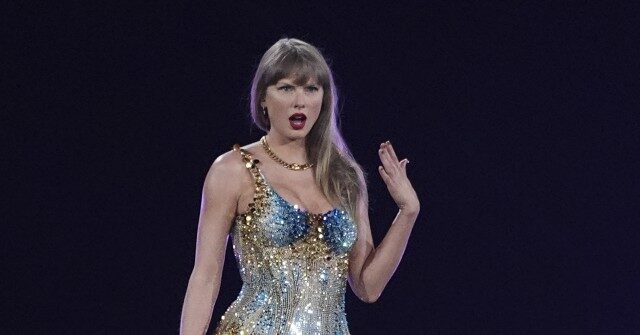

Courtesy of Houlihan Lokey

- GlobalData said Houlihan Lokey is the top M&A advisor by volume so far this year.

- The LA-based investment bank hired senior dealmakers and expanded its ranks as rivals held back.

- CEO Scott Adelson says “the flywheel is catching,” explaining how the bank is positioning itself.

Scott Adelson didn’t expect to be sitting in this seat right now.

“I’m probably an accidental investment banker,” the CEO of Houlihan Lokey — which has become one of Wall Street’s busiest investment banks by deal volume — said in an interview with Business Insider in September.

After earning an MBA from the University of Chicago Booth School of Business, Adelson started a small business and expected to spend his career building companies, not advising them. But when he joined a roughly 30-person valuation shop in Los Angeles in 1987, he thought he was making just a brief stop in the world of high finance.

Four decades later, and he’s still there — and now sits at the helm of the bank, having been named to the chief executive role last year, and previously serving as copresident and global cohead of corporate finance.

Houlihan has come a long way from its roots as the restructuring and bankruptcy expert clients thought of when a liquidity panic was afoot. This year, Houlihan worked with financial sponsor clients like Carlyle and advised the hair care brand Color Wow on its sale to L’Oréal — part of the 240 transactions it handled through the third quarter, according to GlobalData league tables reviewed by Business Insider.

To be sure, other bulge-bracket banks handle larger corporate mergers or take-privates and have surpassed Houlihan in the transaction value they work on; however, in the middle-market arena — deals generally valued at around $1 billion and under — the firm has drawn significant deal flow.

During its most recent earnings disclosure this week — the bank’s second quarter of the 2026 fiscal year — Houlihan announced that it generated revenues of $659 million, 15% higher than the same quarter last year. Corporate finance revenues of nearly $439 million were about 17% higher than the same period last year; while financial and valuation advisory brought in $87 million, up almost 10%.

“Capital markets are wide open and capital is plentiful,” Adelson said, according to an earnings call transcript. “All this has increased overall confidence in the dealmaking appetite.”

Adelson has been predicting the rebound for months. After a sluggish few years, dealmaking finally appears to have returned in 2025 thanks to a steadier rate environment, lighter regulation, and a wave of optimism about AI and technology. Adelson says the firm’s ready, pointing to a strategy that’s expanded its ranks while others have retreated from hiring and deepened its sector-specific coverage.

“The flywheel is catching,” he told Business Insider, “and we’re ready for it.”

Hiring through the cycle

While many large banks have remained cautious about growing staffing levels in recent months, unsure how technology or other efficiency pushes will impact their compensation budgets, Houlihan has taken the opposite approach.

Since early September, it’s added six managing directors from companies like UBS and Capital One. They’ve joined Houlihan teams in the US and Europe, broadening the bank’s reach in healthcare finance, mortgage technology, IT services, private equity coverage, and capital solutions.

Courtesy of Houlihan Lokey

Adelson said one growth area of continued investment is the firm’s capital solutions group, which advises clients on financings and balance-sheet strategies. As of mid-2025, the firm’s overall head count was nearly 2,700 people, of which nearly 350 were managing directors.

Expanding the playing field

The hiring spree supports a broader effort to deepen Houlihan’s industry coverage. “To be able to hire through the cycles, to never really have any layoffs in an industry that has historically been known for expanding and contracting like an accordion,” Adelson said, has brought “tremendous” stability to the team.

Now, the firm has about 200 dedicated industry sectors, he said; each is led by senior bankers who are specialists in different fields. That’s more than double its coverage from a decade ago.

Within corporate finance, the capital solutions group operates as one of two engines alongside M&A. It helps companies and investors raise private capital, refinance debt, or manage their balance sheets and has handled more than 100 transactions this year, according to the company.

Targeted acquisitions

Another part of Houlihan’s expansion strategy has come through small, targeted acquisitions of boutique investment banks. Since 2020, it has acquired eight individual firms.

In 2024, the firm bought Waller Helms Advisors, a Chicago-based boutique focused on insurance and wealth management. The deal added 50 people to the financial services group, including 13 managing directors, according to the company’s announcement. Later that year, it acquired Prytania Solutions, a London firm that builds analytics software used in portfolio valuation and fund-advisory work — an example of how Houlihan is trying to integrate technology within its core business.

Adelson said the firm’s approach to M&A prioritizes cultural synergy. “We’ve walked away from deals that made tremendous economic sense,” he said, because they weren’t a fit culturally. And he still considers his entrée into banking an accident.

“I joined a really small firm and realized that I liked being the dumbest person in the room rather than the smartest,” he said, recalling Houlihan’s early days. Now, he tends to see himself as more of a builder than a banker — a mindset which he’s bringing to the firm’s next chapter.

“I am very much a ‘looking-forward’ person — what’s next, what’s the plan?” he said. “We’re nowhere near what we’re capable of achieving.”

Read the original article on Business Insider

The post How an ‘accidental banker’ is turning this LA-based investment bank into one of the biggest deal machines appeared first on Business Insider.