Major works from the Okada Museum of Art, which was created by the Japanese billionaire Kazuo Okada and is filled with an important trove of Asian art he collected, are to be sold to resolve a $50 million legal bill left over from his dispute with the casino mogul Steve Wynn.

When the dispute with Wynn was settled out of court in 2018, Okada balked at the fee that his law firm, Bartlit Beck, presented him with. But the firm successfully pursued its claim in a binding arbitration and in court. Next month, works held by the museum are to be sold at auction by Sotheby’s in Hong Kong to cover the bill.

The Sotheby’s sale, scheduled for Nov. 22, features 125 lots and includes masterworks of Asian art, such as late Shang ritual bronzes, Qing imperial porcelain, Japanese screens and Korean ceramics, some of which are expected to draw bids that top several million dollars.

“This is possibly among the finest such collections,” said Nicolas Chow, chairman of Sotheby’s Asia and worldwide head of Asian Art, in a telephone interview. “What we have is basically 3,000 years of some of the greatest ceramics, craft and paintings across China, Japan and Korea.”

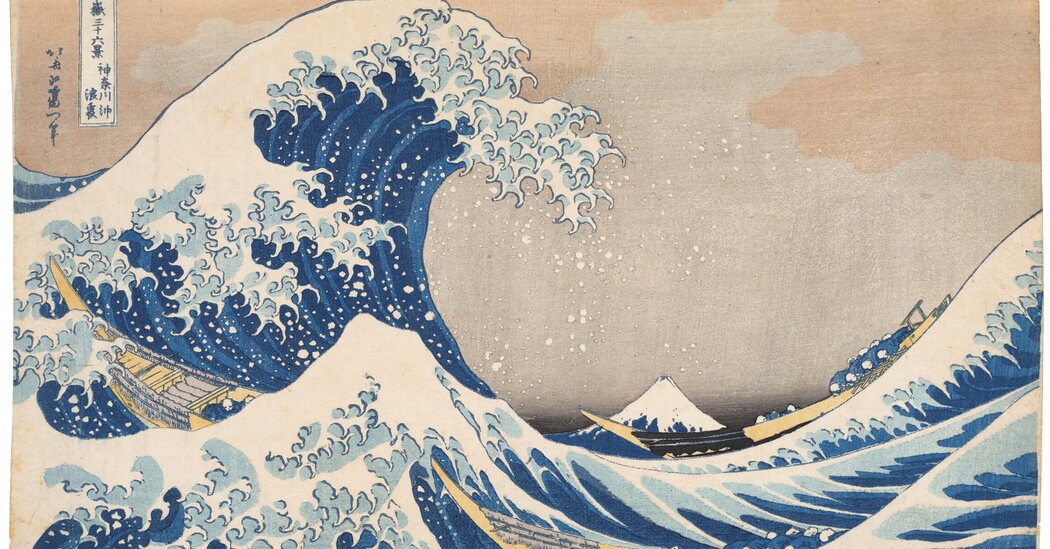

The Okada sale will include a rare Qianlong “Eight Treasures” vase; a large Northern Song Ru “guanyao” bowl; a pair of 16th-century six-panel screens by Kano Motonobu from the Muromachi period; and “The Great Wave Off the Coast of Kanagawa” by Katsushika Hokusai, which has been called “the most famous Japanese woodblock print in the world.”

“The Great Wave” — depicting Mount Fuji in the distance under the crest of a giant wave — is part of Hokusai’s celebrated series “Thirty-Six Views of Mount Fuji,” which helped establish the popularity of landscape prints. The artist started the Fuji series in 1830 at age 70 and produced several iterations.

“There are many impressions of the Great Wave, and there isn’t one ‘definitive’ version,” wrote Capucine Korenberg, a scientific researcher at the British Museum in 2020. “For example, the British Museum has three impressions in the collection, the Metropolitan Museum of Art has four and Maidstone Museum (UK) has one.”

The online information for the Sotheby’s sale reports that the artworks have been consigned “by an agent of the court appointed receivers over the shares of Okada Fine Art Limited” based on court orders issued in Hong Kong.

The Okada museum declined to comment on what impact the sale might have on its holdings. It said that it could not provide contact information for Okada, who could not be reached for comment.

Located in the dense forest surrounding Hakone, a mountain resort, the Okada museum opened in 2013 as a showcase for a collection of several hundred works. Sotheby’s said the museum’s holdings were shaped over three decades by Kochukyo Co., the art dealership founded by Hirota Matsushige (later known as Fukosai) that has guided many museums and private collectors since 1924.

“As my collection’s scope broadened from traditional Japanese paintings to Asian ceramics and Buddhist arts, and as the numbers of each type grew in my collection,” Okada wrote in an introduction to the museum, “I became convinced that I must build a facility that will properly preserve these important cultural treasures, a place where they can be enjoyed by as many people as possible.”

Okada is the former chairman of Universal Entertainment Corporation, which makes and sells amusement devices, in particular pachinko machines — a cross between pinball tables and slot machines that are used in gambling parlors in Japan. He came to be known in Japan as the “Pachinko King.”

Years ago, he and Wynn became friends and they formed Wynn Resorts in 2002 after Wynn sold Mirage Resorts to MGM Grand.

“I love Kazuo Okada as much as any man that I’ve ever met in my life,” Mr. Wynn gushed during an earnings conference call in 2008.

But a few years later, relations between them soured, with each eventually accusing the other of questionable payments to public officials in Asia. In 2012, Wynn Resorts ousted Okada as vice chairman and redeemed Universal’s 20 percent stake in the company at a discount.

Universal, based in Tokyo, went to court to dispute the redemption amount. Okada’s company ultimately prevailed in 2018 in a settlement in which Wynn and Wynn Resorts agreed to pay $2.6 billion to settle its litigation with Universal and its American subsidiary, Aruze USA Inc.

But, according to court records, Okada refused to pay the $50 million to the law firm that had represented him in the court battle with Wynn, which led to the arbitration. Okada later argued in court that the arbitration panel’s decision had been unfair, in part because a health issue had prevented him from participating fully.

But federal courts in Illinois confirmed the arbitration panel’s decision, asserting in one decision that Okada “took himself out of the race” by choosing not to continue to present evidence to the arbitrators.

Sotheby’s said the items to be sold are estimated to draw bids in excess of $50 million. Any extra proceeds not needed to retire the debt and any unsold artworks will be returned to Okada Fine Arts, which is controlled by Okada.

Kiuko Notoya contributed reporting from Japan.

Robin Pogrebin, who has been a reporter for The Times for 30 years, covers arts and culture.

The post Museum’s Treasures to Be Sold as Founder Faces $50 Million Legal Bill appeared first on New York Times.