Fed Up With High Costs, American Theater Takes a Trip to London

In a ramshackle onetime warehouse on the south side of London, with a leaky pitched roof, a shabby chic bar,...

Oil prices seesaw as Trump sends mixed messages on what’s next in Iran

Oil prices reached heights not seen since the aftermath of Russia’s 2022 invasion of Ukraine on Monday before falling back...

Former Meta A.I. Chief’s Start-Up Is Valued at $3.5 Billion

Late last year, Yann LeCun left his job as chief A.I. scientist at Meta to launch a start-up. Arguing that...

US FAA issues ground stop for all JetBlue planes

JetBlue Airways has requested for a ground stop at all destinations, the US Federal Aviation Administration said in an advisory...

Ukraine says it’s fought over 57,000 Shaheds. Now, the US and its allies are clamoring for help with the same battle.

Ukraine's bread-and-butter tools against Shaheds include mobile fire groups, equipped with truck-mounted machine guns, and interceptor drones. Andriy Dubchak/Frontliner/Getty ImagesAfter...

Yann LeCun Raises $1 Billion to Build AI That Understands the Physical World

Advanced Machine Intelligence (AMI), a new Paris-based startup cofounded by Meta’s former chief AI scientist Yann LeCun, announced Monday it...

So Much for the Donroe Doctrine

On Saturday, President Trump met with leaders from across Latin America and the Caribbean for the so-called Shield of the...

Workers at OpenAI show support for Anthropic as the company says it could lose $5 billion in its feud with the Pentagon

Dado Ruvic/REUTERSAnthropic faces a $5 billion loss due to its feud with the Pentagon, the company said in a court...

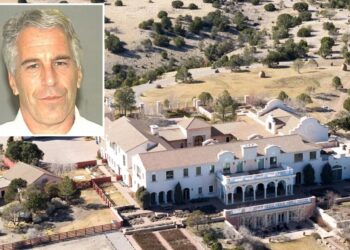

Mysterious Zorro Ranch formerly owned by Jeffrey Epstein searched by New Mexico authorities

New Mexico authorities launched a search on Monday of a notorious secluded ranch previously owned by pedophile financier Jeffrey Epstein....

CEOs are using one number in the AI age to decide how many people they still need

Tim Walsh knows the the metric that is quietly reshaping how corporate America thinks about its workforce. It isn’t revenue...