What Lies Ahead for Mamdani and Tisch?

Good morning. It’s Thursday. Today we’ll look at the unusual relationship between Mayor Zohran Mamdani and the police commissioner, Jessica...

Democracy’s Doomsday Prepper

Betting money puts the odds of constitutional collapse in the United States at about one in 25. Anyone can wager...

Brazil’s Newest Film Icon Is Not Your Typical Star

Even shielded by dark sunglasses, Tânia Maria de Medeiros Filha can’t step outside these days without fans fawning over her....

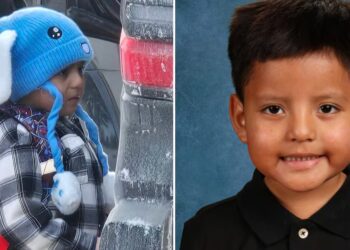

ICE Detains 5-Year-Old Child After School

ICE agents in Minnesota have taken President Donald Trump’s immigration crackdown to a shocking new low, detaining a 5-year-old boy...

The Writer Who Defined 1920s Paris? It Wasn’t Hemingway.

THE TYPEWRITER AND THE GUILLOTINE: An American Journalist, a German Serial Killer, and Paris on the Eve of WWII, by...

Mt. Whitney hiker who forged on after friend turned back is found dead

Another hiker has died while attempting to summit the highest peak in the contiguous U.S., marking the third reported death...

Trump set to meet Zelensky in Davos as his envoys head to Moscow

KYIV — Ukrainian President Volodymyr Zelensky scrambled to get to Switzerland on Thursday for a high-stakes meeting with President Donald...

Hello, Greenland. Goodbye, Checks and Balances.

President Trump has changed America — and the world — in ways both large and small in the first year...

Starving and stranded: Inside the desperate effort to save 24 wild horses

The Sunday before last, Blake DeBok snowmobiled out to nine wild horses he was told were stranded in deep snow...

Jason Mantzoukas Makes It Weird

On a chilly January afternoon, the actor Jason Mantzoukas, wide-eyed and bearded, tramped the streets of Manhattan with an air...