This summer, Steve Witkoff, President Trump’s Middle East envoy, paid a visit to the coast of Sardinia, a stretch of the Mediterranean Sea crowded with super yachts.

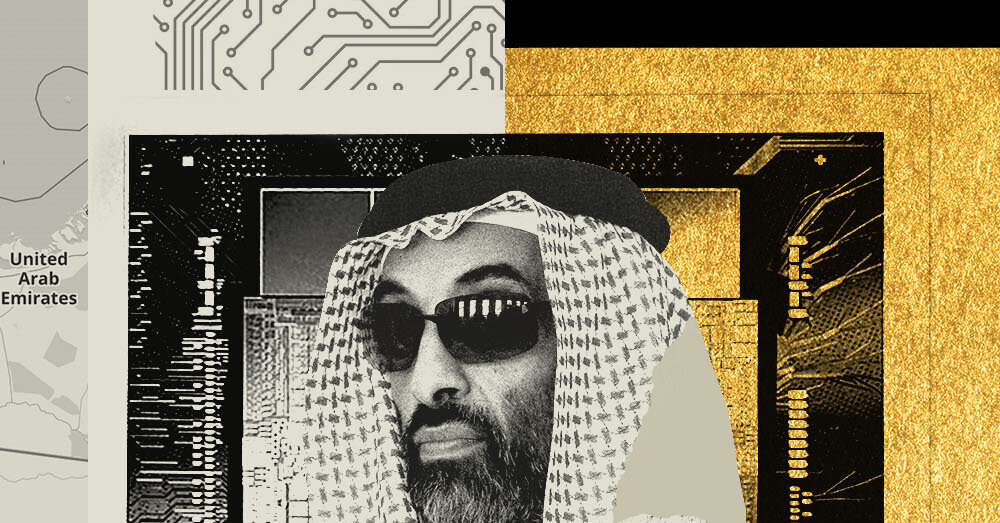

On one of those extravagant vessels, Mr. Witkoff sat down with a member of the ultrarich ruling family of the United Arab Emirates. He was meeting Sheikh Tahnoon bin Zayed Al Nahyan, a trim figure in dark glasses who controls $1.5 trillion of the Emiratis’ sovereign wealth.

It was the latest engagement in a consequential alliance.

Over the past few months, Mr. Witkoff and Sheikh Tahnoon had become both diplomatic allies and business partners, testing the limits of ethics rules while enriching the president, his family and his inner circle, according to an investigation by The New York Times.

At the heart of their relationship are two multibillion-dollar deals. One involved a crypto company founded by the Witkoff and the Trump families that benefited both financially. The other involved a sale of valuable computer chips that benefited the Emirates economically.

While there is no evidence that one deal was explicitly offered in return for the other, the confluence of the two agreements is itself extraordinary. Taken together, they blurred the lines between personal and government business and raised questions about whether U.S. interests were served.

In May, Mr. Witkoff’s son Zach announced the first of the deals at a conference in Dubai. One of Sheikh Tahnoon’s investment firms would deposit $2 billion into World Liberty Financial, a cryptocurrency start-up founded by the Witkoffs and Trumps.

The post Anatomy of Two Giant Deals: The U.A.E. Got Chips. The Trump Team Got Crypto Riches. appeared first on New York Times.