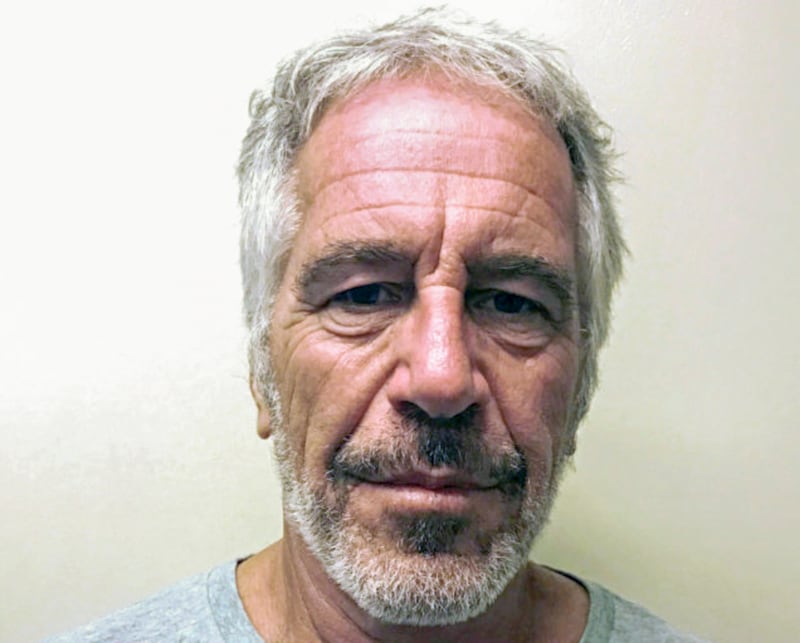

Fresh documents from the estate of late pedophile Jeffrey Epstein reveal how the convicted sex trafficker carried on doing business with high-powered Wall Street firms and banks until well after his crimes came to light.

The Epstein estate has reportedly handed a list of more than 20 banks—including behemoths like Wells Fargo, TD Bank, and FirstBank Puerto Rico—to Congress.

The House Oversight Committee now expects to subpoena those lenders as part of their wider review of the case, The Wall Street Journal reports.

JPMorgan Chase told the newspaper it didn’t close the pedophile’s accounts until 2013, roughly eight years after he was first accused of sexually abusing minors. Deutsche Bank said it did not cut him off until 2018, just one year before he died in police custody while awaiting trial on charges related to one of the most notorious sex trafficking conspiracies in U.S. history.

Both lenders have previously expressed regret over their relationships with the disgraced financier and entered into settlements with his victims, albeit without admitting any wrongdoing. The WSJ notes that while sex crimes are not necessarily grounds for cutting ties with a client, banks nevertheless “use many factors to evaluate the legal and reputational risk of retaining clients and are required to monitor suspicious activity, such as frequent cash withdrawals.”

The latest documents from the Epstein estate reportedly also show how, between 2016 and 2019, the sex trafficker transferred at least $60 million to hedge-fund Honeycomb Partners, and a further $38 million to firm Boothbay between 2014 and 2017. Boothbay reportedly dispersed $10 million back to Epstein at the end of that period.

Meanwhile, Blockchain Capital, one of the earliest venture investors in the cryptocurrency sector, is understood to have purchased stakes in private companies from Epstein through at least three of its funds in 2018.

The tranche of documents apparently reveals several previously unreported transfers to known associates of Epstein. These include former Treasury Secretary Larry Summers, who received just over $1,000 in travel reimbursement for a series of meetings with Epstein between 2013 and 2016.

Also on the list are Joi Ito, the former MIT Lab director who received $2.5 million in investments from Epstein between 2014 and 2015, and Norwegian diplomat Terje Rod-Larsen, who received $250,000 for unspecified purposes in 2015.

The files reportedly also serve to confirm several previously reported, high-value transfers between Epstein and other influential business figures, among them billionaires Peter Thiel and Leon Black, as well as members of the Rothschild banking family.

The post Wall Street Banking For Jeffrey Epstein Until the Bitter End appeared first on The Daily Beast.