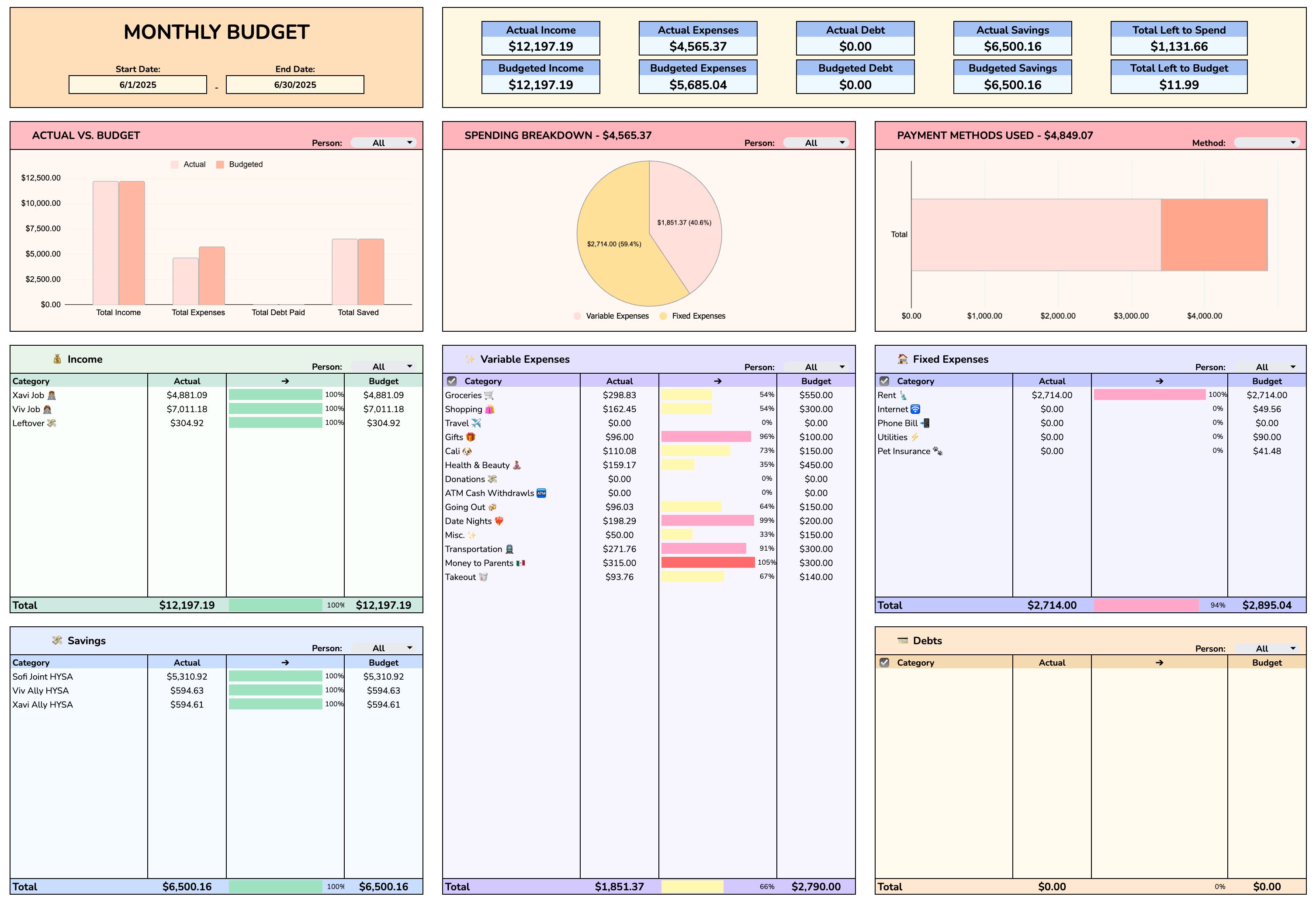

We discussed the pros and cons of each and ultimately decided on a hybrid system that works beautifully for us: 90% of our 9-to-5 income goes into a shared pool in a joint checking account and a joint high yield savings account (HYSA), and 5% of our combined income stays in each of our separate HYSAs. My content creation income is budgeted separately and is used only for growing my business.

