When it comes to retirement planning, no two journeys are exactly alike.

Your retirement plan should be dependent on who you are as an individual: lifestyle, income sources and goals all play a factor.

Instead of relying on general principles like the “4% rule,” personalized plans are much more effective.

If you are in retirement or approaching retirement, you don’t want to be just taking money out of accounts here and there and doing guesswork. You need an actual income plan.

Bright Wealth Management provides clients with detailed income strategies, including monthly and annual withdrawal schedules.

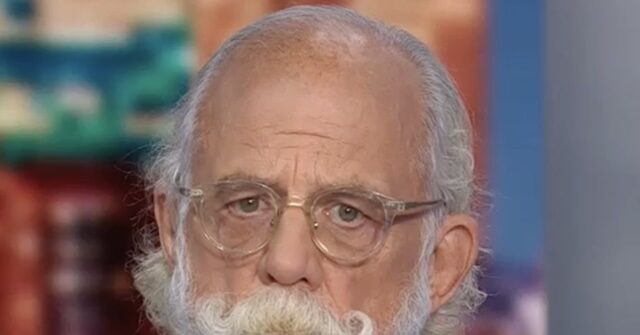

“Maybe you have a pension, maybe you’re just living on social security, maybe you have multiple pensions,” said Matt Dages, president and founder of Bright Wealth Management. “We need to set out exactly a plan that goes along with your lifestyle, your expectations, where you’re at today and work backwards and make sure that every base is covered.”

Bright Wealth Management will also help you identify which accounts to draw from and how to manage risk and returns.

“What we do for every client of ours is we sit down with them and we set up an investment strategy and we’ll show them actual income strategies to say, ‘Here’s how much money you are taking out every single month or every single year,” Dages said. “Here’s the specific account it’s coming out of. Here’s how we can focus on safety and risk returns.”

Bright Wealth Management will also help you focus on tax efficiency so that you are not creating excessive tax liabilities for yourself.

“We want to make sure that you have a specific plan that is set way ahead of time, or as soon as possible,” Dages said.

Bright Wealth Management helps provide retirement transparency

By using third-party tools like Morningstar to analyze client portfolios and uncover hidden fees, Bright Wealth Management helps provide transparency, while showing historical returns, risk levels and cost structures.

Education and transparency are central to Bright Wealth’s mission of financial empowerment.

For more information or to set up your complimentary consultation and portfolio review, call 833-777-4296 or go to brightwm.com.

The Bright Wealth Management Show with Matt Dages airs Saturdays from 1 p.m. to 2 p.m. and Sundays from 3 p.m. to 4 p.m. on KTAR News 92.3 FM.

The post Why retirement planning should be personalized appeared first on KTAR.