A provision in President Donald Trump‘s One Big Beautiful Bill has barred federal student loans for degree programs whose graduates did not meet new earnings thresholds.

It also has imposed new lifetime borrowing caps for graduate and professional students, a move that analysts and educators said could change which fields students choose to pursue.

Why It Matters

Federal student loans have been a primary financing channel for millions of students, and tightening eligibility based on post-graduation earnings could narrow program access and influence career paths.

Nearly 6,000 institutions provide federal loans and 30 percent to 40 percent of undergraduates borrow federally each year, representing roughly 7 million students who rely on federal loans, according to Forbes.

What To Know

The law, signed last month, requires undergraduate programs to show graduates’ median earnings exceeded state median earnings for 24- to 35-year-olds with a high school diploma, and it required graduate and certificate programs to exceed the state median earnings for bachelor’s degree holders in the state.

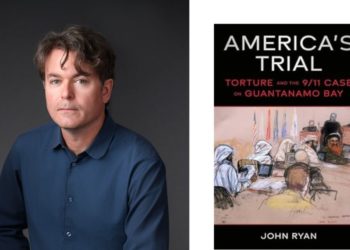

“Sounds reasonable, right? Here’s the problem: It completely ignores the market reality that many essential careers pay poorly not because they lack value, but because they’re undercompensated,” Michael Ryan, a finance expert and the founder of MichaelRyanMoney.com, told Newsweek.

“This creates a feedback loop. Fewer people can afford to study education or social work, so we get teacher shortages, which will drive up demand, which eventually increases wages. But only after years of crisis.”

The legislation also sets new borrowing caps for graduate students, including a $100,000 lifetime cap for graduate loans and a $200,000 lifetime cap for professional degree borrowers, and it phased out Grad PLUS for new borrowers starting July 1, 2026.

Early childhood education leaders warned that the earnings threshold could shut off loan access for many early-childhood programs and deter prospective teachers amid staffing shortages in child care, according to PBS NewsHour.

Medical and other professional students also face an elevated risk of funding gaps because many graduate professional degrees already exceeded the new federal caps. CNBC reported that average medical school costs often exceed federal caps, leading to a potential deterrent effect for future doctors.

“We’re essentially telling 22-year-olds to optimize for immediate earnings rather than long-term career satisfaction or societal contribution. That’s a recipe for a workforce full of regrets,” Ryan said.

“The unintended consequence? Students from wealthy families can still pursue these careers without federal loans, while working-class kids get funneled exclusively into STEM and business. We’re not making education more efficient, we’re making it more elitist.”

Academic research also shows that student debt shaped career choices in fields with lower and more variable pay. A 2023 peer‑reviewed analysis found that “student loan debt reduces the probability of arts graduates working in related fields by over 25 percent and working as artists by over 30 percent.”

What People Are Saying

Drew Powers, the founder of Illinois-based Powers Financial Group, told Newsweek: “There is a long-held belief that any degree in any major will set you on the path of financial success, and over the past 30 years we have seen that is no longer true. However, that does not mean a broad subject education is not valuable, nor does it mean holders of that diploma cannot pay back their loans. But student loans have become hyper-politicized, and a liberal education diploma holder has become the scapegoat.”

Michael Ryan, a finance expert and the founder of MichaelRyanMoney.com, told Newsweek: “This earnings threshold rule sounds good on paper, but it’s creating a two-tiered education system where only ‘profitable’ degrees get federal backing. We’re about to price out teachers, social workers, and counselors. you know, the very people we desperately need.”

Kevin Thompson, the CEO of 9i Capital Group and the host of the 9innings podcast, told Newsweek: “This is the problem when businesspeople run the government: Value gets measured purely in profit and cost, not in how an industry pushes the economy forward. I don’t think this will rock the overall job market—people chasing higher pay will flock to the industries making the most money right now. The bigger concern? Industries at the top today can become tomorrow’s laggards in just a few years.”

What Happens Next

Implementation steps and timelines will determine immediate effects. Grad PLUS is scheduled to be phased out for new borrowers starting July 1, 2026, and the new caps and earnings-based loan eligibility are also set to take effect for future enrollment periods.

“We’ll have to wait and see what the actual effects are, but it does feel as if this policy risks steering students toward higher-paying fields at the expense of broader educational diversity and purpose, which has pros and cons,” Alex Beene, a financial literacy instructor for the University of Tennessee at Martin, told Newsweek.

The post Student Loan Update: Major Change Likely To Impact Career Decisions appeared first on Newsweek.