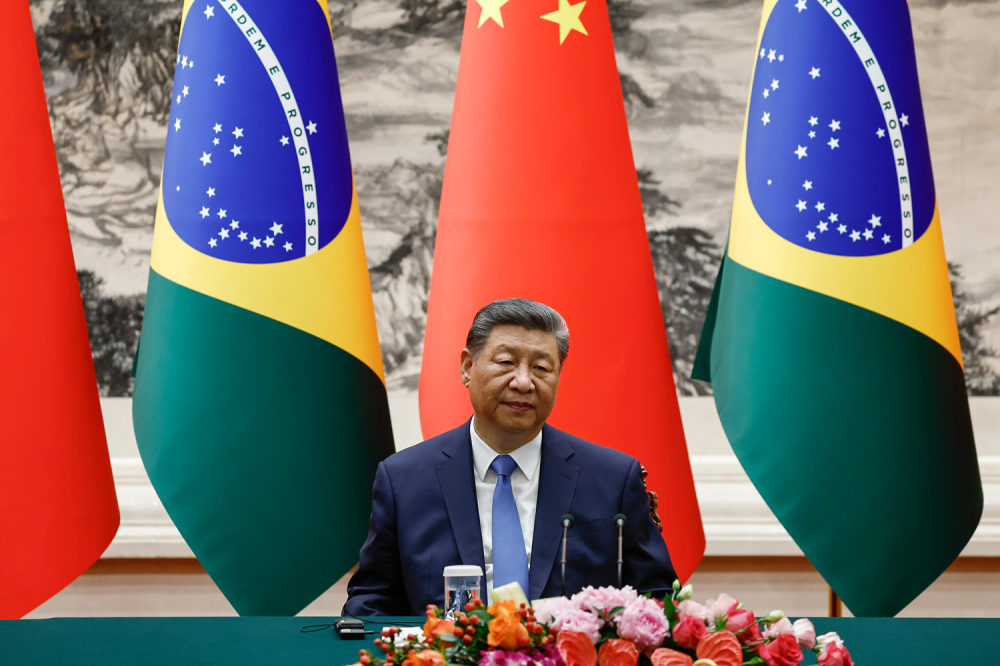

Earlier this month, China pledged $9.2 billion of credit to Latin American leaders gathered in Beijing. But there’s a twist: It wants to lend all this money in Chinese yuan, instead of the usual U.S. dollar credits that China has announced at previous gatherings of this regional forum.

This raises an interesting question over who actually wants to borrow these quantities in yuan: a barely convertible currency that—unlike the euro—has largely failed to capitalize on the dollar’s slide these past few months.

Indeed, one might have expected China to be better positioned to capitalize on this very moment. China has sought to internationalize its currency for at least the past 15 years and has built the infrastructure to prove it. Initiatives include China’s “Cross-Border Interbank Payment System” (CIPS) to rival SWIFT, the multilateral mBridge for central bank digital currency transactions, and the building of yuan clearing centers around the world. But what it ultimately cannot control is who buys or uses the yuan.

In this vein, China has tried to incentivize uptake through lending. New research at the Federal Reserve Board finds that China has actually increased its proportions of yuan-denominated overseas loans from around 15 percent in 2021 to almost 40 percent in 2024, albeit mostly focused on Asia. It’s therefore not inconceivable that China will find borrowers for its currency in Latin America, too.

However, this reliance on debt to advance the yuan can only go so far. Several countries in Latin America are already at risk of debt default for the first time in decades, and their appetite for Chinese loans to buy more Chinese goods and services is no doubt limited. As the World Bank’s 2024 International Debt Report made clear, global south economies no longer face a liquidity crisis like they did in previous generations—they have proved very capable of borrowing on bond markets and from commercial banks. In other words, they have options, so the Chinese yuan needs to be appealing.

China’s capital controls are its biggest impediment in this regard. China may be wary to liberalize its capital account for fear of suffering a similar fate to Japan in the 1980s or South Korea in the 1990s. But simultaneously, China hopes it can convince the world to use more yuan by guaranteeing the stability of its value—a difficult task in the present trade war with the U.S. and ironically one that depends on Beijing holding USD as a backstop.

Furthermore, China is currently facing pressure to lend money to stimulate overseas demand for its exports, and the data on yuan holdings beyond loans would suggest that most countries still prefer to hold several other currencies before the yuan.

Even China’s biggest fans have only modestly incorporated yuan reserves into their central banks over the past few years. The great exception is Russia, which has been forced to inhale masses of yuan in exchange for the oil and gas it struggles to sell elsewhere due to sanctions over the invasion of Ukraine. China effectively has Moscow over a barrel to take yuan, and yet, Russia cannot convert those yuan into U.S. dollars fast enough in Hong Kong.

The reality is that most of the world’s export invoices, debt issuances, and foreign exchange reserves are still in U.S. dollars, and until Chinese capital controls are significantly relaxed nobody wants to be too exposed to the yuan for fear of its lack of convertibility. Furthermore, world markets have often gravitated toward a hegemonic currency throughout history for the ease of doing business, whether they like the hegemon or not.

So, for now, the bigger question may actually be how many U.S. dollars will China be deploying toward Latin American trade before the next conference with Latin American leaders in three years? Quite possibly a lot more than the $9.2 billion in yuan, whether it comes in the form of buyer’s credits to the region’s governments, or seller’s credits that are issued directly to China’s exporters to cover costs before they receive their dollar payments.

Lastly, but certainly not least, China is not the only country that has tried to displace U.S. dollar hegemony. The French have been railing against the United States’ “exorbitant privilege” of having the world’s reserve currency since at least when Valéry Giscard d’Estaing was finance minister in the late 1960s and 1970s. Since they began those efforts to democratize central bank holdings of reserve currencies more than 50 years ago, they have made very little progress.

In fact, one hope for the euro was that it would catalyze France’s erstwhile modest gains. Once again, though, the French, among others who wished to see less USD dominance, have been largely disappointed. The euro has risen from around 18 percent of global reserves when it was launched to roughly 20 percent in 2025. Similarly, China’s gains of nothing in 2000 to 2 percent in 2025 are also pretty modest, having briefly overtaken the Canadian dollar in 2018 only to fall behind it again in 2023.

The upshot is that China is likely to keep driving the yuan in every arena it can, and borrowers like the Latin American leaders in Beijing last week may be its best opportunity in the short term. But this approach has its limits, and catching up with the euro, let alone the U.S. dollar, can only happen with a shift in demand. Without that, China may quickly find itself pushing rope.

The post China’s Yuan Ambitions Are an Uphill Struggle appeared first on Foreign Policy.