As large swaths of Americans are dipping into their savings to combat increased costs and economic tensions, living in some states as opposed to others could provide better long-term financial security.

Why It Matters

Financial instability has roiled countless Americans, some of whom are now more fearful of running out of money than dying. Simultaneously, people short on cash or worried about the stock market are dipping into their retirement accounts at higher levels than previously seen.

What To Know

Americans’ economic anxieties come from different places, including fears of recessions, inflation, health issues, grocery and gas prices, tariffs, and fears of government cuts to Social Security and Medicaid.

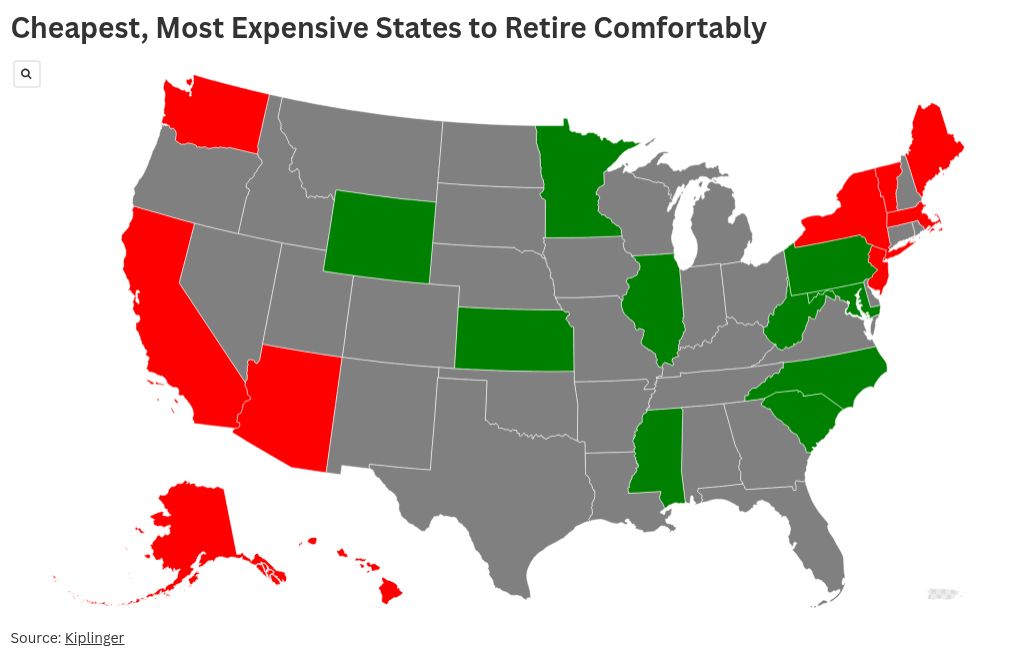

Kiplinger, a publisher of business forecasts and personal finance advice, devised a list of the states where money will go the longest in retirement without breaking the bank.

The top 10 states where you need the least savings to retire are as follows:

- West Virginia – $712,913

- Kansas – $741,455

- Mississippi – $753,472

- Pennsylvania – $864,633

- South Carolina – $869,140

- Minnesota – $870,642

- Wyoming – $872,144

- Illinois – $873,646

- North Carolina – $905,192

- Maryland – $924,720

The top 10 most expensive states where you need savings to retire are as follows:

- Hawaii – $2,212,084

- Massachusetts – $1,645,764

- California – $1,612,716

- Alaska – $1,292,753

- New York – $1,292,753

- New Jersey – $1,163,566

- Vermont – $1,153,051

- Washington – $1,145,540

- Maine – $1,144,038

- Arizona – $1,133,522

A recent AARP survey found that about 20 percent of adults age 50 and older have no retirement savings, and roughly 61 percent are worried they will not have enough money to support themselves in retirement.

While Americans are 15 times more likely to save for retirement when they have access to a plan through their employer, AARP reports that nearly 57 million people do not have access to a work-based retirement plan.

John Tamny, founder and president of the Parkview Institute and senior fellow at the Market Institute, told Newsweek that the nation is in a “pivotal moment” following general inaction on behalf of multiple presidential administrations and countless lawmakers in Washington, D.C.

He said the Trump administration is taking steps required to stabilize long-term fiscal sustainability by addressing structural deficits, rebalancing global trade relationships, and initiating housing reforms that prioritize supply-side incentives.

“There are tensions,” Tamny said. “Tariffs, housing affordability, concerns around entitlement spending—but these issues didn’t begin today. What is new is the willingness to confront them head-on. That means Americans should reframe retirement planning not around fear, but around resilience.

“In this environment, retirement preparation should be more dynamic, incorporating inflation-protected investments (like Treasury Inflation-Protected Securities, or TIPS), flexible retirement age expectations, and diversified income streams. Social Security may see adjustments, but by acting now, decades before any potential shortfall hits, this administration is likely protecting the program’s future viability.”

A study by Vanguard that examined data from nearly 5 million people with retirement accounts found a record 4.8 percent of account holders took hardship withdrawals from their 401(k) accounts in 2024, up from 3.6 percent in 2023.

He also said that geography certainly plays a role in how Americans of different ages and financial backgrounds are affected, and in turn their retirement prospects.

For example, Americans in high-cost areas should plan more carefully as should those in coastal cities with high housing costs and climate-related infrastructure pressures, like California and Florida.

“For Americans in high-cost states, that means thinking seriously and strategically about location,” he said. “It’s practical to think this way. Remote work, more portable benefits, and expanding infrastructure make relocation more feasible than ever.

“Retirement security is no longer just about how much you save; it’s also about where you spend those savings.”

The post Map Shows Cheapest and Most Expensive States to Retire Comfortably appeared first on Newsweek.