To understand how Americans are faring economically these days, it’s helpful to consider the eleventh letter of the alphabet.

Experts describe the current U.S. economy as “K-shaped,” a reference to the divergent fortunes of wealthier consumers compared with people lower down the ladder. The upward-slanting stroke of the “K” represents the ongoing trend of strong spending and healthy income growth among upper-income Americans.

By contrast, the letter’s lower-slanting stroke points to the multiple financial strains facing low- and middle-income people, from stubborn inflation and prohibitively expensive homes to surging credit card debt and high health insurance costs.

This bifurcation of the economy isn’t a new phenomenon, with inequality on the rise since the 1980s, noted Mark Zandi, chief economist at financial research firm Moody’s Analytics. But the divide in income and wealth has grown more skewed since the pandemic, reflecting the “growing gap between the wealthy and the well-to-do and everyone else,” he said. “It’s taken off.”

Several trends help explain what’s behind the emergence of a K-shaped economy.

Consumer spending

Consumer spending — which drives over two-thirds of economic activity — is growing overall in the U.S. These days, however, a large and growing share of that commercial activity is driven by upwardly mobile Americans. In the second quarter of 2025, the top 10% of income earners accounted for almost half of all spending, according to an analysis of Federal Reserve data by Zandi.

“That group has always accounted for a much larger share of spending, but that share has risen significantly over time, and now is the highest it’s ever been in the data,” he told CBS News.

Other data tells a similar tale. In September, spending by lower-income households grew 0.6% from a year ago, compared with 2.6% for higher-income consumers, according to a recent report from the Bank of America Institute.

Spending on U.S. luxury fashion was also up 8% year-over-year in October, according to the bank’s data — another sign that wealthier households are driving spending.

“Younger, less affluent households are facing ongoing challenges, while older, wealthier consumers are driving overall spending growth,” said Grace Zwemmer, an associate economist at investment advisory firm Oxford Economics.

Record stock prices

Because much of their income is held in stock and other securities, affluent Americans have particularly benefited from this year’s run-up in financial markets, which have notched record after record largely on the strength of investor excitement about artificial intelligence.

A May Gallup poll found that 87% of Americans who own stock live in households with incomes of $100,000 or more. The top 1% of income earners — who on average earn around $731,000 per year, according to personal finance site SmartAsset — own nearly half of corporate securities and mutual funds, Federal Reserve Bank of St. Louis data shows.

A bullish stock market also benefits the millions of employees with 401(k), mutual funds and other investments, but does much less to lift the many Americans without such holdings, said Tuan Nguyen, an economist at RSM US, an audit, tax and consulting firm.

“For lower- and middle-income people, especially the ones that live paycheck to paycheck, the rally in the equity markets might not be relatable to them because they are facing higher inflation and lower wage growth,” he said.

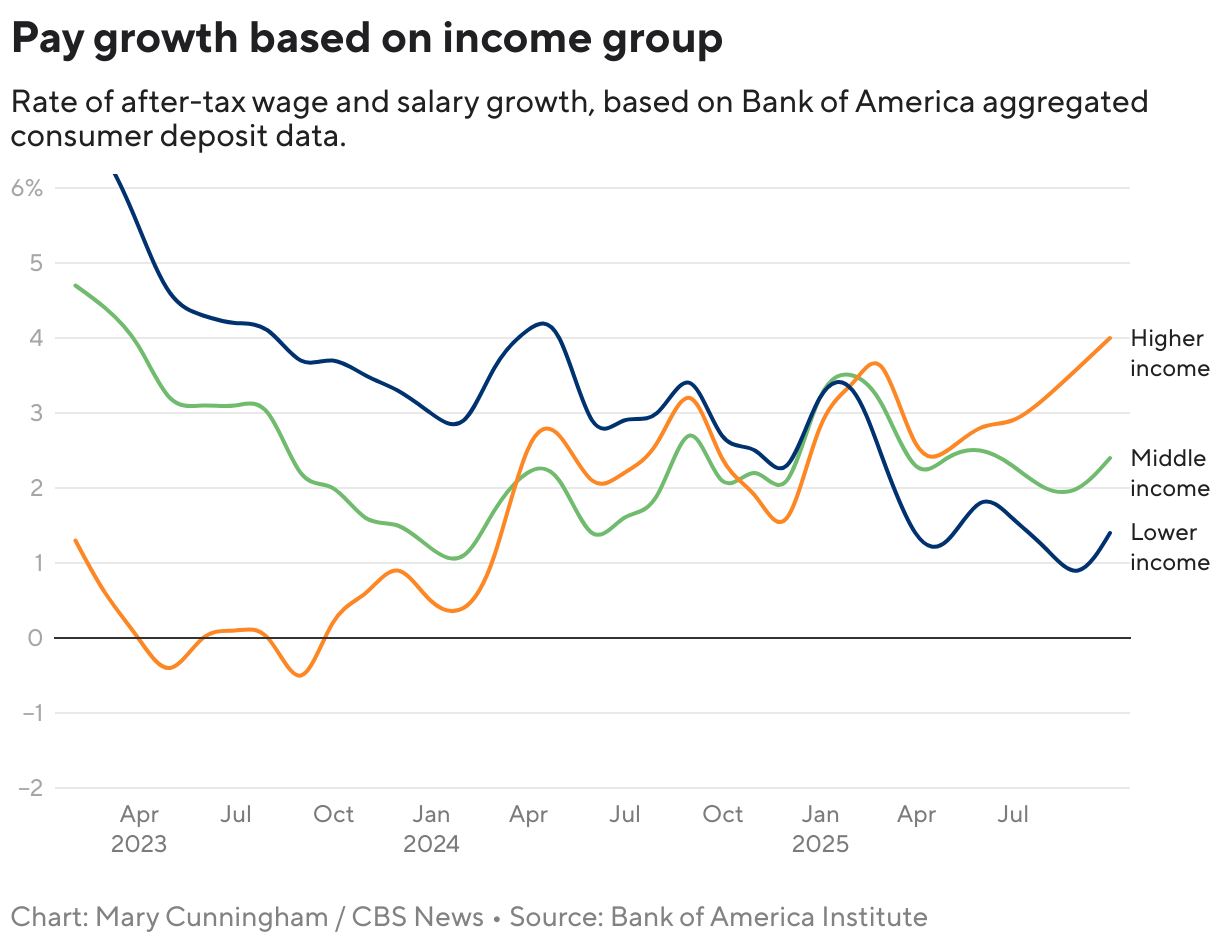

Of late, better-heeled Americans have also seen stronger pay gains. According to the Bank of America Institute, the rate of wage growth for higher-income households in September rose to 4% year-over-year. Annualized pay growth for lower-income households as of August fell to 0.9%, the lowest since the financial giant started tracking the data in 2016, said Taylor Bowley, an economist at the Bank of America Institute.

What lower-income people “see from the grocery store, from the gas stations, is that prices are going up while their wages are not going up,” Nguyen added.

Lower-income households also face a toxic stew of inflation, credit card debt, student loans and mortgage loans, sapping their spending power. They also feel the pinch of a slowing job market more acutely than high-income groups, Zandi told CBS News.

“They may have a job, although if they lose one, they’re having a harder and harder time getting back into the labor market,” he said.

Edited by

The post You’re living in a “K-shaped” economy. Here’s how that affects you. appeared first on CBS News.