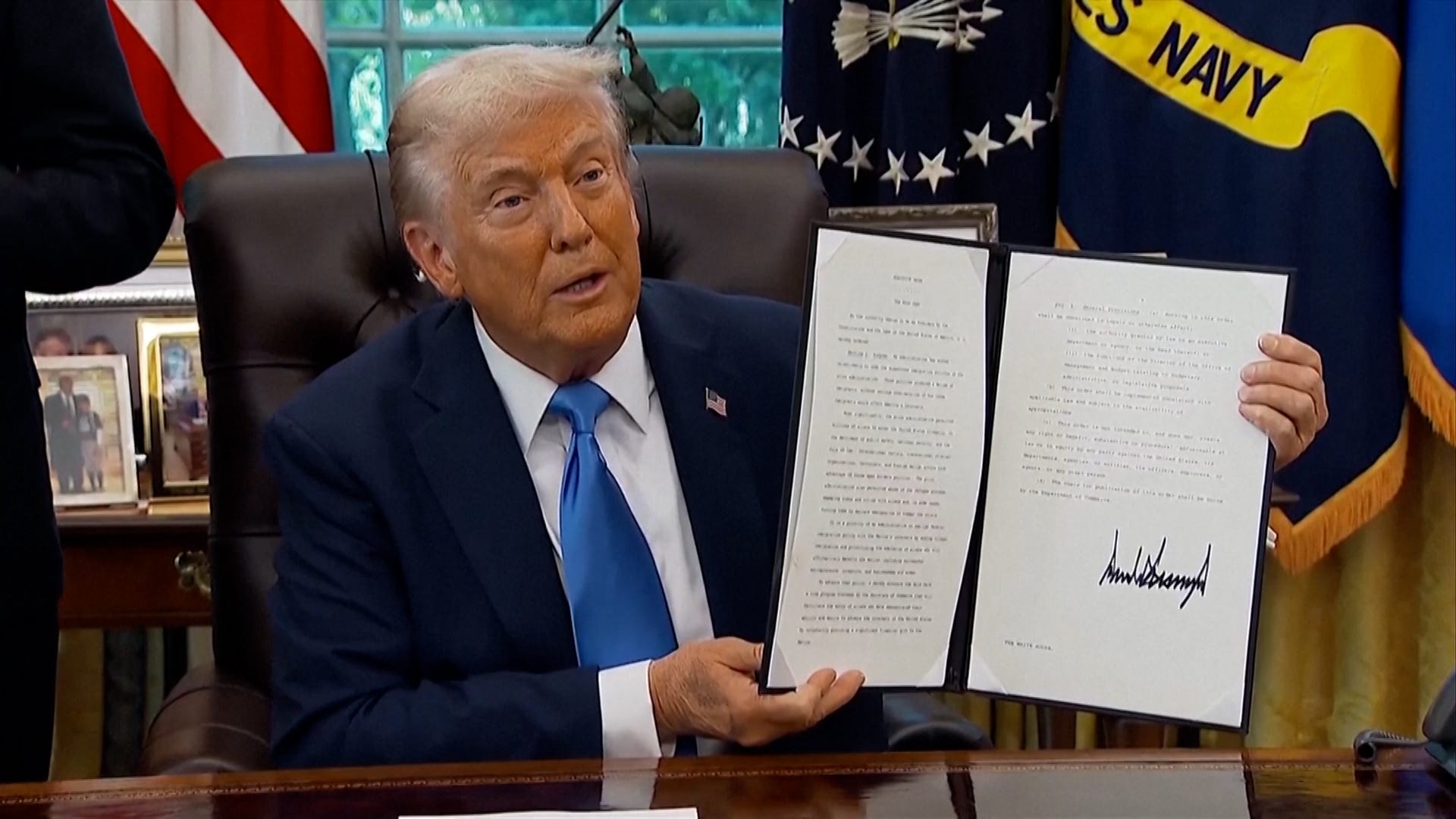

Reuters

- Donald Trump has raised the cost of new H-1B applications to $100,000.

- Banks and other financial firms rely on the program to fill a range of roles, including tech.

