Daniel Zuchnik/WireImage/Getty Images

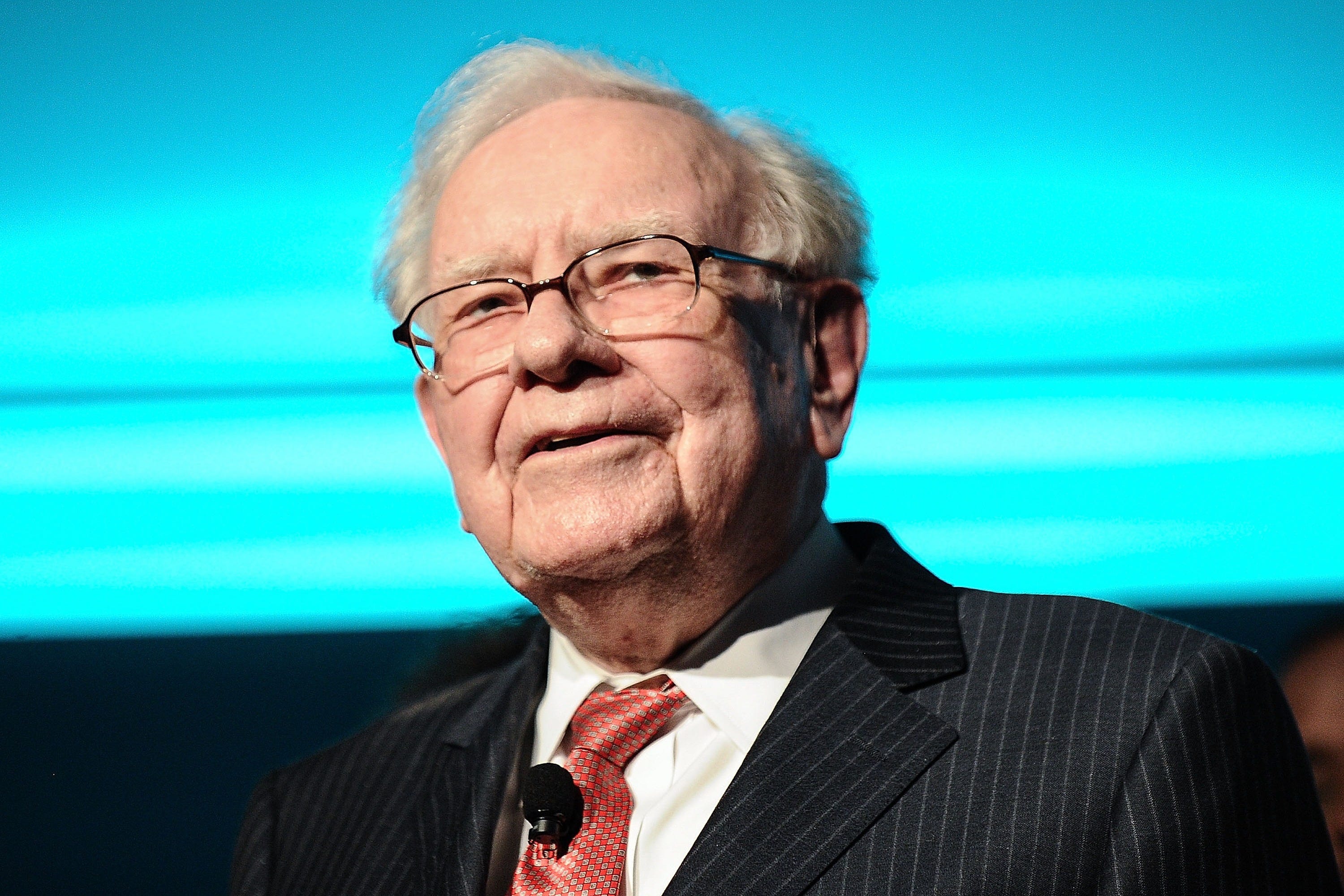

Berkshire Hathaway’s investors may be looking at the stock and wondering if the “Buffett premium” is real — and disappearing before their eyes.

The “premium” refers to the long-standing view that Berkshire stock trades at a premium because of Warren Buffett’s legendary stock-picking skills, dealmaking prowess, and shrewd management, which saw him transform a failing textile mill into a world-beating conglomerate over six decades.

Going into the annual shareholder meeting in Omaha in early May, Berkshire was up 19% year-to-date, while the benchmark S&P 500 index was down 3%.

