Deported 2-Year-Old May Not Have Had ‘Meaningful’ Legal Process: Judge

A Trump-appointed federal judge has raised concerns that a 2-year-old U.S. citizen may have been deported to Honduras “with no...

Fine-print fiasco: More carmakers charging subscription fees for once-free features

Hey, automakers: Enough with the upsells! According to a new survey, most drivers are fed up with being asked to...

Trump’s Far-Right Allies in Europe Lose Out

U.S. President Donald Trump blinked first, averting trade war with the European Union for now—but the damage is done. After...

George Santos’s Many, Many Lies Finally Catch up to Him

Congress’s mouthiest liar will be spending the next seven years in prison. A federal judge sentenced former Representative George Santos...

Sofia Vergara rocks lace bustier top on night out with Eva Longoria, friends in Madrid

Sofía Vergara dressed in a sexy burgundy lace bustier top during a night out with Eva Longoria and Eiza González...

US State Department appoints new top official for Europe

A business consultant and former member Secretary of State Marco Rubio’s Senate staff has been appointed as the US State...

Breaking Down the Intense Ending of Weak Hero Class 2

Warning: This article contains major spoilers for the ending of Weak Hero Class 2. Weak Hero Class 1 ends at...

Samsung Just Accidentally Leaked the Galaxy S25 Edge Price

Ever since Samsung unveiled the rest of the Galaxy S25 lineup at January’s Galaxy Unpacked event, those left pining for...

2-year-old U.S. citizen apparently deported ‘with no meaningful process,’ judge says

A federal judge in Louisiana said Friday that a 2-year-old U.S. citizen appears to have been deported with her mother...

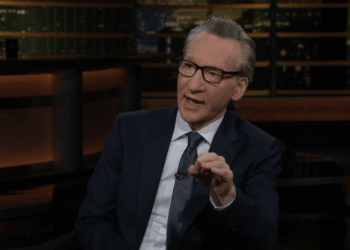

‘Real Time’: Bill Maher Continues Denouncing Nazi Comparisons: “A Hard Word To Use With Nuance”

Bill Maher is standing his ground over dining with Donald Trump after recent Nazi comparisons. On Friday’s episode of Real...