The Powerball jackpot climbed to an estimated $1.7 billion after no one hit the top prize in Wednesday night’s drawing — up from $1.4 billion following Monday’s draw.

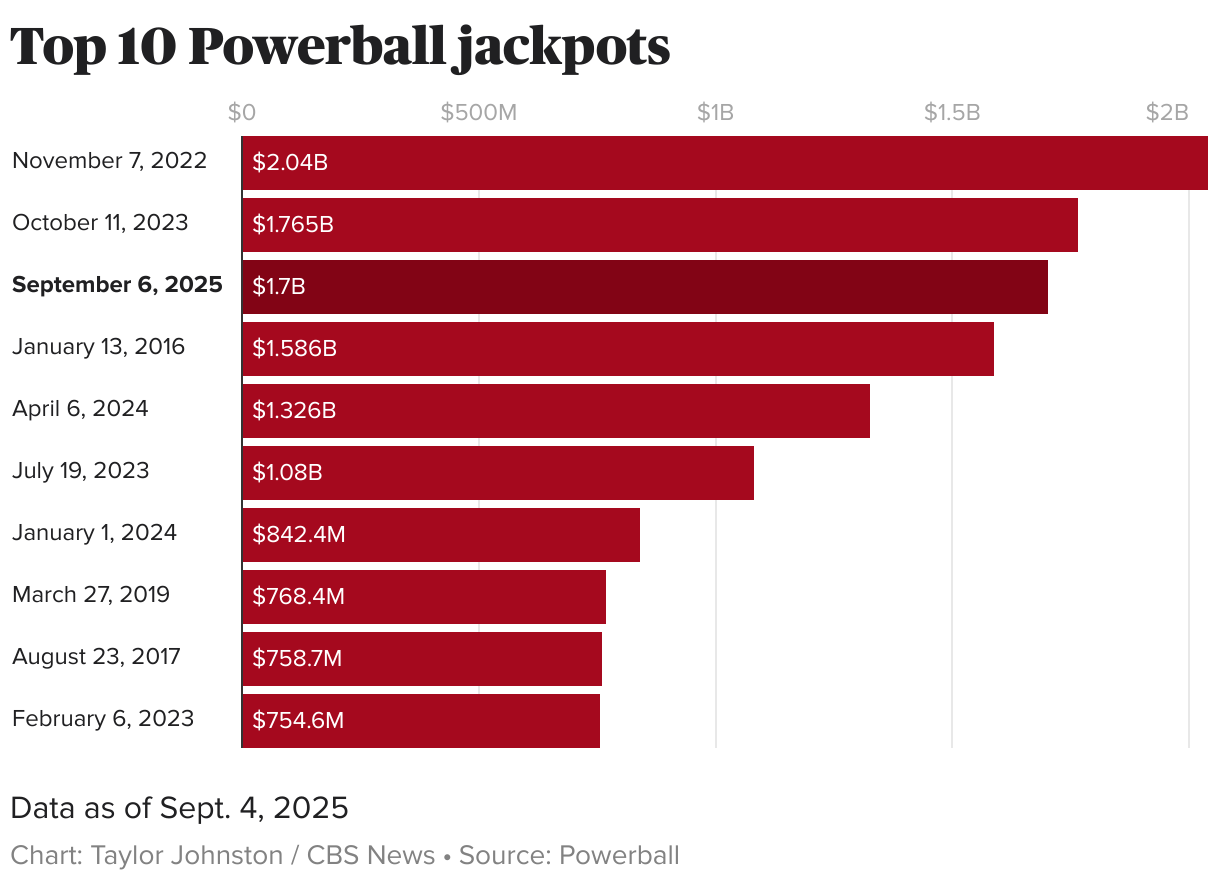

Saturday’s jackpot is the third-largest in U.S. lottery history, with an estimated cash value of $770.3 million. The record jackpot was $2.04 billion, won on Nov. 7, 2022, according to Powerball.

The CBS News data team looked into Powerball data to see where winners take home the most and least, how often numbers are drawn, and the timing and size of every jackpot so far this year.

Here’s how the numbers break down:

What are the odds?

The odds of winning the jackpot are 1 in 292.2 million, according to Powerball. The overall odds of winning a prize are 1 in 24.9.

Saturday’s drawing will mark the 42nd since the jackpot was last claimed in California on May 31, setting a new record for the most consecutive drawings without a jackpot winner.