At the end of his Q&A, Buffett rocked the financial world by announcing he would step down as CEO in December. Berkshire stock has since fallen 11% while the S&P has climbed 10%.

Berkshire Hathaway didn’t respond to a request for comment from BI.

The sell-off might seem like a reaction to the legendary investor’s impending departure. But, when they spoke to Business Insider, six of the company’s keenest observers were divided over whether this was the famous “Buffett premium” disappearing.

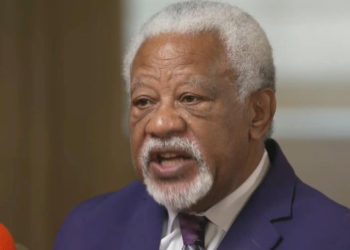

Paying up for Buffett

AP

“I believe there is a ‘Buffett premium’ although I think it is difficult to quantify,” John Longo — a finance professor, investment chief, and author of “Buffett’s Tips: A Guide to Financial Literacy and Life” — said.

Long said that fewer people might be willing to sell their businesses to a Buffett-less Berkshire, nodding to the investor’s reputation for offering clean and simple transactions, hands-off ownership, and a permanent home for companies.

Bill Smead, the founder and chief investor of Smead Capital Management, told BI that Berkshire, which has a $1 trillion market capitalization, commands an above-market valuation multiple for a conglomerate because Buffett is at the helm. Once the investor fully retires, “there’ll be another part of the Buffett premium that goes away,” he said.

In his 2014 shareholder letter, Buffett said that, during his time as CEO, Berkshire stock fell about 50% from its high three times. Smead said the fact that Buffett remained CEO showed investors have an “unusual level of faith” in him. Smead added that there may be a higher risk of shareholder revolt if the same happens to Buffett’s successor, Greg Abel.

“In Buffett’s case, confidence in him causes even the newcomers to stay put” when the stock is floundering, Smead said. “When he’s no longer in the office, the people won’t have that same backstop.”

Buffett isn’t Berkshire

Kevork Djansezian/Getty Images

Chris Bloomstran, president of Semper Augustus Investments, told BI, “I don’t think a ‘Buffett premium’ has existed since 1998,” when the investor used Berkshire shares trading at nearly three times book value to buy General Reinsurance.

Bloomstran said strong underwriting earnings had propelled Berkshire shares to record highs ahead of May’s fateful annual shareholder meeting. They then retreated along with the wider property-and-casualty insurance and reinsurance industry, Bloomstran added. Berkshire owns several insurance companies including Geico and National Indemnity.

Berkshire is the result of “what Warren lovingly built over six decades,” he continued. “It’s no longer worth less if he’s not running it,” Bloomstran added.

Steven Check, the CEO of Check Capital Management, agreed that the stock had surged to the point it was “arguably, slightly overpriced” and has since returned to a fairer valuation.

“We think Buffett leading the company is a great thing, but the stock has also been underpriced for periods over the last five to 10 years with Buffett leading the company,” Check said.

Brett Gardner, an analyst and author of “Buffett’s Early Investments,” said two months of trading weren’t enough to draw conclusions.

“The magnitude since his retirement does surprise me, though,” he said, adding that Buffett turns 95 this year and his departure “should have been priced in.”

Larry Cunningham, the author of several books about Buffett and Berkshire and the director of the University of Delaware’s Weinberg Center, said he didn’t attribute the stock’s fall to the “evaporation” of a “Buffett premium.”

“Frankly, I’ve never seen a responsible valuation analysis that explicitly assigns such a premium to his presence,” Cunningham told BI. “So I don’t think this move reflects the loss of a rational premium, nor does it represent a justified discounting,” he continued.

Cunningham agreed with Bloomstran that Buffett’s key contribution was building Berkshire Hathaway up, and now that it has matured, it requires his oversight less.

“Today, his value is concentrated in rare, opportunistic acquisitions, which have been scarce in recent years,” he said.

“I don’t think you can quantify Warren Buffett’s value to Berkshire,” Check said. “But part of his genius is he has built the company to do well after he is gone.”

Abel, who is due to take over as CEO on January 1, has been Berkshire Hathaway’s vice chair of non-insurance operations since 2018.

“Buffett is irreplaceable,” Check said, adding he still expects Berkshire to “do quite well” under Abel.

The post We asked Warren Buffett gurus whether his exit is what’s bringing Berkshire Hathaway’s stock down appeared first on Business Insider.