Heidi Health

- Heidi Health just nabbed a $65 million Series B for its free AI medical scribe.

- It’s competing with ambient tech from hot startups like Abridge and formidable incumbents like Epic.

- Heidi wants to build an AI medical search tool to compete with the likes of OpenEvidence.

The medical AI scribe space has been red-hot this year, with new unicorns emerging and incumbent giants digging in. Startup Heidi Health just raised fresh funding in a late bid to take them on.

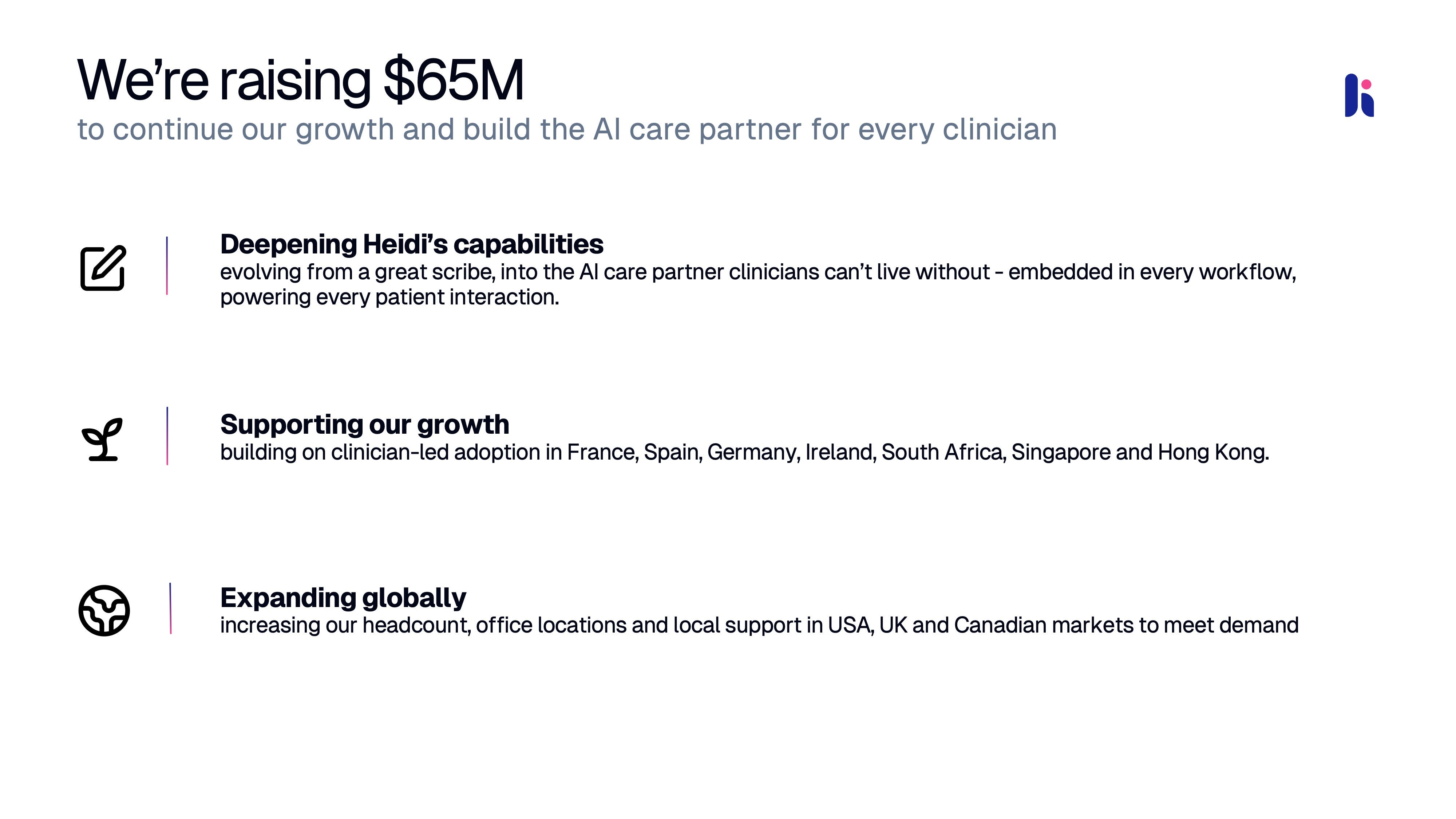

The Australian healthcare AI company raised $65 million in a Series B round led by hedge fund manager Steve Cohen’s Point72 Private Investments. The round values Heidi Health at $465 million post-money and brings its total funding to about $97 million to date.

