Chinese officials shot down President Donald Trump’s claim that the U.S. and China are actively negotiating to de-escalate the trade war ignited by his aggressive tariff policy.

Trump’s rhetoric on China has softened since he was reportedly spooked by market turmoil and warnings from CEOs that prices would rise and shelves would empty if the trade war continued. He’s now claiming he’s ready to be “very nice” in talks with Beijing—which he said were already taking place.

“I don’t think either side believes that the current tariff levels are sustainable, so I would not be surprised if they went down in a mutual way,” he told reporters on Wednesday, NBC reported.

He later added that the U.S. and China are in direct contact on trade “every day.”

But a spokesperson for China’s foreign ministry on Thursday said that, “China and the U.S. have not engaged in any consultations or negotiations regarding tariffs, let alone reached an agreement,” according to NBC.

Spokesperson Guo Jiakun added that China was open to negotiations but would only talk under certain conditions, The New York Times reported.

“China’s attitude is consistent and clear: If you want to fight, we will fight to the end. If you want to talk, the door is open,” Jiakun said.

A spokesperson for the Ministry of Commerce also said “any claims about progress in China-U.S. economic and trade negotiations are baseless rumors without factual evidence,” the Times reported.

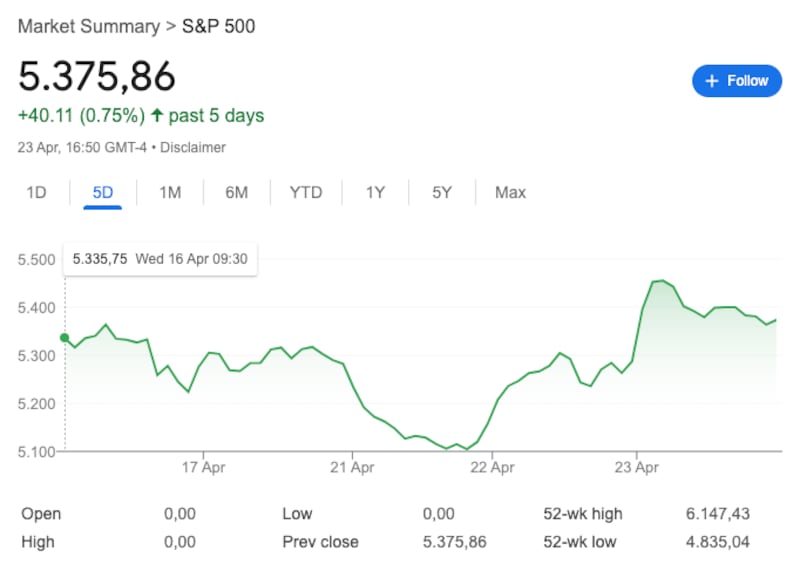

The news caused stock markets to stall Thursday after a two-day rally.

The S&P 500 has seesawed all week based on the Trump administration’s statements about China and whether Trump plans to go through with his plan to try to fire Fed Chair Jerome Powell.

Following a sharp sell-off on Monday, Treasury Secretary Scott Bessent told investors at a closed-door event the following day that the president’s trade war was unsustainable and he expected it to de-escalate.

Trump also told reporters later that day that he didn’t plan to play hardball with China, and that he was confident the two countries could strike a deal that would bring the tariffs down well below their current levels.

Trump hit products from China with 145 percent tariffs, while China has responded with 125 percent duties on American products. The tariffs are an import tax paid by American companies, with the added costs typically passed along to consumers.

The rates have gotten so high they have effectively become trade embargoes, with companies in both the U.S. and China saying they can’t sell at those prices. Some financial authorities are consequently fearful that the U.S. is heading toward recession.

The president announced a “Liberation Day” on April 2 as he unveiled universal 10 percent tariffs against all products entering the U.S. from other countries. Additional tariffs were added for products from countries that have trade deficits with the U.S.

Many of those countries vowed to retaliate against the measures, sending global stock markets tumbling and wiping out trillions of dollars in value. Even the usually stable U.S. bond markets were shaken.

Trump was reportedly unfazed by the prospect of a recession but privately expressed concern that his tariffs could lead to a more severe depression. He finally agreed to halt levies on dozens of countries for 90 days.

The duties on Chinese products, however, remain in effect.

“145 percent is very high and it won’t be that high,” Trump said Tuesday, according to CNN. “It won’t be anywhere near that high. It will come down substantially, but it won’t be zero.”

That same day, Trump told reporters he had “no intention” of firing Powell—less than a week after writing on social media, “Powell’s termination can’t come fast enough!”

The president’s top economist, Kevin Hassett, had also confirmed that Trump and his team were studying how to take the unprecedented step of removing the Fed chair.

But the president’s advisers reportedly warned him that getting rid of Powell could cause as much market turmoil as his trade war, according to CNN.

The post China Calls BS on Trump’s Panic Claim They’re in Trade Talks appeared first on The Daily Beast.