- Business Insider crunched the data to see which financial firms could be most impacted by the new rules.

Silicon Valley isn’t the only industry reeling from President Donald Trump’s plans to charge companies hiring skilled foreign workers $100,000 for visas.

Wall Street banks and other financial firms also stand to be hit hard by the new H-1B visa application fee, scheduled to go into effect on October 1st. No one was prepared for the rapid change to this program, which firms use to fill an array of roles, from computer programmers to traders and even investment bankers.Trump’s executive order, signed late Friday, “caught everyone off guard,” JPMorgan Chase CEO Jamie Dimon said on CNBC while in Mumbai, India, this week.

In order to visualize the potential impact on the financial industry, Business Insider turned to publicly available data from the Department of Labor and the US Citizenship and Immigration Services (USCIS). The data covers H-1B application data for the first three quarters of the government fiscal year 2025, as well as the less-common H-1B1 and E-3 visas, from October of 2024 to the end of June this year.

We studied certified visa applications during this time period to highlight the biggest financial industry users of the visa program. The data does not reflect the total number of H-1B employees at any given firm, but it provides helpful context on immigrant labor demands.

The data shows that some of the largest financial employers heavily rely on this visa to fill a range of roles, especially technology roles. Major banks like Chase and Goldman Sachs dominate the list alongside major payments companies like American Express. Asset managers like BlackRock and Vanguard, and research and ratings agency Moody’s, help to round it out.

Wells Fargo, Bank of America, and Citigroup declined to comment. The others did not respond to a request for comment from BI.

1. JPMorgan Chase

Noam Galai via Getty Images

Certified applications: 2,440

Employees worldwide: 317,160 as of the second quarter of 2025

The country’s largest bank focused its H-1B hiring heavily on technologists, with more than 500 certified applications for vice president, lead software engineer, and associate software engineer III positions. The bank also filed visa applications for the firm’s main business lines, such as an investment banking managing director.

2. Fidelity

SOPA Images/Contributor/ Getty Images

Certified applications: 1,575

Employees worldwide: Over 78,000 per its website

Fidelity submitted a wide range of applications for technical roles, with 40 certified applications for full-stack engineering directors and 125 for full-stack engineering principals. Non-technical roles included a director of marketing.

3. Goldman Sachs

Ramin Talaie/Corbis via Getty Images

Certified applications: 1,280

Employees worldwide: 45,900 as of the second quarter of 2025

Not all of Goldman Sachs’ certified applications specified the role, focusing instead on the level of hire, such as an associate. The data, however, does show a wide range of technologist hires and financial hires, including many vice president-level banking roles.

4. American Express

John Moore/Getty Images

Certified applications: 921

Employees worldwide: 75,100 as of the end of 2024

American Express’s certified applications were largely for technologist roles, with more than 125 for”engineer” roles. Business Insider also found applications for non-technical roles, including director-level applications for risk management, communications, and controller.

5. Citigroup

Tom Williams/CQ Roll Call

Certified applications: 874

Employees worldwide: 229,000 as of the end of 2024

Citi’s certified applications also largely focused on technology roles, including more than 150 certified applications for “Application Development Technical Lead Analyst” roles.

6. Capital One

SOPA Images / Getty Images

Certified applications: 871

Employees worldwide: 76,500 as of the second quarter of 2025

Like others on this list, Capital One’s certified applications largely focused on technology and data roles. The data showed hundreds of applications for data science and analysis roles, as well as some less technical roles like “business manager.”

7. Visa

Timothy A. Clary/AFP/Getty Images

Certified applications: 770

Employees worldwide: 31,600 as of the end of 2024

Visa is yet another company largely focused on tech and data hires. Some non-technical roles include compensation business analysts, senior financial analysts, and managers.

8. Bank of America

Kristoffer Tripplaar for The Washington Post via Getty Images

Certified applications: 718

Employees worldwide: 213,000 as of the second quarter of 2025

Bank of America also focused its applications on tech hiring. Their most common role on the list, a vice president-level software engineer III, could be found on over 100 applications.

