Science Photo Library/Reuters

- A version of this story originally appeared in the BI Tech Memo newsletter.

- Sign up for the weekly BI Tech Memo newsletter here.

A few years ago, FAANG engineers were famously “locked in” by massive equity windfalls. Today, the same dynamic is playing out with AI chipmakers.

According to Levels.fyi data, engineers at AMD, Broadcom, and Nvidia are sitting on life-changing stock gains.

Heavy equity-based offers made in late 2023 have ballooned as these stocks have soared. Some Nvidia mid-level engineers, for instance, have seen total compensation swell from roughly $360,000 to $670,000.

Broadcom and AMD engineers are experiencing similar locked-up wealth increases, according to Levels.fyi estimates.

![]()

This is the new cost of leaving. Imagine getting 10,000 restricted stock units at $100 a share, which would be worth $1 million over four years. That’s the typical vesting period for equity awards like this.

At a normal company, the stock might go up a bit, or it might fall. So your year 3 and 4 vests would probably be worth about $500,000 in total, or maybe $750,000 if you’re lucky and the stock goes up a bit.

What if you’re at a fancy AI company, and the stock triples? That total 4-year award would balloon to $3 million. Walking away after year 2 could mean forfeiting about $1.5 million. So people often stay.

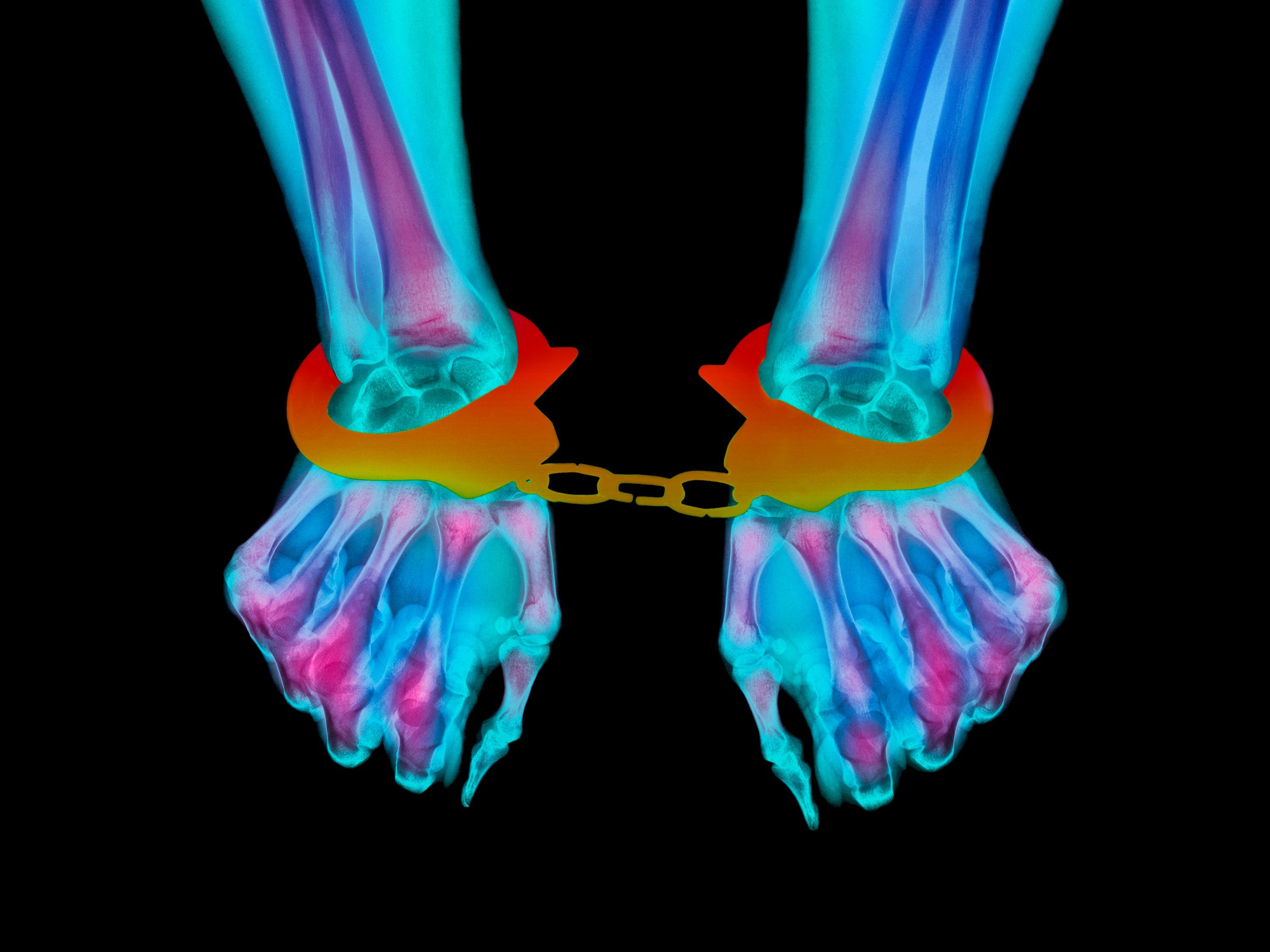

The “golden handcuffs” haven’t disappeared; they’ve just migrated from Big Tech software giants to the silicon stars powering the AI boom.

Levels.fyi calls these “silicon handcuffs.”

Sign up for BI’s Tech Memo newsletter here. Reach out to me via email at [email protected].

Read the original article on Business Insider

The post Big Tech’s ‘golden handcuffs’ have become ‘silicon handcuffs’ appeared first on Business Insider.