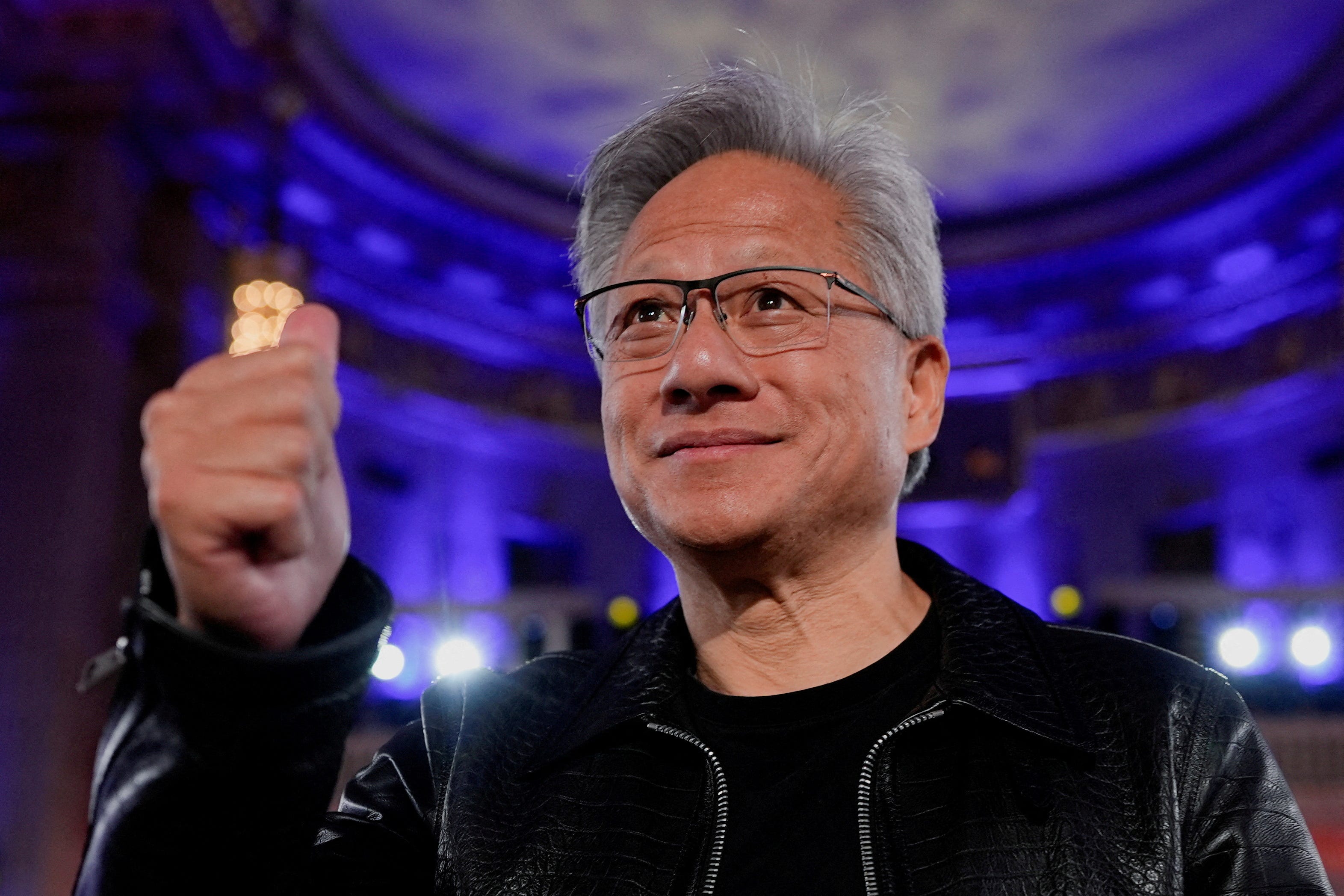

Kent Nishimura/REUTERS

- Eight AI companies have gained a combined $4.3 trillion in market value this year.

- Nvidia alone has added $1.2 trillion as high hopes for its microchips have sent its stock up 38%.

- Microsoft, Alphabet, Oracle, AMD, Palantir, Broadcom, and Meta have also surged in the AI bull run.

It took Warren Buffett nearly 60 years to build Berkshire Hathaway into a $1 trillion conglomerate. Eight AI companies have together gained quadruple that in market value in just over nine months.

Whether you think AI stocks will keep booming or burst like the dot-com bubble, the growth of these companies has been unprecedented. Their year-to-date gains alone dwarf the total value of some of America’s biggest and best-known companies.

Nvidia has added $1.2 trillion to its market value to reach an unprecedented $4.5 trillion, as investors have sent its stock up 38% this year on hopes that its microchips will power the AI revolution. Two years ago, it was worth less than a quarter of that, about $1 trillion.

Shares of Microsoft, an early investor in ChatGPT maker OpenAI, and Alphabet, which makes the Gemini family of AI models, have each jumped more than 25% this year, adding around $800 billion and $740 billion to the tech titans’ respective market values.

These three companies together are worth $2.8 trillion more this year — more than the combined $2.7 trillion market value of Berkshire, JPMorgan, and Walmart.

Other major AI companies surging include Palantir, which has soared 137%. Oracle and AMD have leaped about 70% each, Broadcom has shot up 45%, and Meta has climbed 22%. These five companies have had a $1.5 trillion rise in their joint market value since January. That’s roughly as much as Mastercard, Netflix, and Exxon Mobil combined.

Put together, these eight high-flying AI stocks have grown in market value by $4.3 trillion this year — roughly equivalent to six Eli Lillys, 15 Coca-Colas, or 20 McDonald’s.

A steady stream of AI deals has driven some stocks higher this year. Nvidia, Oracle, and AMD have all struck high-profile agreements with OpenAI recently that have excited Wall Street and underpinned forecasts of rapid growth.

Steve Hanke, a professor of applied economics at Johns Hopkins University, recently told Business Insider that it’s not yet clear whether the buzz around AI is rational, and the answer will “largely depend on whether the AI firms’ spectacular revenue forecasts hold water.”

Read the original article on Business Insider

The post 8 AI stocks are worth $4.3 trillion more this year. That’s 15 Coca-Colas or 20 McDonald’s. appeared first on Business Insider.