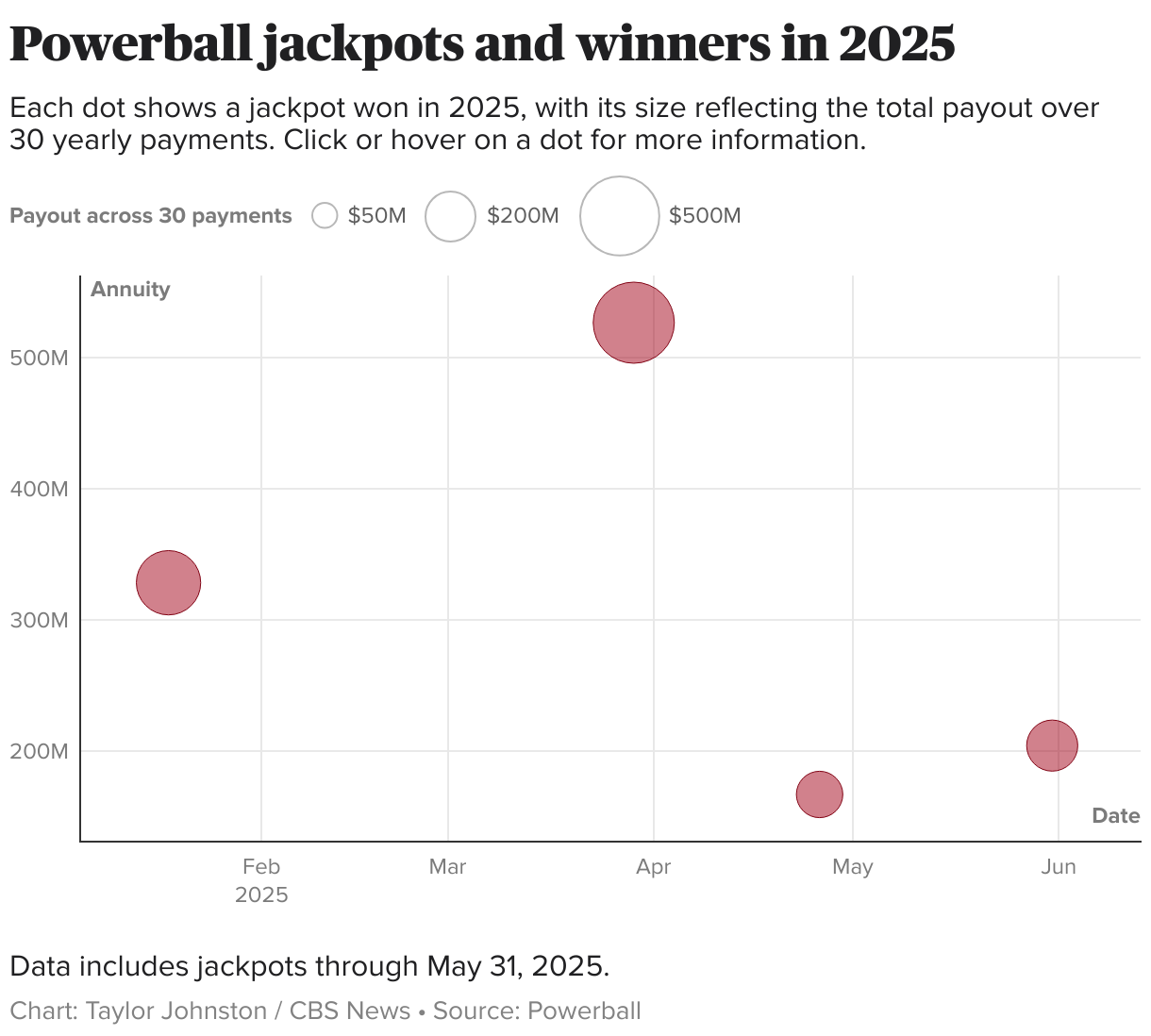

So far this year, the jackpot has been hit four times. The chart below shows the timing and size of each jackpot so far.