9. Morgan Stanley

Brendan McDermid/Reuters

Certified applications: 673

Employees worldwide: 80,000 as of the first quarter of 2025

Morgan Stanley’s data only showed the level of roles it was hiring for, so we cannot analyze what kinds of jobs its looking to fill. However, we can see that they have applied for vice president-level roles the most, followed by associates and then directors.

10. US Bank

Mike Blake/Reuters

Certified applications: 624

Employees worldwide: More than 70,000 per their company website

US Bank is yet another bank that largely uses H-1B visas for for technology roles, such as senior software engineer. There are other financial roles though, like tax accountant, underwriter, and project manager for the firm’s impact finance, focused on affordable housing.

11. Barclays

AP Photo/Richard Drew

Certified applications: 457

Employees worldwide: 92,900 as of the end of 2024

The British bank’s US visa hiring is also largely focused on technology. Some front-office hires included an equities derivatives trader and an equities “exotic” trader.

12. Mastercard

SOPA images

Certified applications: 434

Employees worldwide: 32,600 per the firm’s website

Charles Schwab is also using H-1B visa to hire tech talent, with the data showing nearly 50 software development and engineering senior manager roles and nearly 100 software development and engineering manager hires. We were unable to find a single role that didn’t appear to be related to technology.

13. Wells Fargo

Justin Sullivan/Getty Images

Certified applications: 391

Employees worldwide: 217,000 at the end of 2024

Wells Fargo joins the ranks of financial firms largely focused on technological hires in its H-1B visa applications. The data also showed certified applications for roles like lead securities trader and strategy and planning director.

14. UBS

Getty

Certified applications: 339

Employees worldwide: 110,323 as of the end of 2024

UBS had certified applications for a slew of tech and financial roles. On the financial side, it has applied for roles like investment banking analyst and associate, the entry-level role to a banking career, as well as an associate director of global markets FX trading.

15. BlackRock

Arnd Wiegmann/Reuters

Certified applications: 294

Employees worldwide: Approximately 22,000 per the firm’s website.

Like Morgan Stanley, BlackRock only provides the level of roles hired. The bulk of roles culled by Business Insider were at the associate or vice president level, though there are also more than 20 director-level applications.

16. State Street

Brendan McDermid/Reuters

Certified applications: 213

Employees worldwide: Approximately 53,000 as of the first quarter of 2025

State Street’s visa applications were largely focused on technology hires, though financial roles were also on the menu. Non-financial roles included applications for a head of internal liquidity stress testing in treasury and a global head of liquidity risk oversight.

17. Vanguard

Rafael Henrique/SOPA Images/LightRocket via Getty Images

Certified applications: 209

Employees worldwide: Approximately 20,000 per the firm’s website as of the end of 2024

A large chunk of Vanguard’s applications were for application engineering and other technical roles. The asset management firm also had applications for a fixed-income trader, a head of wealth management and advice, and a head of fraud, strategy, and analytics.

18. Moody’s

Emmanuel Dunand/Getty Images

Certified applications: 199

Employees worldwide: 15,838 at the end of 2024

The ratings and research powerhouse joins the rest on the list with a focus on technologists. Senior software engineers and staff software engineers lead the way in certified applications. Some non-technical applications included a director-level sales manager, a credit associate, and a commercial real estate researcher.

19. Truist

Rafael Henrique/ SOPA Images/ LightRocket/ Getty Images

Certified applications: 185

Employees worldwide: 38,335 as of the end of 2024

Software engineering roles made up roughly half of Truist’s applications reviewed by Business Insider. Most other roles were tech-focused, such as a senior data analyst in liquidity and regulatory reporting, though there were some rare non-tech roles, such as Treasury market and liquidity risk officer.

20. Discover

Discover; Business Insider

Certified applications: 144

Employees worldwide: 21,000 as of the end of 2024

Discover joins the ranks of others on this list with roughly 100 applications mentioning data science. Other interesting technical roles included a lead robotic process automation analyst.

Read the original article on Business Insider

The post The 20 financial firms that could be hardest hit from Trump’s new H-1B fee — from Goldman Sachs to Citi appeared first on Business Insider.