He Raps, He Rants, He Promises Change. Meet Nepal’s Presumptive New Leader.

In his 35 years, Balendra Shah has been a rapper, a mayor, an engineer and an unswerving fan of rectangular...

U.S. Solar Installations Fell in 2025 as Trump Attacked Clean Energy

Solar power installations declined in the United States last year, as the Trump administration sought to impede the growth of...

Bannon warns Hegseth’s answers could cost GOP

MAGA influencer Steve Bannon criticized Defense Secretary Pete Hegseth on his Monday broadcast for dismissing questions about whether Iran posed...

Senate Republicans split over Trump’s ‘No. 1 priority’ in Congress

Senate Republicans are increasingly divided over how – or whether – to pass President Donald Trump’s sweeping elections overhaul, a...

Finnish pair wins a barrel of ale in annual ‘wife-carrying’ contest in England

To have and to hold took on a new meaning for about two dozen couples who put their relationships to...

U.S. holds on to defeat Mexico in the World Baseball Classic

Aaron Judge hit a two-run homer and Roman Anthony added a three-run blast in a big third inning to lead...

Trump is holding key endorsement hostage as GOP primary heats up: report

President Donald Trump is delaying a pivotal endorsement in the Texas Republican Senate primary as he seeks to pressure GOP...

Texas woman allegedly plowed through crime scene, ran over already-dead victim

A Texas woman allegedly crashed through a cordoned-off crime scene and ran over the body of an already dead victim...

Trump admin ordered to process tariff refunds with massive interest accruing

Judge Richard Eaton of the U.S. Court of International Trade set firm deadlines for the Trump administration to process refunds...

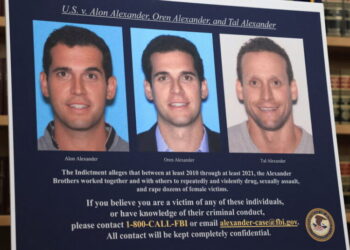

Alexander Brothers Found Guilty on All Counts in Sex-Trafficking Trial

Three brothers, including two who were among the country’s most prominent real estate brokers, were convicted in Manhattan on Monday...