As Jensen Huang, the chief executive of the chip making giant Nvidia, traveled to Asia to meet with President Trump on Wednesday, his company’s value topped $5 trillion. It was a show of wealth that would have been unthinkable a few years ago.

But that was before the ChatGPT chatbot ignited an artificial intelligence boom that is remaking the global economy. It was before other tech titans began spending hundreds of billions of dollars on construction projects on almost every continent. And it was before Nvidia’s computer chips, the most essential and expensive component in almost every A.I. scheme, became a linchpin of the Trump administration’s foreign policy.

Nvidia’s milestone, the first publicly traded company to top $5 trillion in market value, is indicative not only of the astonishing levels of wealth consolidating among a handful of Silicon Valley companies but also the strategic importance of this company, which added $1 trillion in market value in just the past four months.

Nvidia has become a driving force behind the U.S. economy. Spending on data centers, which are filled with the company’s chips, accounted for 92 percent of the country’s gross domestic product growth in the first half of the year, according to Jason Furman, a professor of economic policy at Harvard. Without it, the economy would have grown 0.1 percent.

But Nvidia’s stunning growth also comes with a warning to investors, from the biggest banks on Wall Street to small-time traders on Main Street, that the stock market is becoming more and more dependent on a group of technology companies that are churning out billions in profits and splurging to develop an unproven technology that needs to deliver enormous returns.

“There’s unbridled optimism about where this technology is going to go,” said Gene Munster, a managing partner at Deepwater Asset Management, which invests in emerging technology companies. “But the question is: Will it deliver? The usefulness of A.I. is still limited today.”

There have been periods of market concentration before but none as stark as the one created by A.I. Nvidia alone makes up more than 8 percent of the S&P 500, according to Howard Silverblatt, a senior index analyst for S&P Dow Jones Indices. Apple and Microsoft now top $4 trillion. Those companies combined with Meta, Amazon, Alphabet and Tesla make up more than a third of the entire index.

Nvidia’s A.I. chips, which account for more than 90 percent of the market, are highly coveted by businesses and governments around the world. Mr. Trump has put them at the forefront of America’s trade strategy, striking deals to sell A.I. chips to the United Arab Emirates, Saudi Arabia, South Korea and Japan.

As the president traveled across Asia this week, he signaled that Nvidia would be a factor in U.S.-China trade talks. Sales of its chips to China were suspended over the summer as tensions flared between those countries. The nations have been wrestling with how to deal with a powerful technology that can be used to develop advanced weaponry and drive economic opportunity.

Mr. Huang, 62, has spent much of the year bouncing between Washington and Beijing trying to find a solution. In the process, he has become a valuable conduit between China’s top leader, Xi Jinping, and Mr. Trump, who is eager to strike a trade deal between the countries, said two people familiar with the confidential trade talks who spoke on the condition of anonymity.

“Nvidia works with governments across the world,” said John Rizzo, a company spokesman. “We do not engage in geopolitical or diplomatic discussions between governments.” The White House didn’t immediately provide comment.

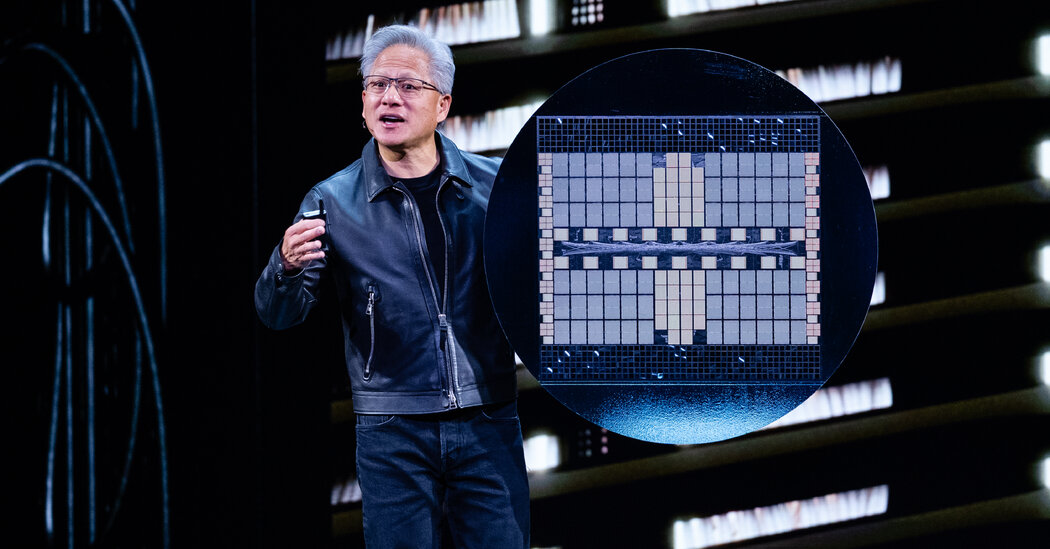

Nvidia has further endeared itself to Mr. Trump by shifting some of its manufacturing to the United States. This month, the company started making its latest A.I. chip, known as Blackwell, at Taiwan Semiconductor Manufacturing Company’s plant in Arizona.