The Series B raise comes just seven months after Heidi raised its $16.6 million Series A, led by Headline and including Anthology, Anthropic, and Menlo Ventures’ $100 million partnership fund.

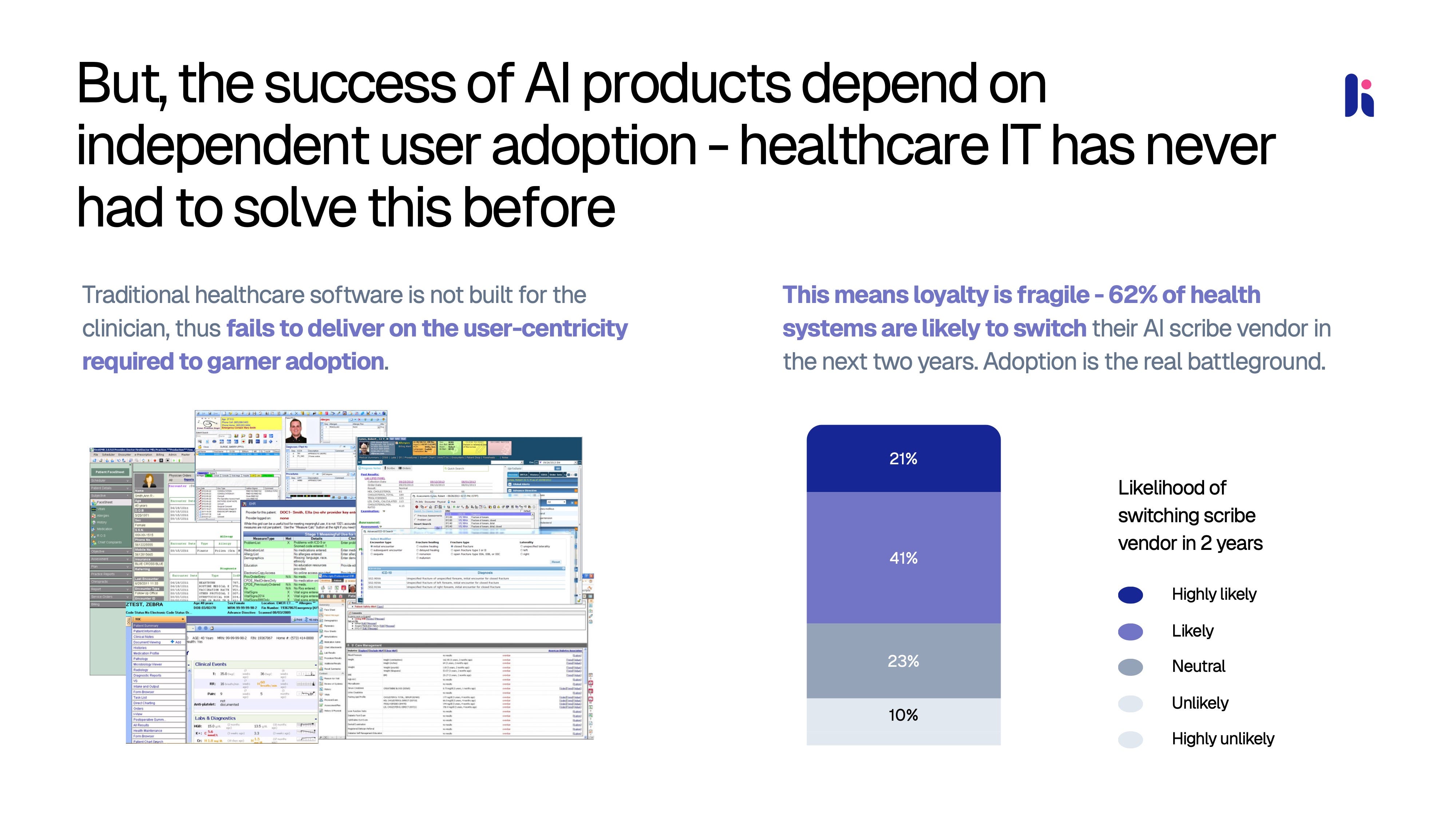

Heidi is gaining traction despite how crowded the ambient documentation space has become. It’s competing against AI scribe startups like $5.3 billion Abridge and Ambience Healthcare, as well as behemoths like medical records company Epic, which said in August it would release its own AI clinical documentation product.

Cofounder and CEO Dr. Thomas Kelly, a former vascular surgery resident, founded Heidi Health in 2019 under the name Oscer with tech to help medical students study for their exams. Two years later, seeing a bigger opportunity to ease doctors’ administrative burdens, he rebranded the company and pivoted toward automating clinical documentation.

