Uli Deck/picture alliance via Getty Images

Central banks have been stocking up on gold.

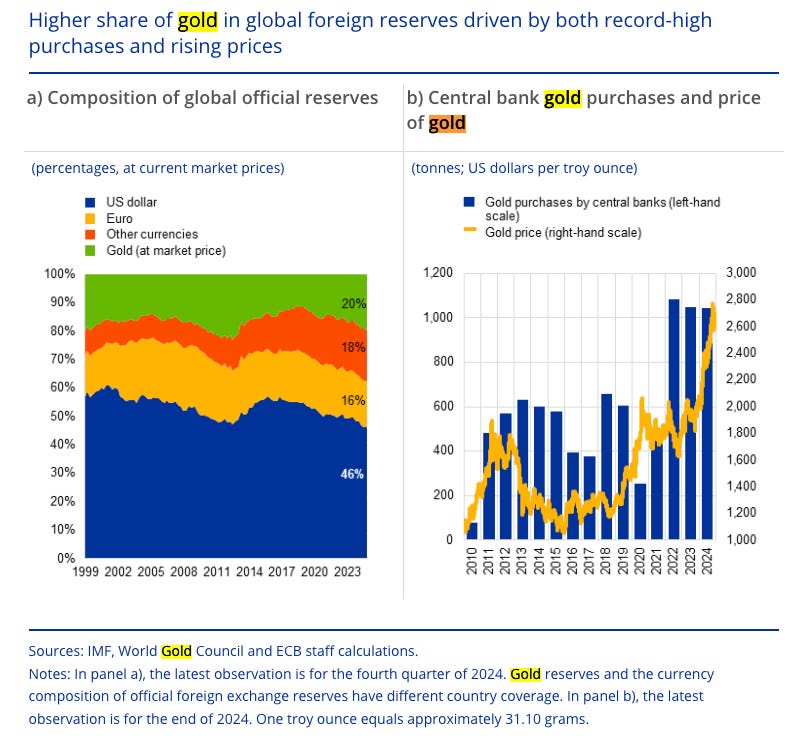

They bought over 1,000 tonnes of the precious metal last year, double the average amount purchased in the previous decade, according to a European Central Bank report published on Wednesday.

The authors wrote that global holdings of gold by reserve banks increased to 36,000 metric tons in 2024, close to the record of 38,000 metric tons reached around 60 years ago.

Per the survey, two-thirds of central banks invested in gold to diversify their portfolios, and about 20% did so to provide protection against economic and geopolitical risks, like Russia’s invasion of Ukraine.

“Adjusted for inflation, real gold prices in 2024 surpassed their previous peak seen during the 1979 oil crisis,” the report said.

The stockpile of the yellow metal, matched with rising prices, made it the second-largest global reserve asset after the dollar in 2024.

Gold prices were $3,342 per troy ounce as of roughly 11:30 a.m. ET on Wednesday. This is up close to a quarter year-on-year and over 90% in the past five years.

A rise in demand was partially driven by increased buying activity by central banks, as well as fears of an economic slowdown and tariff uncertainty.

Meanwhile, the US Dollar Index has declined more than 8% since the start of the year.

Now, central bank reserves are composed of, on average, the dollar, at 46%, gold, at 20%, other currencies at 18%, and the euro at 16%.

European Central Bank

Gold has hit a number of all-time highs this year. It broke a record by passing the $3,500-per-ounce threshold in April as more investors sought safe-haven assets following President Donald Trump‘s criticisms of Federal Reserve chair Jerome Powell.

Before this, the precious metal reached the $3,000 level for the first time in March.

Get the latest Gold price here.

The post Central banks just can’t get enough of gold appeared first on Business Insider.