The Panicked Moments When a Beach Celebration Became a ‘War Zone’

It was the kind of Sunday evening cherished by the Sydneysiders who call Bondi Beach home: groups of friends lolling...

Fed chair favorite Kevin Hassett on potential independence from Trump: ‘His opinion matters if it’s good, if it’s based on data’

A leading candidate to be President Donald Trump’s choice for Federal Reserve chair said that he would present the president’s...

Who Looks Like They Belong in America?

On July 7, 2025, armored vehicles rolled into MacArthur Park, in Los Angeles, where children were at summer camp. National...

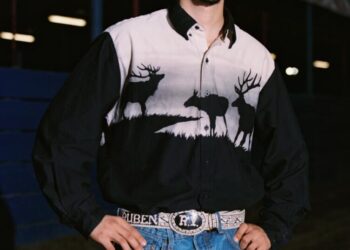

‘This feels like home.’ A fashionably late night out to the Pico Rivera Sports Arena

The belt used to belong to his father. Black leather, silver stitching, “RUBEN” spelled across the side with the initials...

Sergey Brin, who came back to Google to work on Gemini, says staying retired would have been a ‘big mistake’

Google cofounder Sergey Brin says a short-lived retirement left him restless — and pulled him back into the race to...

Seizing Venezuelan oil tankers could backfire on Trump

The Trump administration strategy of blowing up suspected drug-smuggling boats, already criticized by many legal experts as illegal, became even...

Daniel Naroditsky’s Death Exposes an Existential Threat to Chess

In July, the American grandmaster Daniel Naroditsky played a speed chess game against the Swedish chess master and popular streamer...

Exclusive: Visa launches stablecoins advisory practice to keep up with crypto wave

Another major financial institution is doubling down on stablecoins and on crypto. This time, it’s Visa. The company announced on...

Billionaire Trump, 79, Reveals Unhinged White House Priority as Prices Surge

Donald Trump has revealed the White House’s domestic priority, and it’s not bringing down costs or addressing the looming healthcare...

The 52 Best Breakup Lines (Said in Real Life)

“It’s not me — it’s 100% about you. Unless you turn into a different person, this will never work.” Tricia...