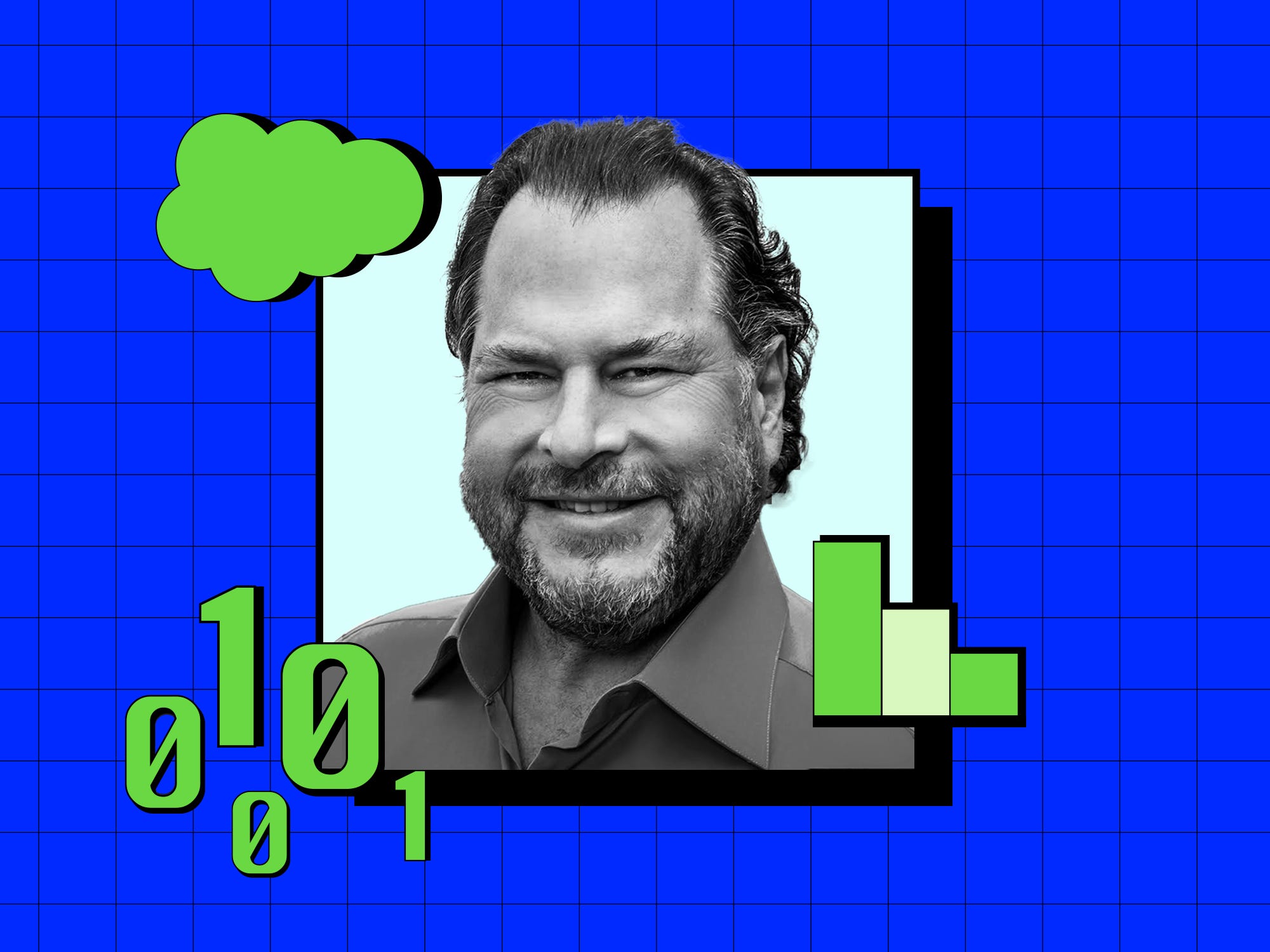

Courtesy of Marc Benioff, Ava Horton/BI

Salesforce chair and CEO Marc Benioff says angel investing is a “side hustle.” His returns say otherwise.

Benioff — who shared his investing strategy with Business Insider in an interview — has backed some of Silicon Valley’s biggest winners.

