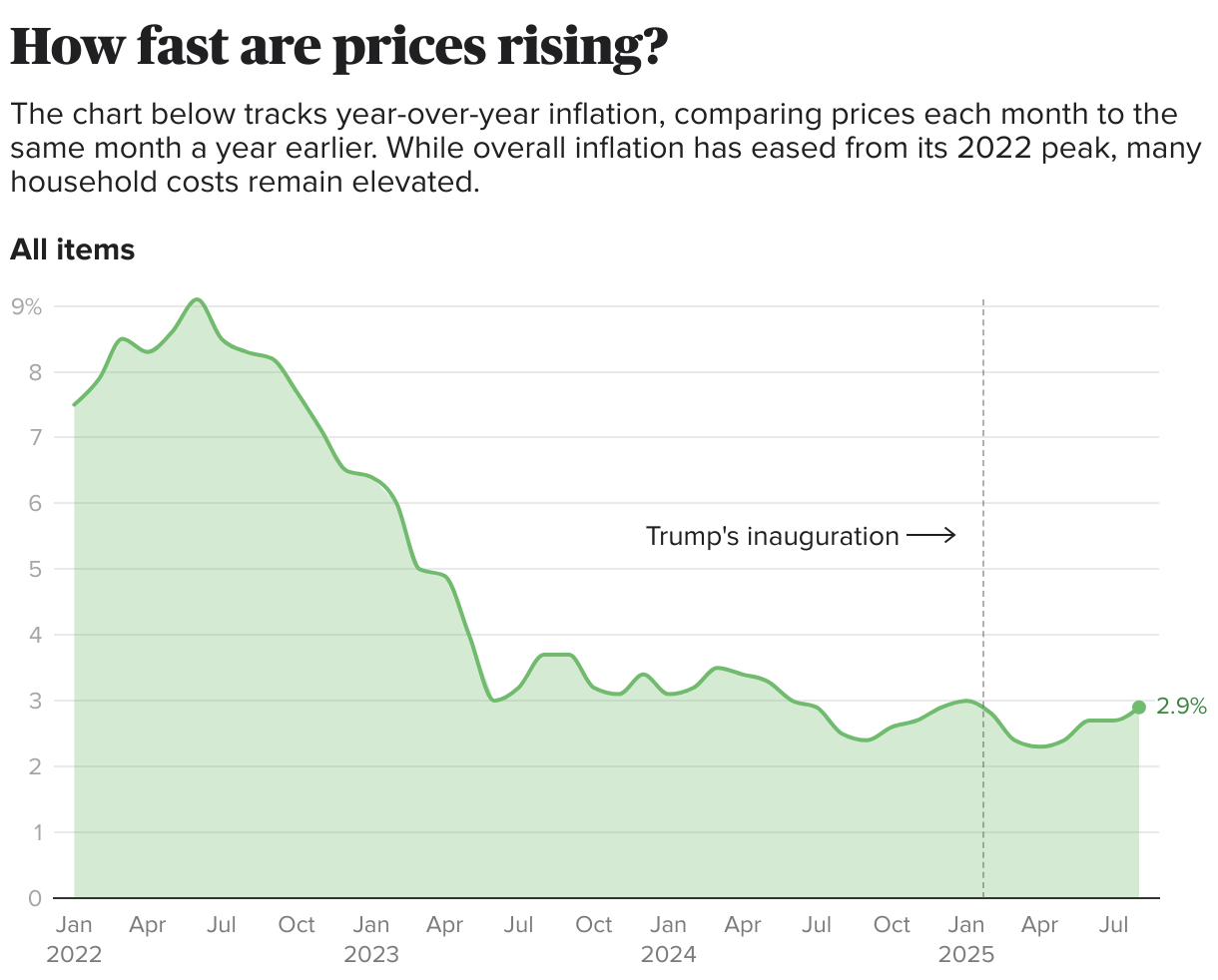

The Consumer Price Index climbed at an annual rate 3% in September, coming in below economists’ forecasts as the impact of President Trump’s tariffs remain muted.

By the numbers

Economists polled by financial data firm FactSet had forecast CPI rose at a 3.1% annual clip last month. The CPI measures price changes in a basket of goods and services typically bought by consumers.

While most federal economic data releases have been suspended during the government shutdown, the Department of Labor is making an exception for the September CPI data. That’s because the inflation rate is needed to determine the Social Security Administration’s annual cost-of-living adjustment for beneficiaries, which is also scheduled to be announced on Friday.

What economists say

Inflation is inching higher partly due to the Trump administration’s tariffs, according to economists. U.S. businesses are eating some of the costs in the form of lower profits, which has blunted the impact of the import duties on consumers.

Still, companies are also passing on as much as 55% of those import taxes to consumers in the form of higher prices, according to a Goldman Sachs analysis. Other research shows a lower rate of passthrough tariff costs to shoppers.

“Tariffs have put upward pressure on prices, particularly in the goods-producing sector of the economy,” Brandon Zureick, senior managing director and chief economist at investment firm Johnson Investment Counsel, told CBS News. “We’re definitely a little higher than where we started the year, and above the Fed’s target” of 2% annual inflation.

Mr. Trump has pointed to tariffs as a tool for protecting U.S. manufacturing, as well as to convince businesses to reshore their factories within the country, and for generating billions of new federal revenue.

Prices today are rising far more slowly than during their peak growth in June 2022, when the CPI hit a 40-year high of 9.1% and set the Federal Reserve on a path of hiking interest rates. Higher borrowing costs can temper inflation because it makes loans and credit cards more expensive, which can cause consumers and businesses to pare spending.

What does the CPI mean for interest rates?

The recent rise in inflation is complicating the Fed’s decision on interest rates, with the central bank scheduled to make its next rate decision on Oct. 29. But today’s inflation data could provide additional support for another cut, analysts said Friday.

“There was little in today’s benign CPI report to ‘spook’ the Fed and we continue to expect further easing at next week’s Fed meeting,” Lindsay Rosner, head of multisector fixed income investing at Goldman Sachs Asset Management, said in a Friday email. “A December rate cut also remains likely with the current data drought providing the Fed with little reason to deviate from the path set out in the dot plot.”

Still, inflation is edging higher, which could be an argument for keeping rates steady. But at the same time, the job market is experiencing a sharp slowdown in hiring, which Fed Chair Jerome Powell cited last month when the central bank made its first rate cut of 2025. Lower borrowing costs can help support the job market by making it cheaper for businesses to borrow, encouraging them to expand and hire.

That means the combination of rising inflation and weakening job growt is putting the Fed’s dual mandate — to keep both inflation and unemployment low — in conflict. Powell said earlier this month that the risks posed by the labor market may be outweighing concerns about rising inflation.

“The Fed has recognized the trends in the labor market as changing their directives,” Zureick said. “We’ve been dangerously close to a zero level of job growth for a few months.”

Given the Fed’s focus on the labor market risks, the higher CPI rate isn’t likely to derail expectations for a quarter-point rate cut at the Fed’s next meeting later this month, economists say.

The probability of a 0.25-percentage point cut at the Fed’s Oct. 29 meeting is pegged at 98.9%, according to CME FedWatch.

Edited by

The post CPI report shows inflation continued to climb in September appeared first on CBS News.