The U.S. dollar plunged Thursday to a three-year low after word got out that President Donald Trump is plotting to announce a MAGA-friendly Federal Reserve chair as early as this summer.

Peeved at Federal Reserve Chair Jerome Powell’s refusal to slash interest rates, Trump has unleashed blistering attacks against the banker, calling him the “WORST” and a “dummy” who is “costing America $Billions.”

That rhetoric did not persuade Powell to issue a rate cut this week. He told Congress that the U.S. central bank will continue to adopt a wait-and-see approach to gauge how the economy reacts to Trump’s tariffs and other economic uncertainties.

Trump has shared his displeasure with Powell publicly. Behind closed doors, the Wall Street Journal reports that he is considering naming Powell’s replacement—a MAGA loyalist—as early as this summer to undermine Powell’s final months in the position and “influence investor expectations about the likely path for rates … to steer monetary policy before Powell’s term ends.” Powell’s term is not up until May 2026.

Trump has floated the idea of outright firing Powell. However, the Supreme Court has affirmed the Fed’s independence, shielding chairmen from removal over spats with the president.

The dollar reacted negatively to news that Trump plans to replace Powell with a yes-man. It slumped 0.3 percent in the ICE U.S. Dollar Index (DXY) on Thursday to around 97.39, a three-year low. The dollar has now lost 10.48 percent of its value against other currencies on the DXY index in 2025, Fortune reports.

“It’s likely that Trump would want assurances that his next pick for the Fed would lower interest rates,” Fortune reported Thursday. “The dollar’s decline is therefore a sign that investors are nervous that U.S. monetary policy might end up in the hands of someone who doesn’t understand, or care, how inflation works.”

Trump appointed Powell in 2018, but has made clear he regrets his choice. Now, insiders tell the Journal that the president is seeking to replace him with someone who is “unstintingly loyal.”

A White House official told the Daily Beast on Thursday that Trump’s announcement of the next Fed chair is not “imminent.” The official added that Trump has “many good options to nominate as the next Federal Reserve chairman.”

The Fed chair has historically been an independent institution—a fact that most past presidents and lawmakers have respected. However, there is precedent for what can go wrong when the U.S. central bank operates at the president’s behest.

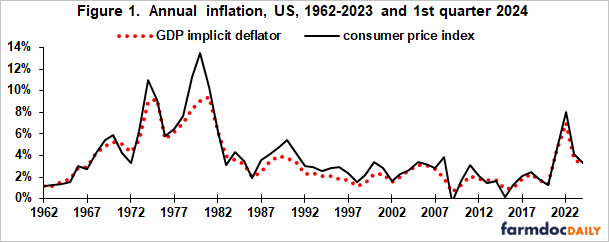

Former President Richard Nixon privately pressured then-Federal Reserve Chairman Arthur Burns to keep interest rates low in the lead-up to the 1972 election. Burns’ decision to keep rates low contributed to crippling inflation that persisted throughout the 1970s.

The Journal reports that Trump’s shortlist for the Fed includes former Fed Governor Kevin Warshand and National Economic Council Director Kevin Hassett. MAGA allies are also pitching Trump to consider choosing his current Treasury secretary, Scott Bessent, for the all-important role. The next Fed chair’s term will run through 2030, with the possibility of being extended at the discretion of the president at the time.

Typically, presidents who do not extend the tenure of a sitting Fed chair announce their replacement three to four months before the chair’s term is up.

The post Trump Sends Dollar Plunging With Plan to Turn Federal Reserve MAGA appeared first on The Daily Beast.