Salesforce Ventures has $6.8 billion under management and has deployed $600 million of its $1 billion Generative AI Fund, including a first-quarter investment in Anthropic, according to a spokesperson.

One of its biggest wins is the cybersecurity startup Wiz, which recently sold to Google for a whopping $32 billion. Salesforce Ventures, which first invested in Wiz’s Series B in 2021, will make roughly $600 million on the deal, Benioff said. (Salesforce’s profit on the Wiz acquisition has not been previously reported. A spokesperson for Salesforce Ventures declined to comment on the firm’s profits from the Wiz acquisition, citing the ongoing nature of the deal.)

“I worked directly with Assaf Rappaport,” Benioff said, referring to Wiz’s CEO and cofounder. “I enjoy working with entrepreneurs. I relate to them.”

It’s a hands-on approach that in many ways mirrors the early mentorship Benioff, who runs Salesforce’s venture arm and writes angel checks through his family office, Time Ventures, received in Silicon Valley.

Founder mode

Benioff’s father, who owned a local department store in San Francisco, instilled in him an entrepreneurial spirit from an early age, which fueled Benioff’s early career moves.

In high school, Benioff sold his first startup, software that taught users how to juggle, to a computer magazine for $75. At 15, he founded Liberty Software, which made early computer games. While in college, Benioff spent a summer interning at Apple, writing code for the Macintosh team under cofounder Steve Jobs.

It also gave Benioff an early mentor in Jobs. “There would be no Salesforce.com without Steve Jobs,” Benioff said in a 2013 interview with Entrepreneur magazine.

Fast-forward a few decades, and Benioff is at the helm of Salesforce, a $255 billion market cap Fortune 500 software company, still thinking like a founder.

Working with and investing in founders, Benioff said, encourages him to think more deeply about how he’s running his own business. “I am one myself,” Benioff said of being an entrepreneur. “I still feel like I’m running a company where you have to be able to adjust to the market as it adjusts and do whatever you can to be successful.”

Paying it forward

Founders in Benioff’s portfolio don’t just get capital — they get his Rolodex. “I can offer way more value to these entrepreneurs than any venture capitalist,” Benioff said.

Benioff said that founders who stand out to him create a shared vision. “Many of these people are visionaries,” he said. “They’re seeing things that don’t exist. Am I also able to see what they’re seeing?”

He also looks for entrepreneurs who have learned what works and what doesn’t, and how to adapt based on that experience.

One of those visionaries is Richard Socher, the founder of the AI-powered search engine You.com. “Marc has been an incredible supporter of my journey,” Socher told BI in an email. “Not only did he lead our seed round for You.com, which also included the You.com domain he had owned since 1996, Marc has opened his network to me, introducing me to early customers and CEOs at Fortune 100 companies.”

Benioff’s Time Ventures invested in You.com‘s $20 million seed round in 2021, and Salesforce Ventures backed the company in its $25 million Series A in 2022 and its $54 million Series B in 2024, according to PitchBook.

When asked about the AI boom, Benioff said he’s still able to discern the most compelling companies from the bubbly ones, pointing to his investments in Socher’s You.com and the AI terminal startup Warp, which was founded by Benioff’s cousin Zach Lloyd. “They have real revenue lines and real customers and real products that are offering real value,” Benioff said. “When you see that, then you’ve got to say, ‘That’s a real company.'”

Benioff invested in Warp’s $17 million Series A1 in April 2022, according to PitchBook.

This reality-based outlook is necessary when investing in startups with under $100 million in revenue, which Benioff called “fragile companies.” It also prevents him from romanticizing early-stage investing, which he doesn’t think is right for everyone. “I don’t encourage my family and friends to get involved in this,” he added. “It’s very high risk. Most of these companies do not work out.”

Amid the AI hype cycle and a boom in venture investing, Benioff still sees founders’ grit — even in himself. It’s a mentality he, after decades of building Salesforce into a giant, hasn’t quite yet shaken. “We still pivot like an entrepreneur has to pivot,” Benioff said. “We’re still in founder mode at Salesforce. We’re just a 75,000-person startup — there’s no difference.”

The post How Marc Benioff’s ‘side hustle’ scored a $600 million windfall from the Google-Wiz deal appeared first on Business Insider.