Eloquent AI

Y Combinator startup Eloquent AI has raised $7.4 million in seed funding to provide AI-fueled customer service in the financial services industry.

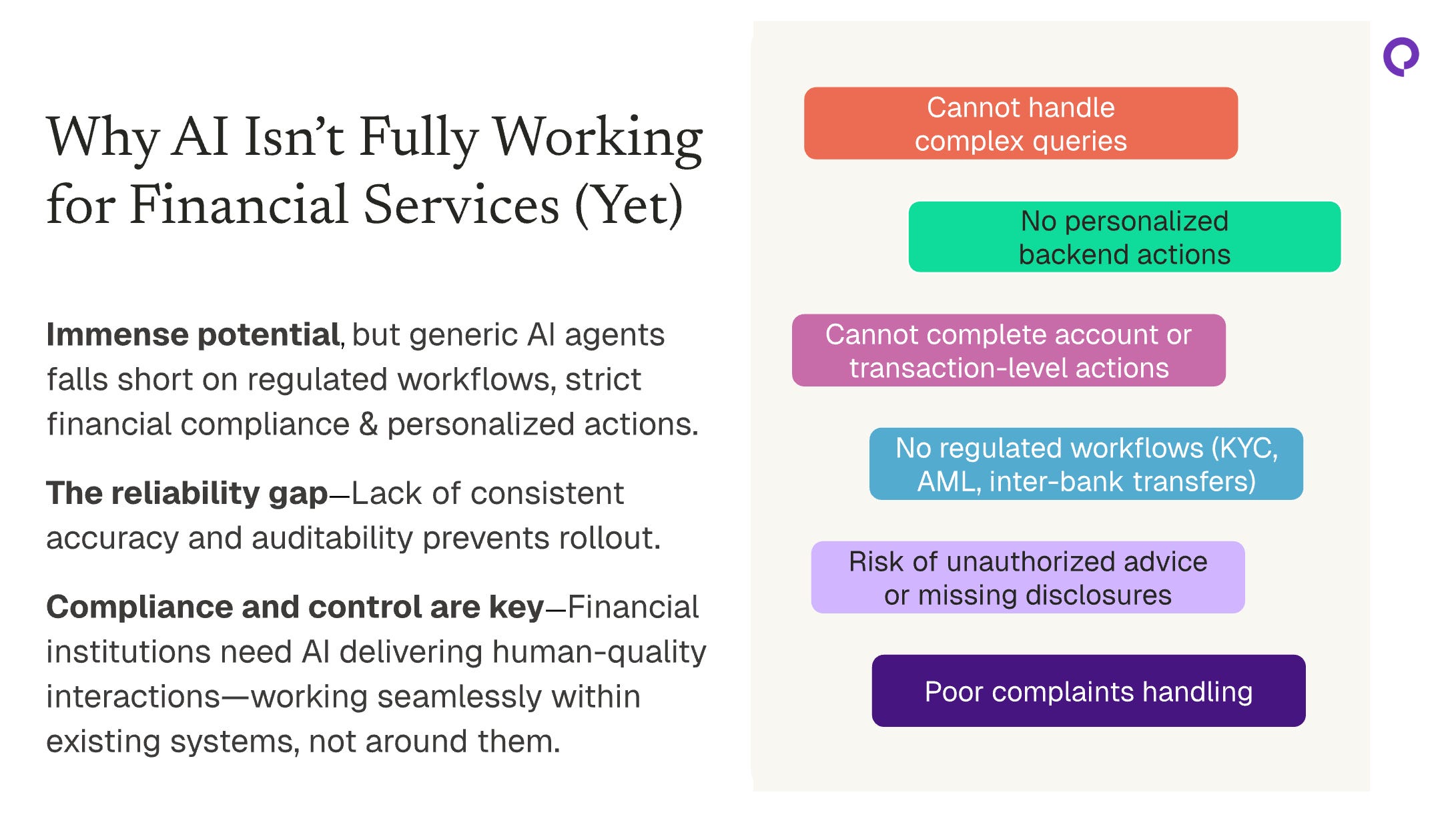

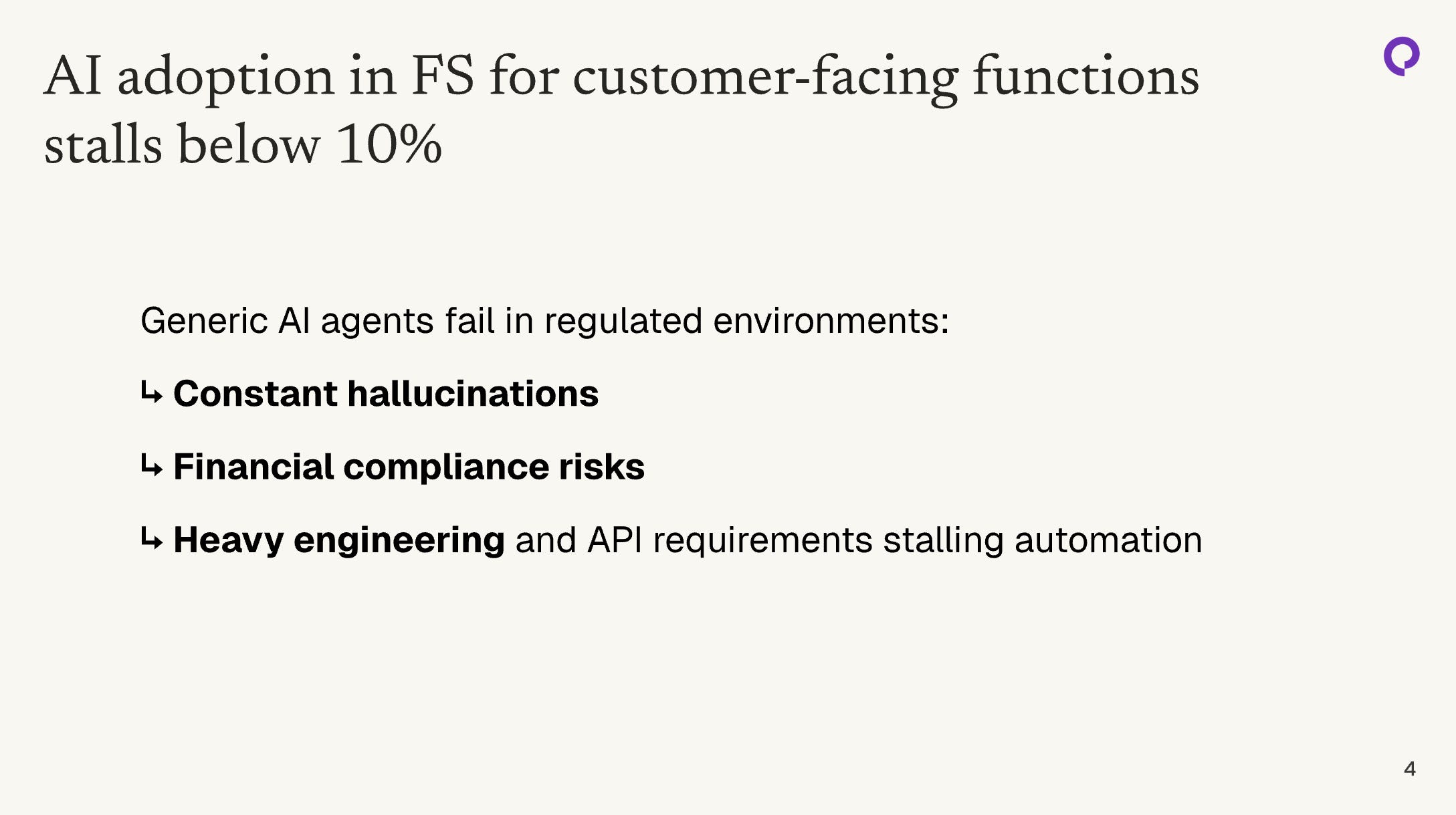

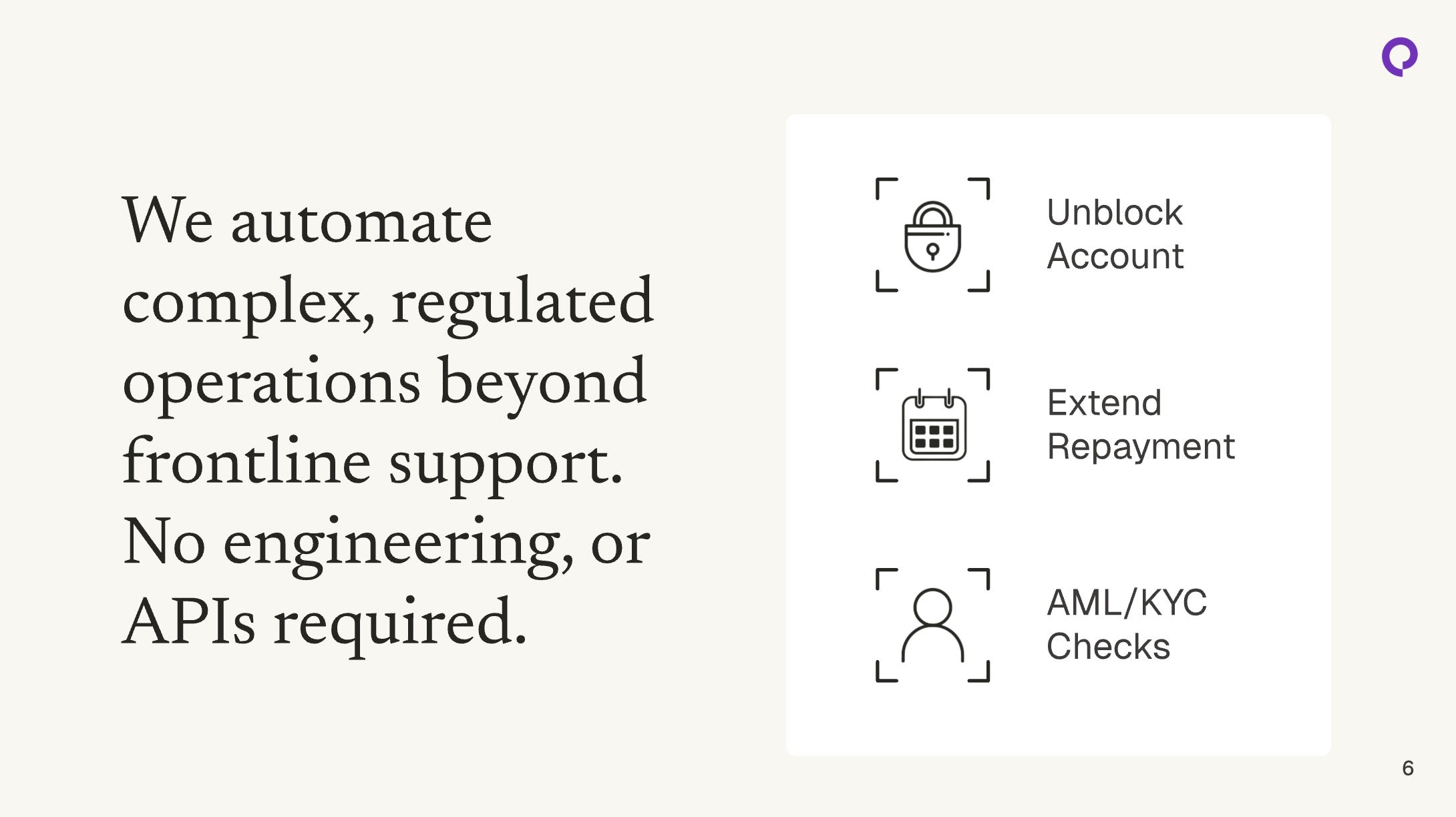

The startup says its AI product can help with complex, regulated workflows, such as onboarding new customers and unfreezing bank cards.

Eloquent was cofounded by Tugce Bulut, who previously cofounded market research startup Streetbees. Bulut left the company two years ago. Last month it went into administration and laid off all staff.

Bulut is building Eloquent AI alongside Aldo Lipani, a machine learning professor at University College London. The two met at a conference in 2023 after she said she was gripped by his presentation on how to control AI’s “stochastic” nature, she said.

Foundation Capital led the seed, which saw participation from EJF Ventures, Duke Capital Partners, Zeno Ventures, and Y Combinator. The round closed in three days and was “12 times oversubscribed,” Bulut told Business Insider — an unexpected outcome she attributed to being a second-time founder and investor interest in “vertical specialists” that train their own AI models specifically for the finance industry.

Eloquent will use the funds to grow its engineering team in San Francisco and expand its capabilities, including tasks like sanctions screening, which helps prevent banks from making loans to those who’ve been blacklisted. The company has 10 employees. Bulut said the company plans to raise another round early next year.

