For more than two decades, the U.S.-China trading relationship has been at the center of globalization’s story: low-cost goods for American consumers, rapid growth for China and an intricate web of supply chains binding the world’s two largest economies together. The Chinese people — hardworking, innovative and industrious — have been essential partners in that story.

But economic relationships are strategic choices. What once seemed like a path toward shared prosperity has become a structural imbalance that weakens America’s autonomy. It’s time to end our excessive trading reliance on China — not over global tensions or hostility, but for the sake of pragmatism.

This isn’t an argument against global trade or ending relations with China. It’s an argument for better trade. It’s about reinforcing — not rebuilding — America’s economic strength by deepening our engagement with democratic, market-based nations while reducing exposure to a single authoritarian power that wields disproportionate leverage over our economy.

The economic facts are stark. In 2024, U.S. exports to China totaled roughly $143 billion, while imports from China reached almost $439 billion. That imbalance produced a trade deficit of more than $295 billion — the largest bilateral deficit the U.S. maintains. Total trade between the two countries approached $659 billion. Some economists have argued that large and persistent deficits with China have contributed to U.S. job losses since China’s accession to the World Trade Organization in December 2001.

Such numbers might not matter if trade were evenly distributed across sectors and partners. But much of this dependence is concentrated in strategically sensitive industries. Nowhere is this more dangerous than with rare earth elements, which are critical to nearly every advanced technology, from semiconductors, electric vehicles, wind turbines and smartphones to radars and precision-guided defense systems. China also accounts for the majority of rare earth production and nearly 90% of its processing worldwide.

For years, importing these materials from China seemed cheaper than producing them at home or working with allied suppliers. But a low price does not ensure security. A single policy decision from Beijing, for example, could send shockwaves through U.S. defense manufacturing, clean energy industries and many industrial supply chains.

In recent years, Chinese export restrictions on gallium and germanium have rattled global electronics supply chains. When the pandemic hit in 2020, American hospitals scrambled to source protective gear from factories thousands of miles away. This dependence is not merely an economic risk — it’s a strategic vulnerability, as it affects supply chains and distorts the policy choices we make. When mission-critical industries rely on inputs controlled by an authoritarian state, economic reliance can turn into political leverage.

There’s another, often overlooked consequence of our trade relationship with China: financial market volatility. Over the last decade, U.S. stock markets have repeatedly swung on news of tariff announcements and tensions between the superpowers. Investors know that any sign of trouble in the U.S.-China relationship can threaten corporate earnings and increase market volatility. By contrast, trade with stable democratic partners is less prone to abrupt political shocks. Diversifying and balancing commerce toward democratic, market-oriented nations would likely reduce the frequency and intensity of these market gyrations, offering greater predictability for companies and their investors.

The U.S. has always thrived in open economies governed by fair competition. The right response to our current challenge is deeper engagement with nations that share those principles — countries like Japan, Australia, England, Canada, Mexico, the Philippines, South Korea and member states of the EU. Many of these trading partners are already investing in new rare earth supply chains and other critical industries to reduce overreliance on China. By working together consistently over a long period of time, democratic nations can create diversified, independent markets that enhance collective security and competitiveness.

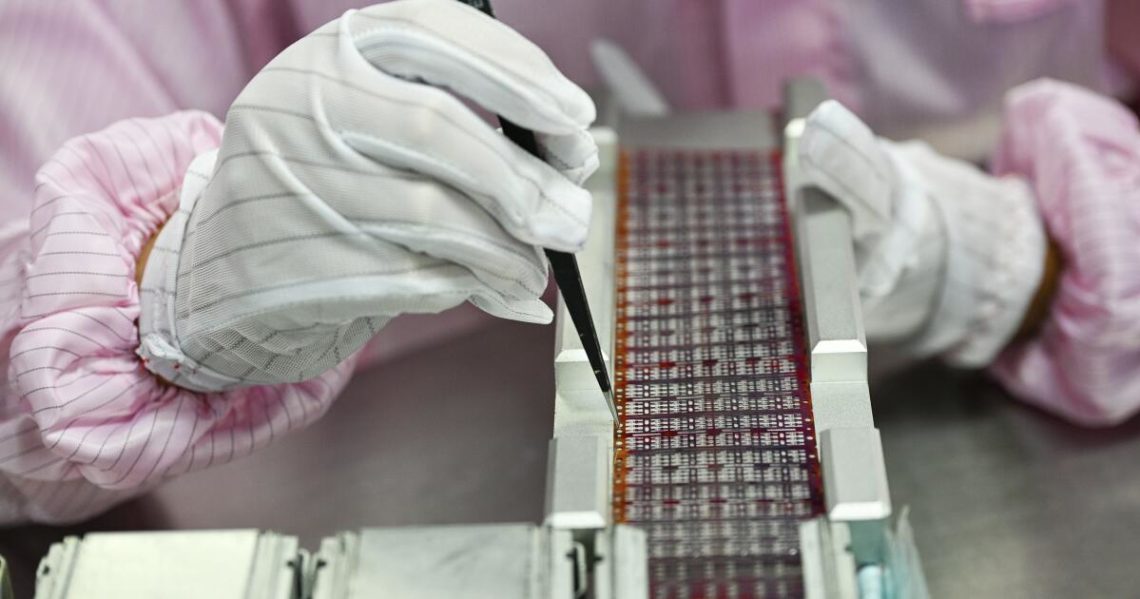

The same logic extends beyond minerals. Strategic industries — semiconductors, pharmaceuticals, auto manufacturing, energy components and medical supplies — should be anchored at home among trusted partners. A globally networked system rooted in open markets and shared rules is not only more secure than dependence on a single country but also more innovative, more inclusive, more resilient and more stable. And it would help better insulate global financial markets from geopolitical shocks tied to a mercurial bilateral relationship.

Critics call efforts to reduce reliance on China “decoupling,” as if it means turning inward. That’s not true. Abating its overreliance on China trade will reaffirm U.S. leadership in free and open markets and will help the U.S. and its allies better align their economic strategies with market transparency and long-term security. Delaying these steps only raises the cost. Each year of dependence deepens the imbalance and narrows America’s flexibility. Rare earths may be the clearest example, but they are hardly the only one. Concentration in China reaches across many areas of manufacturing, creating risks the U.S. can no longer ignore.

The Chinese people will continue to prosper and innovate, just as they should. But the U.S., over time, must chart its own course — one that’s more secure and economically principled. That means reinforcing domestic capacity in industries where it matters most and building deeper, freer trade relationships with democratic, market-based partners that complement our core competencies.

Ending our overwhelming reliance on China for trade and commerce does not mean ending the relationship. Many ties existing between our two countries, which have been cultivated since President Nixon’s 1972 visit to Beijing, should of course continue to both nations’ benefit.

The current trade relationship with China is no longer constructive. Making change will take time — well more than a decade — and will require a great commitment. But ending that dangerous dependence, and embracing new, open markets with trusted allies, is a renewal that’s long overdue, and one that will make all the difference as we navigate the uncharted waters of the 21st century.

Christian B. Teeter teaches global business and international economics at Mount Saint Mary’s University in Los Angeles.

The post Contributor: The real cost of America’s overreliance on trade with China appeared first on Los Angeles Times.