So Much for the Donroe Doctrine

On Saturday, President Trump met with leaders from across Latin America and the Caribbean for the so-called Shield of the...

Workers at OpenAI show support for Anthropic as the company says it could lose $5 billion in its feud with the Pentagon

Dado Ruvic/REUTERSAnthropic faces a $5 billion loss due to its feud with the Pentagon, the company said in a court...

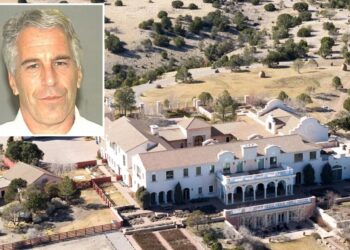

Mysterious Zorro Ranch formerly owned by Jeffrey Epstein searched by New Mexico authorities

New Mexico authorities launched a search on Monday of a notorious secluded ranch previously owned by pedophile financier Jeffrey Epstein....

CEOs are using one number in the AI age to decide how many people they still need

Tim Walsh knows the the metric that is quietly reshaping how corporate America thinks about its workforce. It isn’t revenue...

Free housing, offices, and up to $720,000 subsidies: Chinese cities go all in on OpenClaw startups

Some Chinese cities are going all in on "raising the lobster." VCG/VCG via Getty ImagesSome Chinese cities are going all...

America’s never had such high national debt heading into an economic shock. We need a ‘break glass’ plan, think tank warns

The U.S. has never been more financially exposed heading into a potential economic crisis. With the national debt now equal...

Gen Z is already nostalgic for TikTok—and the platform is only 6 years old

It started, as most cultural alarms do, on TikTok itself. Earlier this year, a wave of young users began flooding...

As War Comes to Gulf States, Migrant Workers Pay the Highest Price

Murib Zaman worked as a driver in the United Arab Emirates for two decades, living more than a thousand miles...

Conan O’Brien knew late-night shows were in trouble after viral ‘Hot Ones’ appearance

Comedian Conan O’Brien realized that late-night shows were in deep trouble after his viral appearance on the popular online show “Hot Ones.”...

Yamaha pulling out of California after nearly half a century: HQ headed to Georgia

After nearly 50 years in Orange County, Yamaha Motor Corp. USA is packing up its headquarters — trading Cypress, California...