BI/Momo Takahashi

- Trump urged the SEC to reduce earnings requirements to benefit companies.

- Companies have complained that such reports are costly and time-consuming.

- Here’s how fewer reports could impact white-collar jobs, from legal and accounting to communications.

The debate over quarterly earnings usually centers on companies and investors — but any disruption to the status quo could rattle an ecosystem full of white-collar workers plying their trade as lawyers, communications pros, and data providers.

On Monday, President Donald Trump asked the SEC to investigate whether fewer earnings reports might benefit companies. “This will save money and allow managers to focus on properly running their companies,” he wrote on Truth Social.

Unlike the administration’s whiplash-inducing trade policies, corporate America agrees with the president. In 2019, after Trump first asked the SEC to explore this issue, the Nasdaq found that three-quarters of the 180 companies it surveyed favored a switch to semi-annual reporting, according to the survey results posted to the SEC’s website.

For companies, the costs of quarterly earnings can feel steep. Preparing a single release can take weeks and pull in dozens of people across legal, accounting, and communications teams. But the money spent on earnings doesn’t just disappear. It underwrites thousands of white-collar jobs — roles now under pressure from artificial intelligence and a slowing economy.

If companies — and Trump — were to get their way, what would it mean for the legions of white-collar professionals helping prop up the earnings ecosystem, from investor relations professionals to finance data providers?

To answer this question, Business Insider spoke to people with knowledge of the process and reviewed comments made by companies and professional associations in response to the SEC’s 2019 request for comment on the pros and cons of fewer earnings reports.

Here is what we learned:

Less reporting doesn’t mean less work

Investor relations and communications professionals play a key role in quarterly earnings by making sure a company’s story — financial results, growth prospects, risks, and strategy — is clearly conveyed to investors, analysts, regulators, and the media.

Reducing earnings, however, might not ease their jobs, said Matthew Brusch, president and CEO of NIRI, an association for investor relations professionals.

“Investors won’t simply just stop asking for the information,” said Brusch, who previously worked in IR. “In my experience, investors never want less information,” he said, adding that he expects many companies would continue to report earnings quarterly even if given the opportunity to report just twice a year.