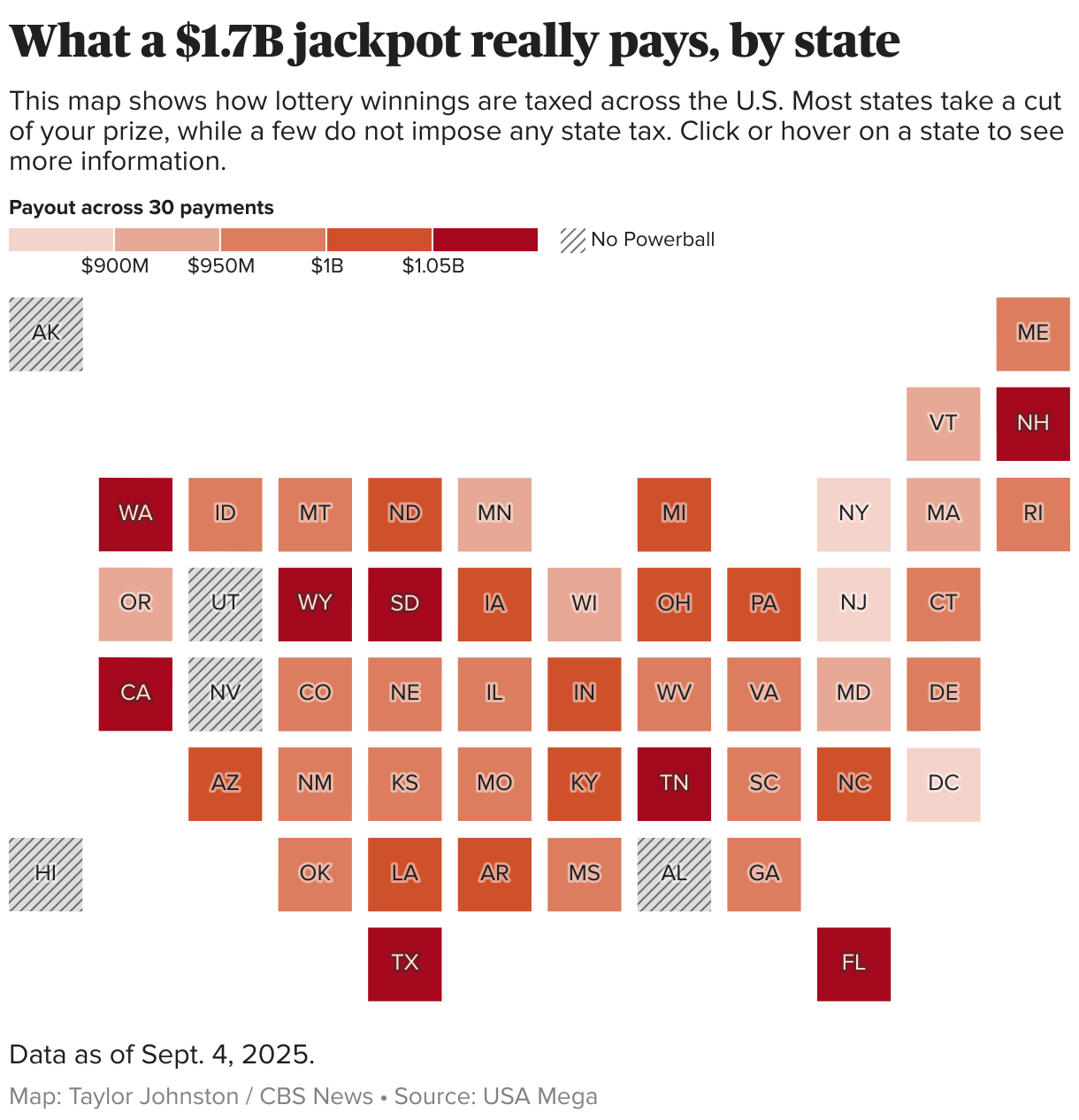

The best and worst states to win Powerball

Powerball jackpot winners may choose to receive their prize as an annuity, paid in 30 graduated payments over 29 years, or a lump-sum payment.

Whatever option you choose, the Internal Revenue Service takes a cut — and most states do, too.

Federal law requires a 24% withholding on lottery winnings over $5,000, with an additional 14.6% due at tax time, bringing the total federal tax to about 37%. On top of that, many states levy their own income tax on winnings, which can range from a few percent to more than 10%, while a handful of states don’t tax lottery prizes at all.

CBS News looked at each state to see where a jackpot winner could take home the most — and the least — after taxes.

