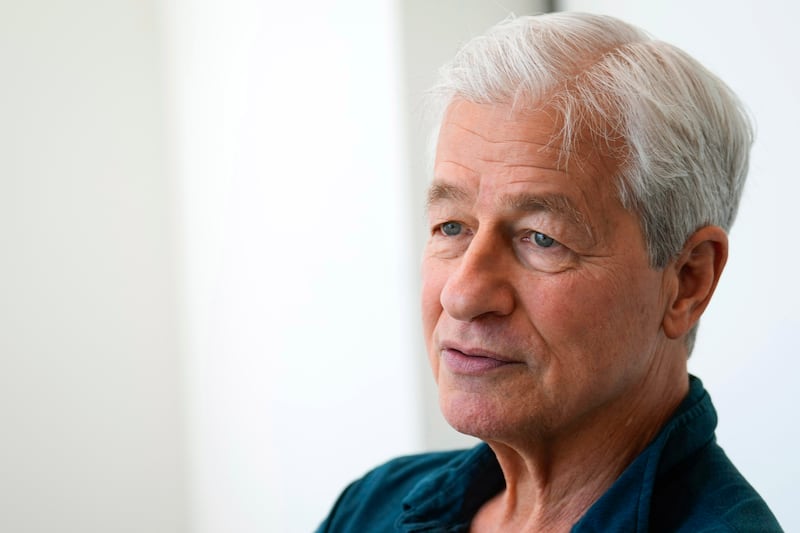

JPMorgan Chase CEO Jamie Dimon has warned that there may be “cockroaches” in the U.S. economy that could spell total meltdown.

The top banker cautioned that despite the stock market’s strong performance, there are masked issues that could spark a downturn similar to the 2008 financial crisis.

“I shouldn’t say this, but when you see one cockroach, there’s probably more. Everyone should be forewarned on this one,” said Dimon on the bank’s earnings call Tuesday with analysts, according to the Guardian.

Dimon cited the collapse of subprime auto lender Tricolor Holdings and car parts supplier First Brands as potential red flags about the health of the credit.

Tricolor Holdings filed for bankruptcy last month after being accused of double-pledging, which is when an entity uses the same group of loans as collateral to secure multiple lines of credit.

The move led JPMorgan to declare a $170 million charge-off—debt that will not be collected.

Soon after, auto-parts supplier First Brands also filed for bankruptcy after an accounting scandal, in which the firm admitted it was missing $2.3 billion in funds. JPMorgan had no exposure to First Brands.

Still, Dimon cautioned, “My antenna goes up when things like that happen.”

Dimon’s warning comes as drivers owe a whopping $1.66 trillion in car loans, larger than student loan debt or credit cards. It marks a 20 percent increase since 2020.

The average American spends over $49,000 on a new car, with $745 in monthly payments. Roughly 1.6 million people faced reposessions last year, the highest rate since the 2008 financial crisis.

TriColor provided loans to families with poor or no credit. Lower-income borrowers are often the first to default, fueling concerns that other lenders catering to them could soon follow—and reviving memories of the 2008 subprime collapse.

The Great Recession involved subprime mortgages on homes defaulting and nearly led to Bear Stearns collapsing before Dimon rescued it.

But some companies aren’t budging. Ford has recently started offering subprime car loans.

A record number of drivers with poor credit are at least 60 days behind on their car payments, according to an Axios roundup.

During COVID, the number of auto loans handed out skyrocketed, including deep subprime loans — people with a credit score below 580 —according to data from the Consumer Financial Protection Bureau (CFPB).

Data show that April 2021 saw over an 80% increase from the same period the previous year. The average loan period also increased at that time, making Sept. 2026 the average end date.

Dimon warned in early October that a recession could hit the U.S. as early as next year. He said that Trump’s trade wars, government spending, and inflation could all lead to a crash.

“I hope for the best, plan for the worst,” said Dimon. “You don’t wish it, because certain people get hurt, but it could happen in 2026.”

The post Top Banker Gives Eerie Warning With Echoes of 2008 Crash appeared first on The Daily Beast.