Drew Angerer/Getty Images

President Donald Trump has once again blasted Federal Reserve Chair Jerome Powell for cutting interest rates too slowly and warned he could remove him from his post. The latest threat to the central bank’s independence sent more shockwaves through markets.

Piling those fresh worries on top of tariff woes meant the “sell America” trade was in full force on Monday with US stocks, Treasurys, and the dollar all dropping.

The S&P 500 fell 2.4%, the dollar slid to its weakest level since 2022, the 30-year Treasury yield rose by about 10 basis points to 4.9%, and gold touched a record $3,500 an ounce as investors piled into the haven asset.

Here’s what big Wall Street voices are saying about Trump’s feud with Powell.

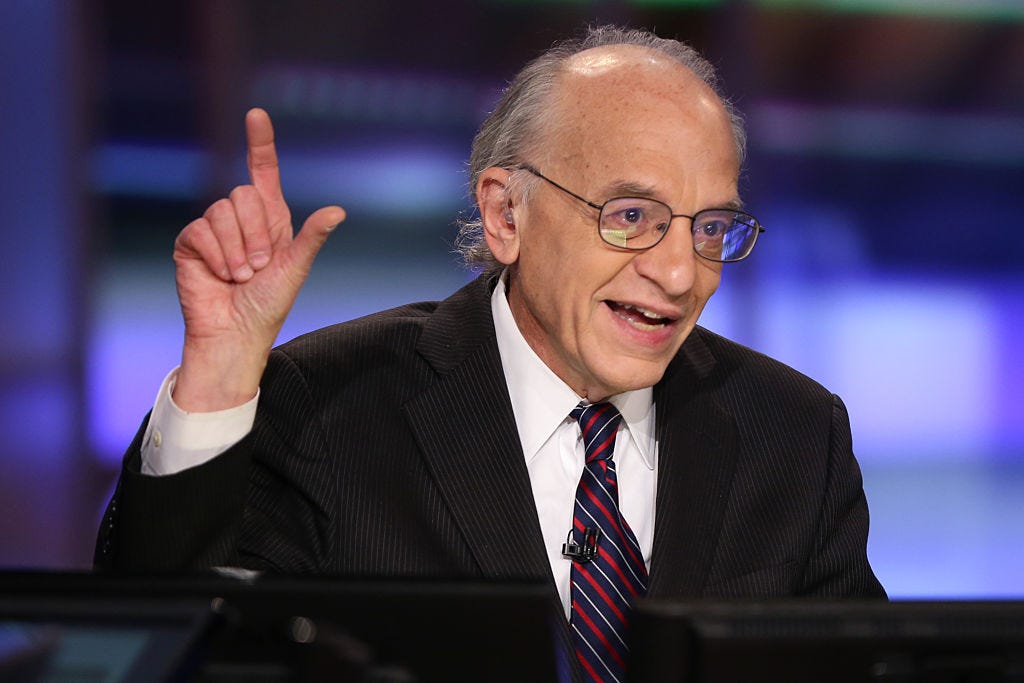

Jeremy Siegel: Powell may be Trump’s ‘scapegoat’

If the Fed doesn’t cut rates in June, Powell “risks not only deepening a potential downturn, but also becoming the scapegoat for it,” Jeremy Siegel said in his weekly WisdomTree commentary on Monday.

The finance professor known as the “Wizard of Wharton” said he expected the president to “increasingly blame the ‘too slow’ Powell for any downsides that materialize from Trump’s policies.”

Getty Images

Siegel added that Powell “may be technically secure in his position, but that doesn’t mean he’s insulated from blame.”

Mark Haefele: Faith in the Fed is in danger

Removing Powell before his term ends in May 2026 “could call into question the ability of the central bank to set interest rates without political interference, and hence the outlook for price stability,” Mark Haefele, the chief investment officer of global wealth management at UBS, said in a Tuesday note.

Haefele and his team said markets are “likely to be sensitive” to any signs that the White House intends to expel Powell or “replace him with a more ‘malleable’ candidate” once his term ends.

Liz Ann Sonders: Removing Powell could send rates higher

Ousting Powell and installing a more compliant Fed chief would undermine the central bank’s vital independence, Liz Ann Sonders, the chief investment strategist at Charles Schwab, said on “Market on Close” on the Schwab Network on Monday.

Alexander Tamargo/Getty Images

In that scenario, “any move by the Fed to preemptively start easing policy aggressively” that doesn’t fit its mandate “might not have the intended effect of boosting growth or boosting confidence,” Sonders said.

It could even push long-term bond yields higher, “defeating the purpose of a lot of this,” she cautioned.

Jim Reid: Powell’s colleagues could revolt

Powell has a big say in Fed decisions, but monetary policy is decided by majority vote “so removing Powell could lead to increased pushback from other members against pressure on the Fed to deliver easier policy,” said Jim Reid of Deutsche Bank in a Tuesday note.

Reid and his team added that investors are concerned the US may lose its credibility as a country with an independent central bank whose monetary policy isn’t dictated by politics.

Nouriel Roubini: Trump’s threats are an ‘own goal’

“Trump is shooting himself in the foot with this talk of firing Powell,” Nouriel Roubini, a professor emeritus of economics at NYU Stern known as “Dr. Doom,” said in a X post on Monday.

Roubini called it “a repeated own goal” as the chatter has hit stocks, bonds, credit spreads, and the dollar. He said that even if Trump succeeds in firing Powell, it would be a”totally Pyrrhic victory as the result would be a de-anchoring of inflation expectations and higher bond yields.”

If Trump is planning to scapegoat Powell for higher inflation and slower growth, it’s “not clear that this clumsy blame game will fly even with the MAGA base whose sentiment is heading south, let alone with financial markets,” Roubini said.

Paul Krugman: Trump is making Powell’s job harder

“What makes Trump’s attempt to bully the Fed especially ominous is the fact that the Fed will soon have to cope with the stagflationary crisis Trump has created,” Krugman said on his Substack.

The former MIT and Princeton professor and a Nobel Prize winner said Powell will soon have to choose between raising rates to fight inflation, or cutting them to fight recession.

REUTERS/Brendan McDermid

The president’s threats had complicated that decision, Krugman said. “Trump has made Powell’s dilemma even worse with his attempted bullying, because a rate cut would be seen by many as a sign that Powell is giving in to avoid being fired.”

Michael Every: Trump isn’t alone in questioning the Fed

Trump’s criticism of Powell as “Mr. Too Late” and a “major loser” represents a “comic-book punch” on the Fed chair, said Michael Every of Rabobank in a Tuesday note.

But the president isn’t the only person frustrated with the Fed, Every continued.

“To be honest, Trump is saying many of the same things that many of those covering the Fed in markets are too — just far less politely; and very inappropriately in the eyes of those same commentators,” Rabobank’s global strategist said.

Peter Schiff: Trump wants a ‘loyal soldier’

Peter Schiff, the chief economist at Euro Pacific Asset Management, outlined what Trump may seek in Powell’s successor.

Trump “will likely nominate the most dovish replacement to ever chair the Fed,” he said in a weekend X post.

The president’s pick will be a “loyal soldier willing to sacrifice the dollar and create as much inflation as needed to monetize exploding debt to keep interest rates artificially low,” Schiff added.

The post Wall Street’s big voices are weighing in on Trump’s feud with Powell — and most aren’t happy appeared first on Business Insider.