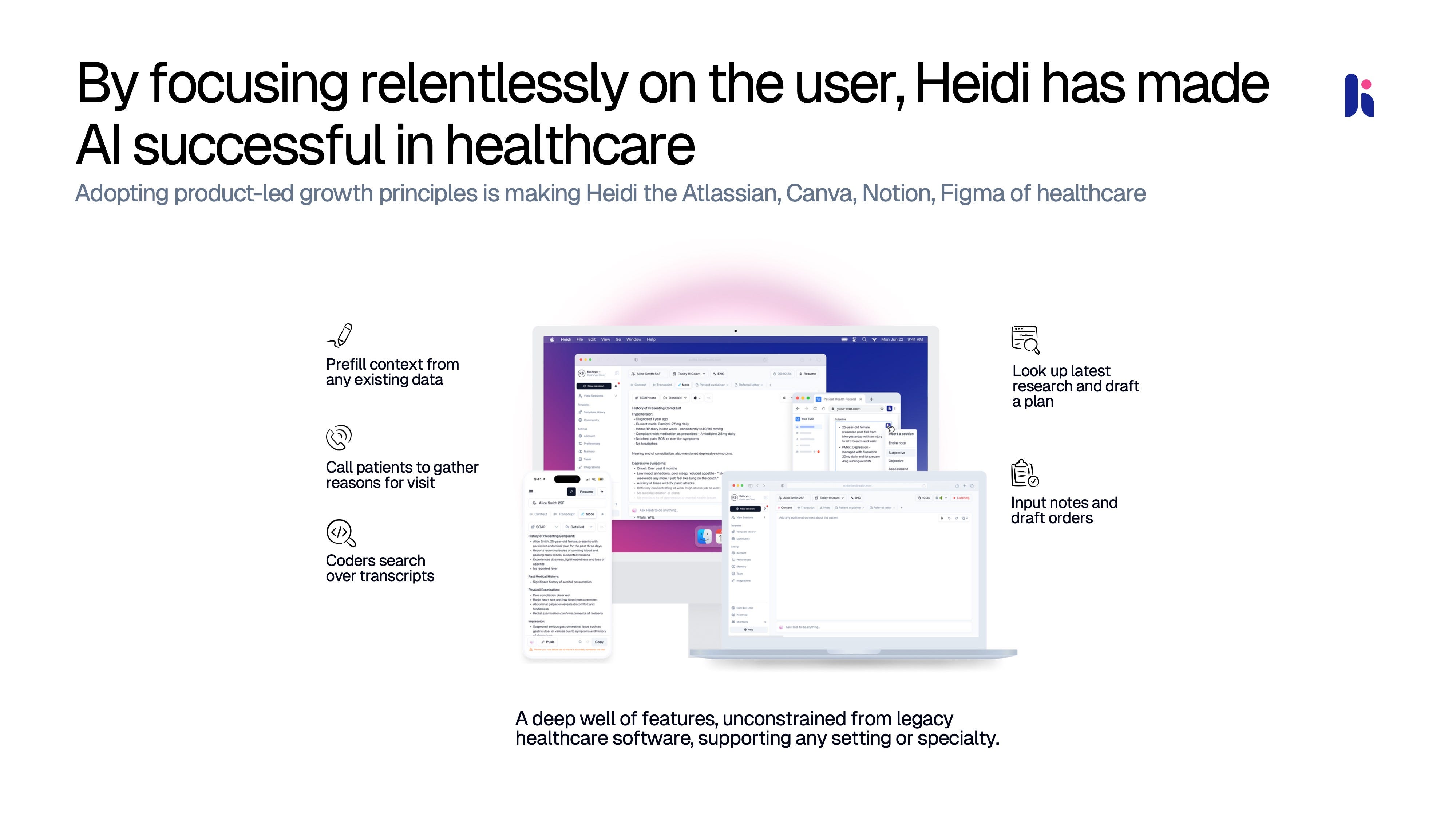

One of Heidi’s biggest differentiators, Kelly said, is prioritizing physician adoption over rigid integration with electronic health records.