States including California, Florida, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming do not tax lottery prizes. A winner of a $1.7 billion jackpot in these states could receive $1.072 billion across 30 payments, or $485 million as a lump sum, after federal taxes, according to data from USA Mega.

In states with higher taxes, the total yearly payments would add up to less in states with higher taxes. For example, a winner in Minnesota would receive about $905 million, followed by Oregon, $903,989,400; New Jersey, $889,539,390; Washington, D.C., $889,539,390 and New York, $886,989,390, which has the lowest after-tax annuitized payout.

Alaska, Alabama, Hawaii, Nevada and Utah do not have Powerball.

Hot and cold numbers

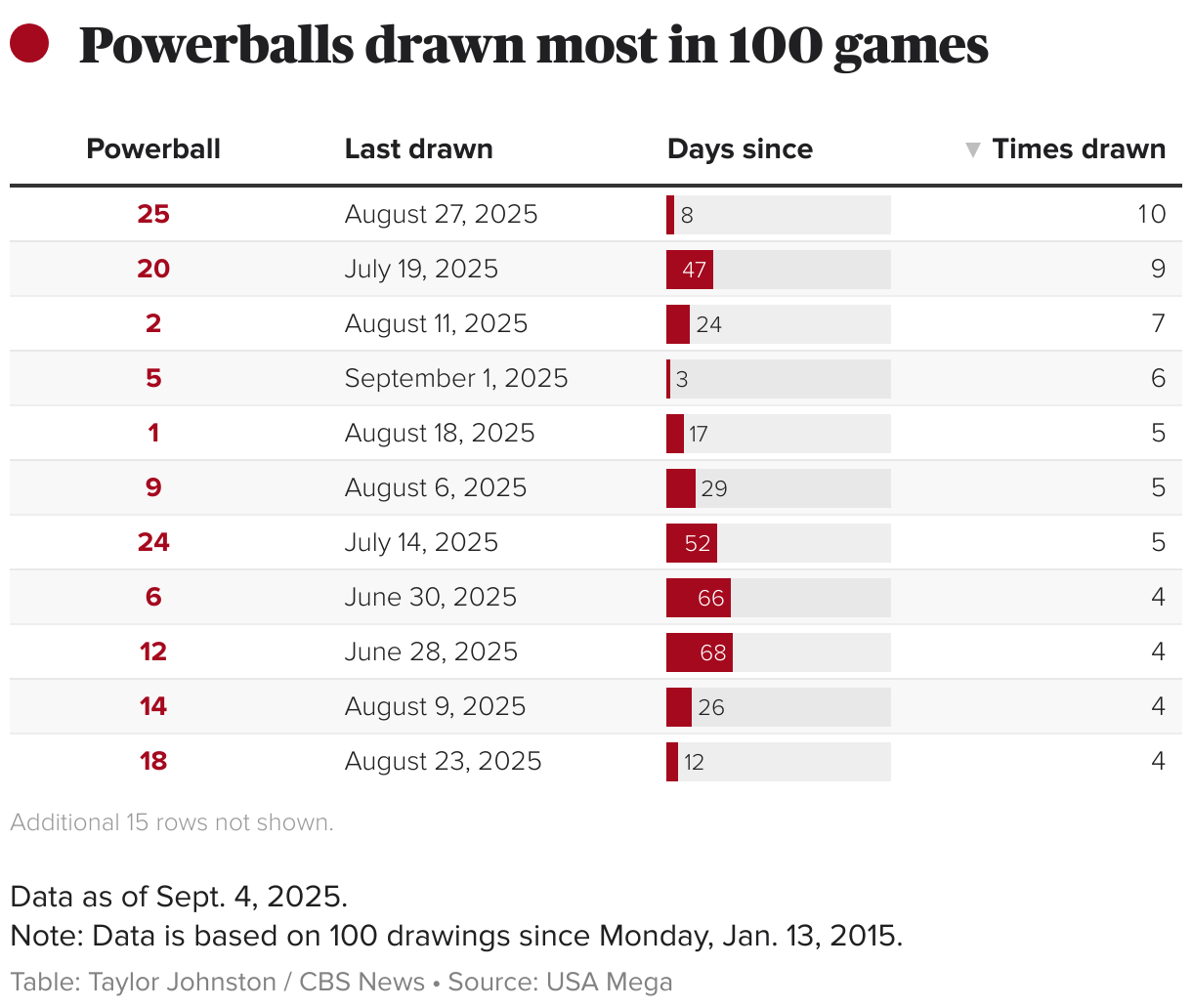

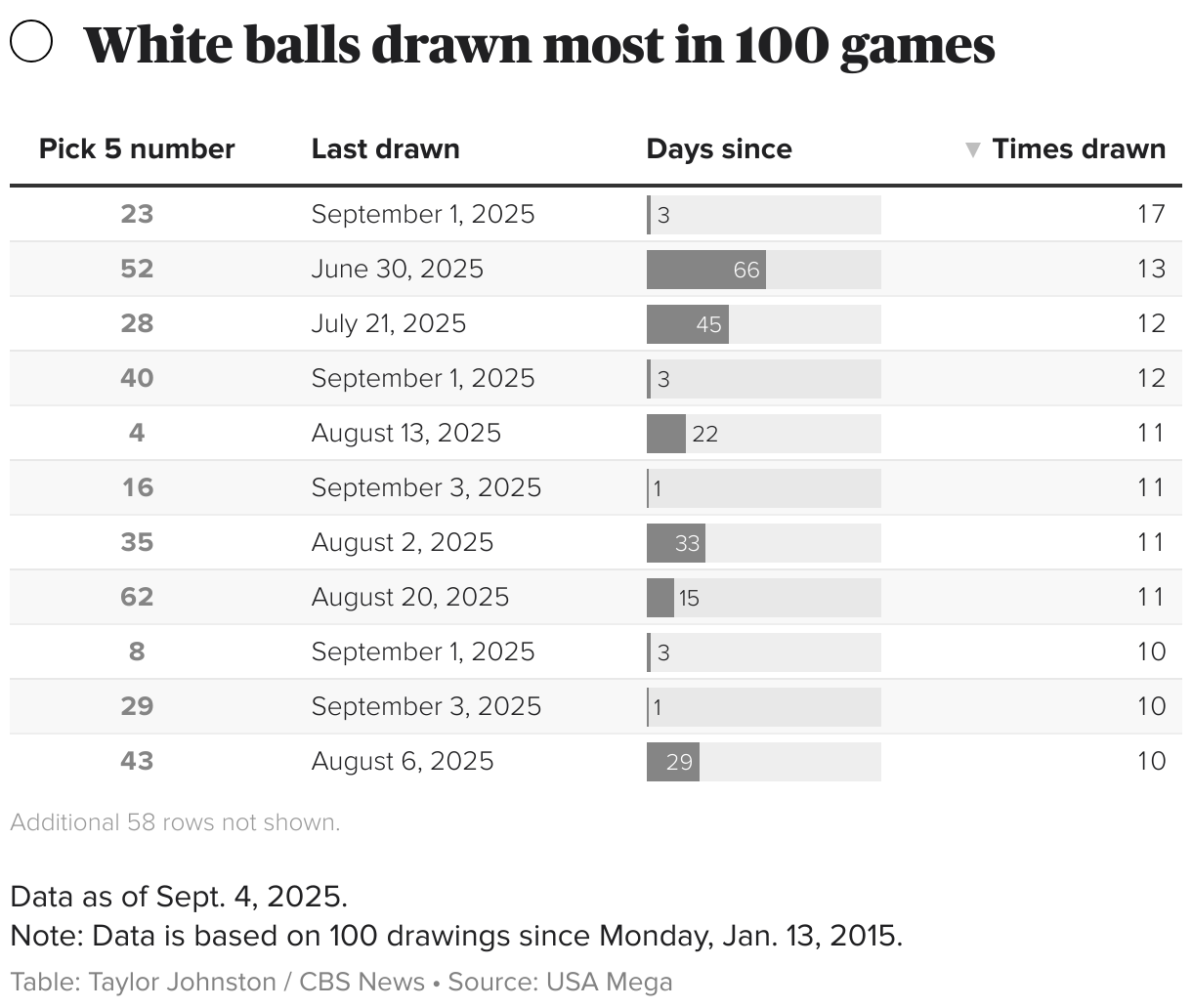

Players choose five numbers from 1 to 69 and one Powerball number from 1 to 26.

While each drawing is random, the tables below show which numbers have appeared most, and least, often.

Taylor Johnston is a visual data journalist working with the CBS News and Stations data team.

The post Powerball jackpot data shows where winners could take home the most, and least appeared first on CBS News.