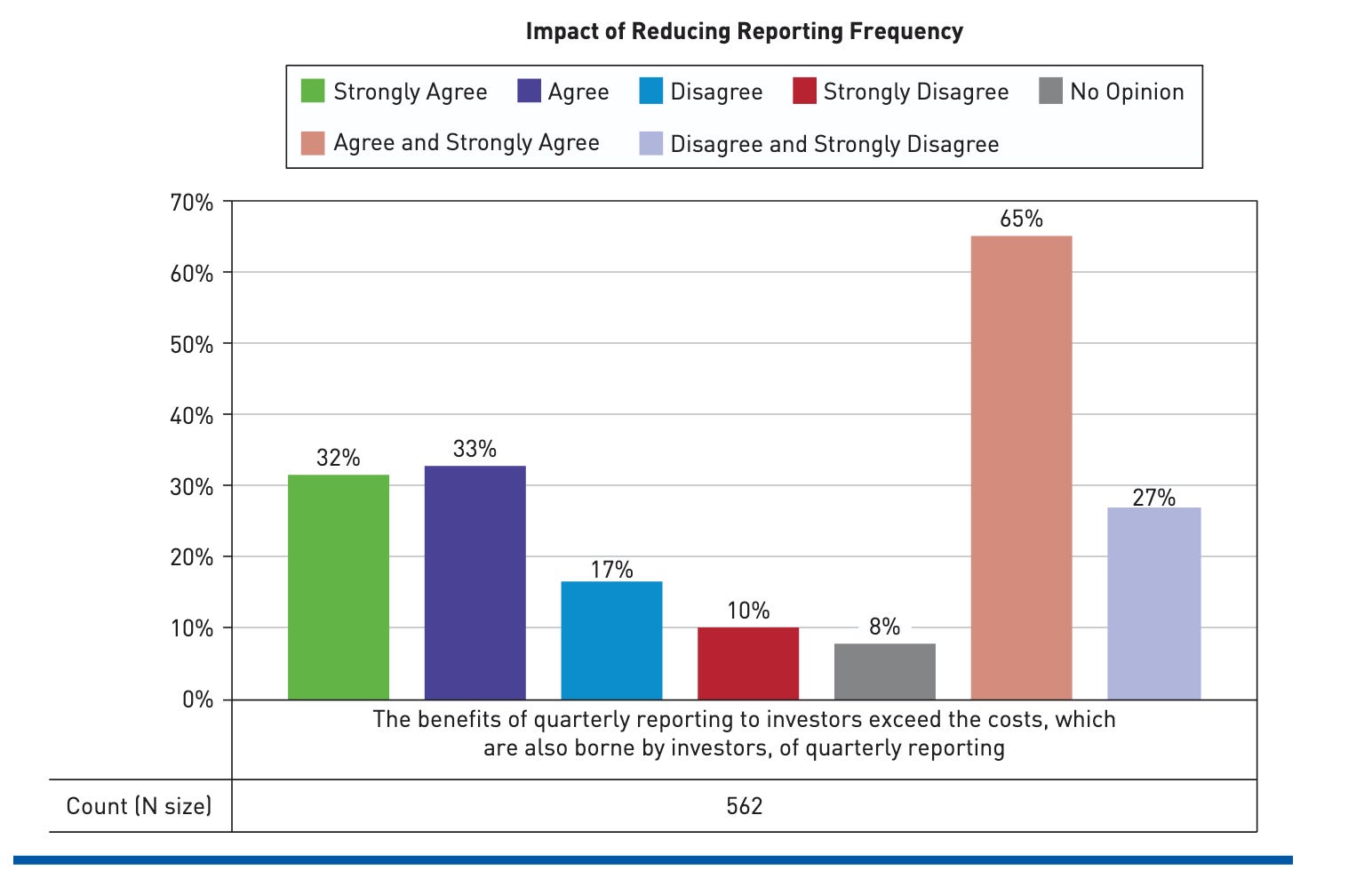

Indeed, a change might even add value to people whose job it is to break into companies, such as Wall Street equity research analysts, who make stock recommendations. A 2018 survey by the CFA Institute found that 82% of investor respondents strongly agreed that they would “struggle to locate information” if earnings reporting requirements were reduced.

Most investors surveyed also agreed that the benefits of quarterly earnings outweighed the costs.

Screenshot

Quarterly earnings could be here to stay

Theoretically, the biggest beneficiaries of fewer earnings reports would be C-Suite executives, like the CEO and CFO, who would have more time to focus on operations, capital raising, and other big-picture initiatives.

Nasdaq’s 2019 survey showed that the average company said it spent about 852.95 hours a quarter on earnings. That’s more than two weeks per person per quarter, assuming a 10-person team. Reducing corporate earnings to just twice a year would therefore give the average executive an entire month back in time that could be spent on other things.

Experts who spoke to Business Insider said they don’t see it playing out this way, however. They pointed to the EU and other regions where many companies continue to report earnings quarterly despite twice-a-year reporting requirements.

“Do you really think management’s going to say, ‘Hey, just because we don’t have to report to the outside, I only want to look at my business every six months?'” Sandy Peters, senior head of global advocacy at the CFA Institute, said. “Probably not.”

Most at risk

The biggest losers, people said, may be for-hire professionals called in on an ad-hoc basis to help pull quarterly earnings together, including corporate lawyers and auditors.

In response to the SEC’s 2019 request for comment on this issue, the Society for Corporate Governance filed a report showing that the costs associated with lawyers and accountants were among the most common concerns.

“Significant diversion of legal and finance/accounting team resources, plus expense of lawyers and accountants,” the organization’s SEC filing said, quoting a member.

“Audit firm fees” ranked as a top cost of preparing earnings reports among the 146 members who responded to the organization’s survey.

The Nasdaq survey said that companies reported paying an average of $334,697.63 a quarter on earnings, with at least one respondent citing quarterly costs as high as $7 million.

Ripple effects for data providers

Reducing earnings requirements could also impact professionals who make money off them, including financial services data providers.

On LinkedIn, Daniel Goldberg asked colleagues in the alternative data world if a potential change would be good or bad for their industry. A vast majority of the dozens of respondents thought the fewer corporate reports would mean more business for them.

“With semi-annual reporting, the unmatched transparency of real-time data could spark a surge in alternative data adoption,” said Goldberg, the former chief data strategy officer at Coresight Research who now works as an independent consultant.

But there is a downside for an industry that’s reliant on hedge funds for a sizeable chunk of its revenues, he said

“Fewer earnings events would mean fewer trading catalysts — a potential challenge for hedge funds chasing alpha,” said Goldberg.

Rado Lipus, the founder of data consultancy Neudata, said “hedge funds are still very reliant on traditional products such as consensus estimates data,” and plenty of alternative datasets use “earnings calls as the input to create their product.” Ravenpack, an alternative data provider, has an earnings call analytics product that uses natural language processing tools to judge the sentiment of the executives speaking on a call, for example.

But the biggest immediate impact of changing quarterly earnings could be to hedge funds themselves, said Marc Greenberg, a former executive at Steve Cohen’s Point72 who now runs a training firm called Greener Pastures.

“It’s the best time of the year to make money as a hedge fund,” he said.

Read the original article on Business Insider

The post The hidden workforce behind earnings reports — and what less reporting could mean for them appeared first on Business Insider.