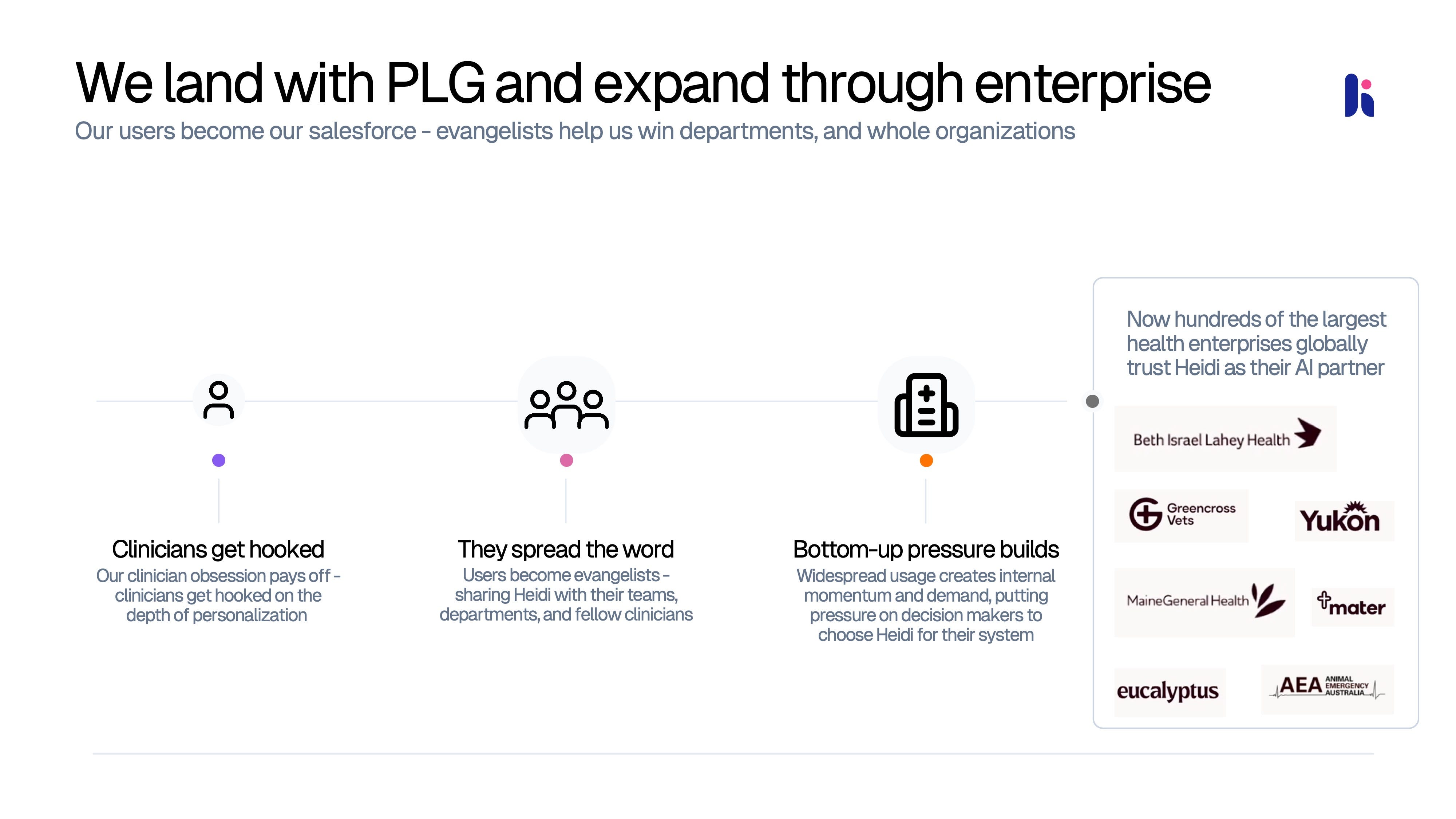

Roughly half of Heidi’s sales come from physicians signing up for its product directly, Kelly said, rather than through outpatient clinic or health system contracts. Heidi offers its core AI scribe product for free, with a $70-per-month premium tier that gives clinicians more personalized features like custom clinical note templates.

That “open plan” approach, as Kelly puts it, isn’t popular with other AI scribe startups.

“For the startups that sell top-down, the open-plan structure can be scary because they’re thinking about clinical documentation integrity and revenue cycle management, where you want some level of standardization. But the problem with AI tools is, you need activation and adoption,” Kelly said. “You can have the best of the best worlds, where clinicians can still build what they like and get the utility, and then structure it as a secondary thing.”

