Cash-strapped Americans are growing increasingly pessimistic about their financial future, as data continues to reveal declines in consumer confidence and heightened anxieties about the economy in 2025.

A recent survey by online lending marketplace LendingTree finds that only 38 percent of Americans who don’t currently consider themselves wealthy believe they will be at some point in their lives. This is down from 41 percent the last time LendingTree asked the question in 2023, from 44 percent in 2022 and 51 percent in 2019.

Matt Schulz, LendingTree’s chief consumer finance analyst, told Newsweek, in part, “This data is further proof that people who aren’t wealthy are struggling right now,” he added.

Why It Matters

The responses highlight a long-term erosion of financial optimism among non-wealthy Americans, while also underscoring more immediate concerns that have plagued consumers this year. Stubborn inflation and the potential for tariffs to drive up prices have aroused significant fears among policymakers and consumers that household budgets and the economy as a whole will be under significant strain for the foreseeable future.

What To Know

According to LendingTree’s survey of 2,000 U.S. consumers, Gen Zers remain the most optimistic about their future financial success. Some 62 percent currently believe they will become wealthy at some point, though this is down from 69 percent in 2023.

Across every demographic, the top three definitions for “wealthy” remained the same: 54 percent selected “living comfortably without financial concerns”; 51 percent said feeling financially secure; and 48 percent said being debt-free. This compares to 56 percent, 45 percent and 38 percent, respectively, in 2023.

As LendingTree’s analysts noted, respondents were more than twice as likely to equate wealth with a lack of financial worries as making a six-figure salary (23 percent) or boasting a net worth of over $1 million (26 percent). This, they wrote, is an indication that “comfort and security—not indulgence—have become the new markers of wealth.” In addition, the vast majority (80 percent) said it is becoming harder to build wealth.

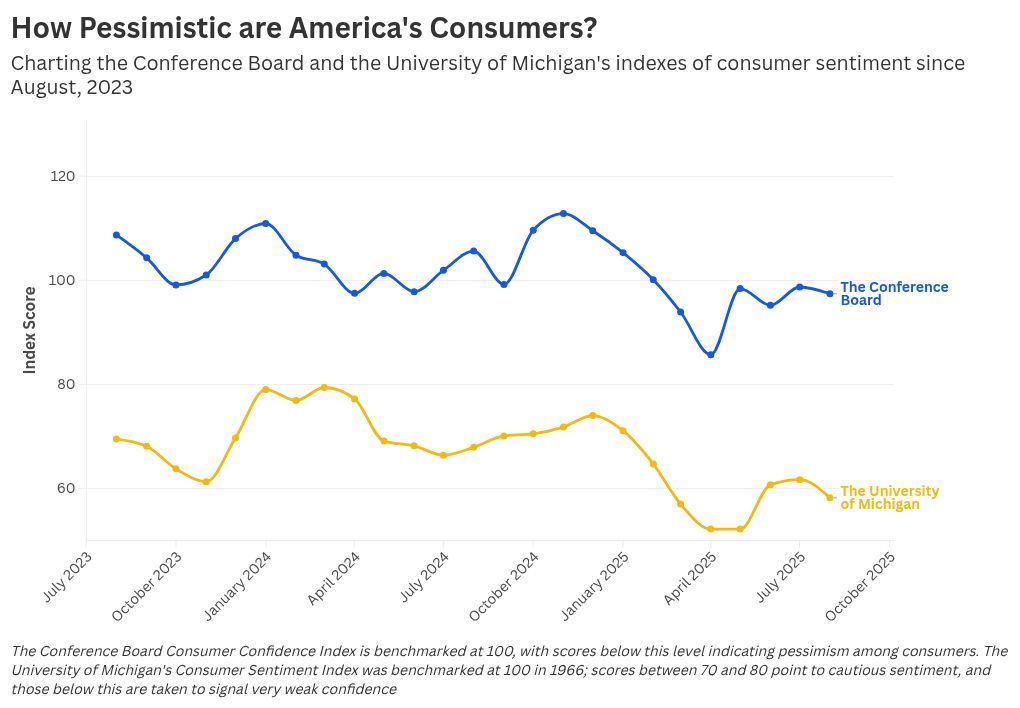

Recent surveys of consumer sentiment seem to echo these gloomy results. The Conference Board’s Consumer Confidence Index dropped to 97.5 in August, down from 98.7 in July and 105.3 in January. The Present Situation Index—which gauges views on current business and labor market conditions—also fell in August, while the forward-looking Expectations dropped 1.2 points to 74.8, below the 80-point threshold the think tanks say “typically signals a recession ahead.”

The University of Michigan’s latest Index of Consumer Sentiment, another closely monitored indicator, declined 6 percent to 58.2 in August, the first drop in four months. Researchers said “perceptions of many aspects of the economy slipped,” with those of buying conditions for durable goods dropping to their lowest level in a year, and year-ahead inflation expectations surging to 4.8 percent from 4.5 percent in July.

What People Are Saying

Matt Schulz, LendingTree’s chief consumer finance analyst, told Newsweek: “Life’s really expensive in 2025, and budgets are really tight for so many American households. That means less money to put toward wealth-building moves such as buying a home, investing in the stock market or starting a small business. People want to focus on building their future but instead feel like they’re treading water today, and that can be incredibly discouraging.

“This data is further proof that people who aren’t wealthy are struggling right now,” he added. “They’re worn out by high prices, high interest rates and economic uncertainty, and it is taking a toll.”

Stephanie Guichard, senior economist for Global Indicators at The Conference Board, said: “Consumer confidence dipped slightly in August but remained at a level similar to those of the past three months.

“Consumers’ write-in responses showed that references to tariffs increased somewhat and continued to be associated with concerns about higher prices,” she added. “Meanwhile, references to high prices and inflation, including food and groceries, rose again in August.”

Joanne Hsu, director of consumer surveys at the University of Michigan, wrote in a recent report: “Since the election, trade policy has captured the attention of consumers, specifically in terms of their anticipated effects on the prices they face. This attention comes as no surprise, given that concerns about high prices and inflation have dominated consumer attitudes toward the economy since the pandemic.

“While making plans to cut back on future spending may be one way to deal with an expected inflationary environment, another strategy could be to pre-emptively make large purchases in order to avoid future price increases,” she continued. “Such advance buying motives can turn high inflation expectations into a self-fulfilling phenomenon, as accelerated buying would create further upward pressure on inflation.”

What Happens Next?

The Conference Board’s next consumer confidence report will cover September and is scheduled for release on September 30.

The post Americans Are Gloomier Than Ever About Their Financial Future appeared first on Newsweek.