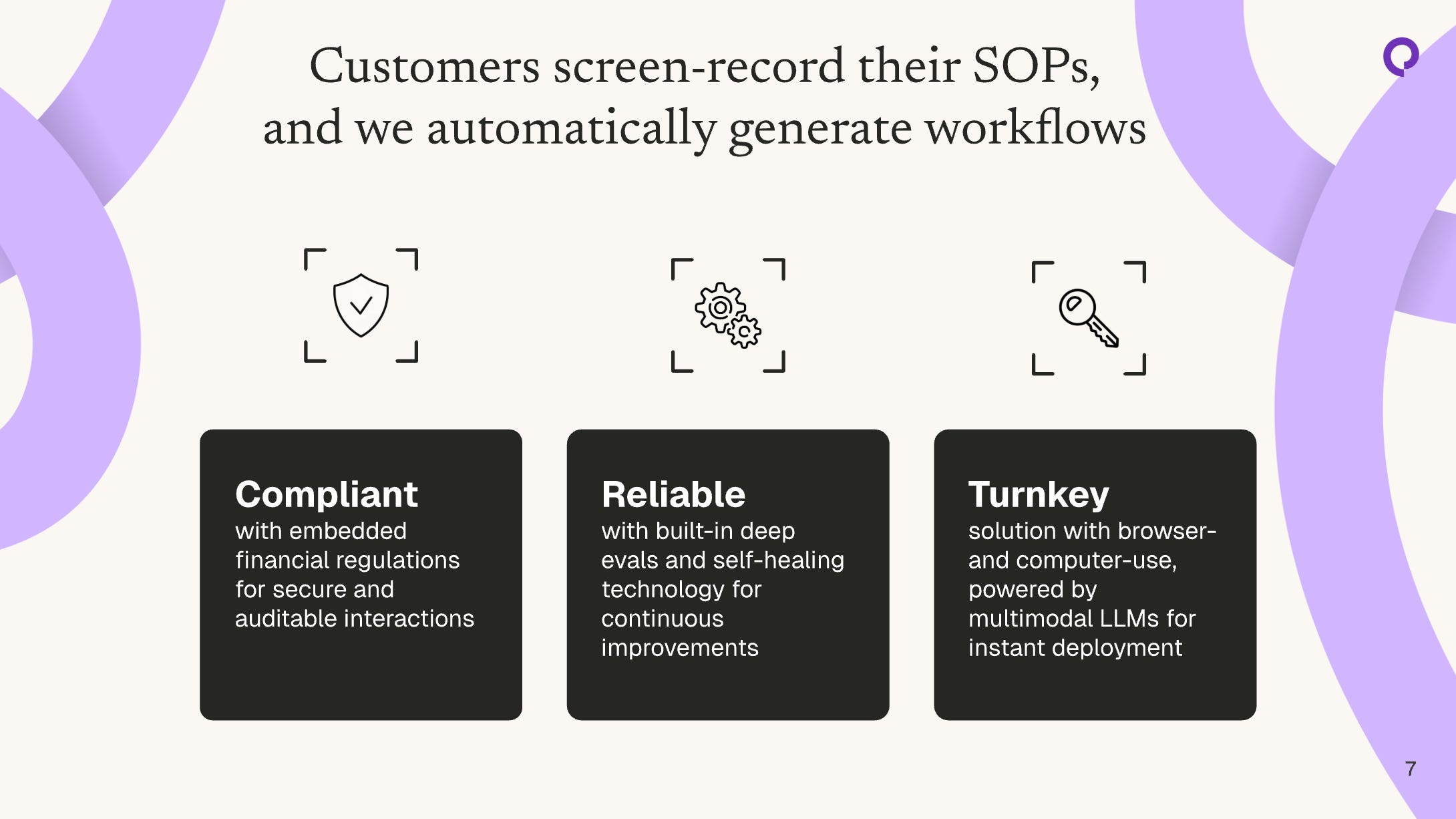

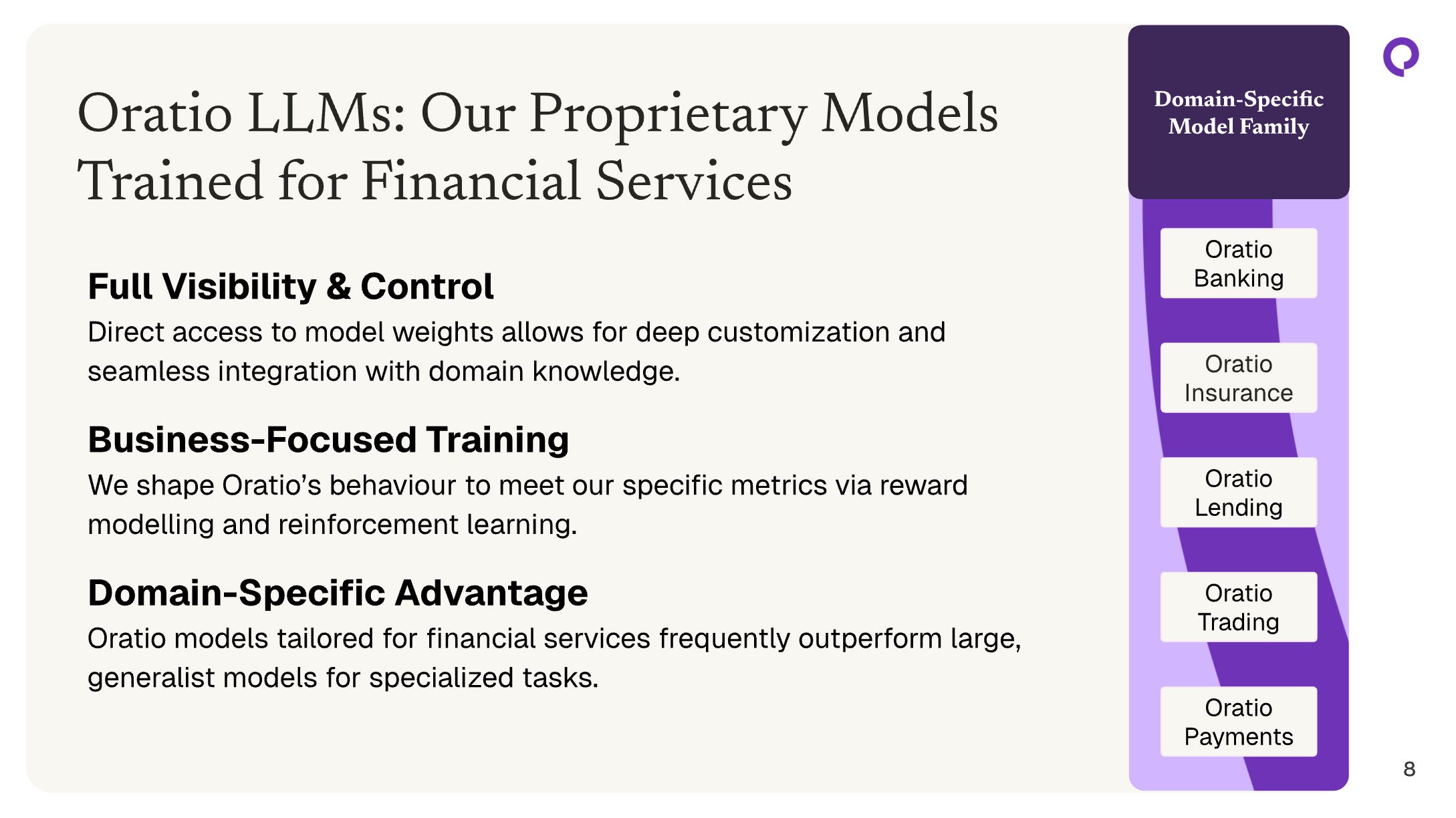

Eloquent AI is powered by a proprietary large language model called Oratio that’s been trained for financial compliance, Bulut said. The product works by analyzing screen recordings of work processes uploaded by human agents, which it mirrors. Technical teams can set guardrails, and the product logs all of its actions for auditing.

Eloquent AI works with banks and fintech companies, and it plans to expand further into the insurance and trading fields, with distinct Oratio models for each branch of its business.

Tugce told BI the company has 10 clients — including financial assistant Cleo, OakNorth Bank, and insurance company Vouch — with a waitlist of 154. The pitch deck said the company hit $500,000 in annual recurring revenue in four weeks.

It makes money by selling credits monthly based on expected usage. Clients only pay if the operator is successful.

Here’s a look at the pitch deck Eloquent AI used to raise its $7.4 million seed. One slide has been removed so that the deck can be shared publicly.

Eloquent AI

Eloquent AI

Eloquent AI

Eloquent AI

Eloquent AI

Eloquent AI

Eloquent AI

Eloquent AI

Eloquent AI

Eloquent AI

The post A second-time founder graduated from Y Combinator with a new AI financial services startup. Read her pitch deck. appeared first on Business Insider.