Last week, Mr. Huang delivered Mr. Trump a signed version of the chip in a red case during a private meeting at the Oval Office. Mr. Trump praised the product in Tokyo this week and called Mr. Huang “brilliant.”

Speaking at a news conference after Nvidia’s first major conference in Washington on Tuesday, Mr. Huang said that the United States and China would benefit from allowing Nvidia to sell its technology in China. The United States would see its technology providers become the foundation for A.I. and American A.I. companies in the world’s most populous nation. China would receive more-efficient chips that make their A.I. companies more productive.

He said the question for China was: “Do they want to be open market or selectively open market? Our job is to wait until they want us to be there.”

During a media appearance on Wednesday ahead of the highly anticipated U.S.-China trade talks, Mr. Trump said that he and Mr. Xi would speak about Nvidia’s Blackwell chip, which he called “super duper.”

The prospects of Nvidia’s return to China pushed its market value above $5 trillion on Wednesday. The company could make more than $50 billion in sales in China over the next year, analysts estimate.

Nvidia has agreed to pay the U.S. government 15 percent of the money it makes from selling A.I. chips to China, as a result of an agreement Mr. Huang and Mr. Trump reached in July. Mr. Huang said Tuesday that the Trump administration was working on a new regulation to make those payments possible.

Additional sales to China would be the latest good news for Nvidia. Speaking onstage at Nvidia’s event on Tuesday, Mr. Huang said that A.I. was as essential to the future as electricity and the internet.

“Every company will use it,” said Mr. Huang, who spoke to several thousand people in his trademark black leather jacket. “Every nation will build it.”

Mr. Huang highlighted how companies like Microsoft and the software company Oracle are pouring hundreds of billions of dollars into building data centers for A.I. To a room full of a thousand people, he showed a chart projecting that the companies’ spending would top $549 billion this year, more than double what they spent in 2023, according to Morgan Stanley.

He said that Nvidia had orders to ship 20 million of its newest chips through the end of next year, up from four million of its previous generation shipped between 2023 to 2025. The orders are worth about $500 billion in sales, far more than analysts had previously estimated.

But Mr. Huang’s speech also stoked skepticism about whether the A.I. spending boom was justified. Some investors have questioned whether A.I. will increase productivity and sales. Mr. Huang offered few concrete examples of that, pointing primarily to how software engineers at Nvidia use it to automate computer programming.

“We’re still really, really early in this process, and there have been enough little examples from early artificial intelligence businesses that have made people say, ‘Wow,’” said Bob O’Donnell, president of TECHnalysis Research, a technology research firm. “But converting those examples that have shown promise into something that changes how people work is taking much longer than people have expected.”

Mr. Huang put Nvidia in position to lead the A.I. transformation by betting that his company’s chips — known as graphics processing units, or GPUs — would be essential to building artificial intelligence. Before then they were popular for powering video game computers and the machines for creating cryptocurrencies. He plowed money into a custom programming language to control those chips that became critical to building A.I. systems.

The combination of the chips and software have allowed Nvidia to dominate what has become the next wave in computing, much as Intel and Microsoft controlled the PC era and Apple the shift to mobile devices like the iPhone.

Nvidia has seen a sevenfold increase in sales since OpenAI’s ChatGPT set off an A.I. arms race in late 2023. It expects to post more than $26 billion in profit for the current quarter, which would eclipse Wall Street projections for other tech heavyweights like Apple and Meta.

The speed of Nvidia’s rise left longtime Wall Street watchers at a loss for words.

“It’s incredible,” David Faber, one of the hosts of the CNBC show “Squawk on the Street,” said on Wednesday morning. “Did you ever think in our lifetime we’d see a $5 trillion company?”

Joe Rennison contributed reporting in New York.

Tripp Mickle reports on some of the world’s biggest tech companies, including Nvidia, Google and Apple. He also writes about trends across the tech industry like layoffs and artificial intelligence.

The post Nvidia Is Now Worth $5 Trillion as It Consolidates Power in A.I. Boom appeared first on New York Times.