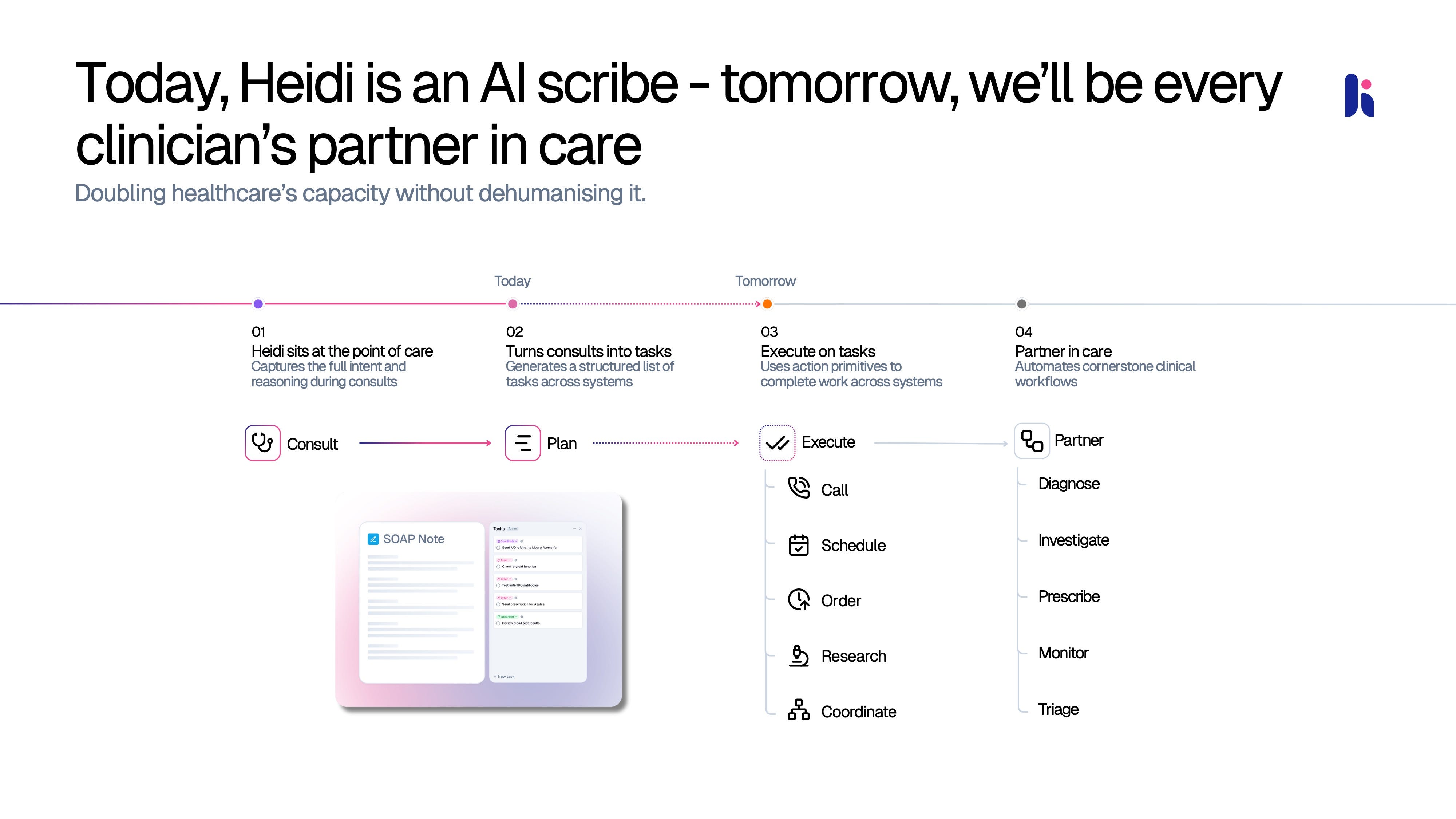

Heidi can afford to stray from standardization in part because its ultimate goal differs from that of its peers: The startup wants to build an all-in-one AI clinical assistant capable of handling some patient care tasks under a doctor’s supervision. Alongside the Series B, Heidi launched a tool that calls patients on behalf of doctors to automate tasks like follow-up scheduling and reminders.

Other AI scribes are digging further into healthcare back-office workflows, a strategy that’s gotten some companies into muddy waters as of late, like Abridge, which has relied heavily on its integration with shareholder-turned-competitor Epic.

“It’s never been our value proposition to be the most integrated scribe with Epic, because we always thought that was the path to short-term sugar highs,” Kelly said of AI scribe startups that prioritized EHR integration. “Yeah, you’ll get lots of adoption, but then you’ll probably just churn everyone and die when they replace you.”

Heidi is also establishing a significant international presence, with physician users in 116 countries. Peers Abridge and Ambience have sold their tech exclusively in North America.

Kelly said the startup plans to use the Series B funding to help expand its office locations and accelerate hiring, especially in the US, UK, and Canada, while digging further into markets where clinicians have already picked up Heidi’s product, like France, South Africa, Singapore, and Hong Kong.

Heidi Health’s next bet will introduce a fresh set of formidable competitors. The startup wants to build AI medical search features in a bid that will pit Heidi against $3.5 billion startup OpenEvidence and public healthtech Doximity.

Kelly said Heidi is still considering whether to partner with another company or build the AI search engine itself. But he said the startup will draw some boundaries that companies like OpenEvidence and Doximity, which let pharmaceutical companies advertise to doctors on their platforms, have not.

“We will never monetize with pharma. I just think that’s a red line, incompatible with being a tool that physicians can trust,” he said.

Check out the 9-slide pitch deck Heidi Health used to raise $65 million for its AI scribe.

Heidi Health

Heidi Health

Heidi Health

Heidi Health

Heidi Health

Heidi Health

Heidi Health

Heidi Health

Heidi Health

Read the original article on Business Insider

The post Here’s the pitch deck that Point72-backed Heidi Health used to raise $65 million to battle in the AI scribe race appeared first on Business Insider.