We treat the shared 90% like our joint income

90% of my paycheck and 90% of Xavi’s paycheck flow into our joint SoFi account. We’re both maxing out our 401(k) accounts this year, which come straight out of our paychecks. From there, we allocate our take-home pay like this:

- Savings — our first priority is always to save at least 20% of our take-home pay. Our HYSA has multiple buckets, including an emergency fund, a Roth IRA fund, a travel fund, our wedding fund, and a holiday fund.

- Fixed expenses — this includes rent, utilities, wifi, car payment, and money to my parents.

- Variable expenses — these are expenses like beauty and eating out that change every month, depending on if we’re traveling or have more social events on the calendar.

Courtesy of Viviana Vazquez

We were able to finish saving for our wedding, which we budgeted $20,000 for, earlier this year by putting aside anywhere from $200 to $1,000 a month. By the end of May, we had saved over $30,000, adding some extra cushion in anticipation of additional financial assistance needed by several family members.

Courtesy of Viviana Vazquez

Before getting married, we made sure to discuss several important financial topics, including how to approach financial support for our families. We decided that we would both take on that expense, as long as we’re able to afford it. We especially want to do this because my parents help us a ton in non-financial ways, such as dog sitting, caring for us when sick, and checking in often.

Our individual accounts — 5% each, or 10% total

We set up 5% of my paycheck and 5% of Xavi’s paycheck to flow into each of our accounts to be equitable.

There are no rules about what we do with this money. We can spend it on anything we want, whether that’s extra individual savings, donations, or surprise gifts for each other.

This way, we stay aligned on the big picture while still allowing each of us space to save or spend a “fun” amount freely without needing to check in with the other.

Courtesy of Viviana Vazquez

Our money must-haves

We have specific rules we follow to keep managing our finances as stress-free as possible:

1. No surprise purchases from the shared account. We budget before we spend. If a purchase isn’t already budgeted, we check in and have a conversation about it.

2. We both have access to the joint account. Transparency is necessary if you’re a team.

3. Personal accounts are personal. I don’t ask about his personal activity, and he doesn’t ask about mine, although we always share our money activity with each other anyway.

4. We have “money dates” twice weekly. Every week, we take 30 minutes to sit down and update our budget to make sure we’re still on track to spend as we planned. If we’re overspending, we make adjustments to our budget together.

Courtesy of Viviana Vazquez

My advice for couples thinking about combining (or separating) finances

1. Talk early and often. Don’t wait until you move in together or get engaged; talk about money early on because your financial goals will most likely evolve as your relationship does.

2. There’s no one “right” or “wrong” way. The 90/5/5 split works for us, but other couples thrive with a different setup. What matters is that you both feel safe and seen in whatever system you create.

3. Remember that money can be emotional. Depending on how you grew up, your relationship with money (or your partner’s) can be deeply tied to your identity, values, and trauma. Be kind to each other and first ask: “What did money look like growing up in your household? Was your first money memory positive or negative?”

4. Use tools that make it easy. We use SoFi for joint banking, Ally for HYSA, and a budget template for budgeting. Do your research and explore accounts that work for you and your partner’s needs.

5. There’s no room for control, just collaboration. Combining finances shouldn’t be about controlling each other. Instead, it’s about trusting each other to build the financial life you both want to live, together.

Courtesy of Viviana Vazquez

We’re breaking the cycle

It isn’t about who makes more or less; it’s about building a life together in which money gives you the ability to achieve your individual and collective dreams.

As two first-gen kids, combining finances was never a numbers decision — it was us continuing to break the cycle. We’re both extremely proud of the wealth we’ve built separately, and can’t wait to now build wealth together, one money date at a time.

Viviana Vazquez is a 29-year-old senior content marketing manager who is documenting her journey on social media.

Do you have a story to share about how you and your partner manage money together and separately? Contact this editor, Jane Zhang, at [email protected].

The post My fiancé and I make a combined $300,000 a year. We use a 90/5/5 budgeting system — here’s a detailed breakdown. appeared first on Business Insider.