This slip-up was a real tipping point.

A special education educator inadvertently left a $5,000 tip at a vape shop — and reportedly spent the next several months fighting with her bank to smoke out the eye-watering number.

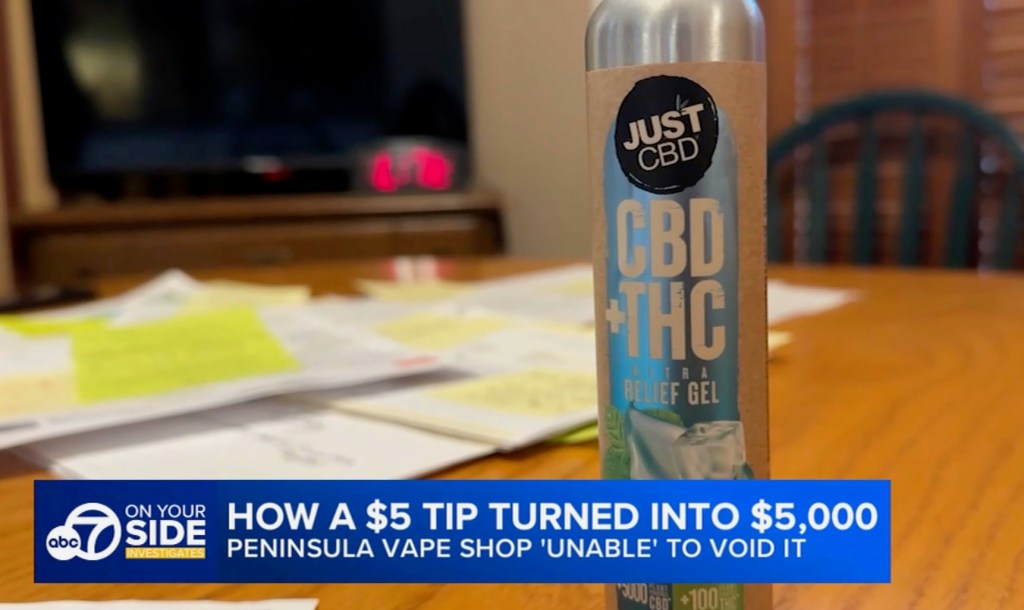

Linda Mathiesen, a Peninsula single mother who struggles with shoulder pain, made a $129.28 purchase for CBD gel to help with the nagging issue at a Bay Area shop last year — and wanted to leave an additional token of appreciation, according to a KGO report Wednesday.

She told the station she only wanted to leave a $5 tip, but struggled to see the credit card pad on the tall checkout stand even on her tippy toes.

“He says enter a tip — so I did… I push what I thought was only two zeroes. Ended up being three zeroes,” Mathiesen claimed.

“But, there’s no decimal point… I’m like, ‘Wait, I want to delete this.’”

The clerk processed the charge and then claimed to Mathiesen he didn’t know how to void it, she said.

The employee also claimed the tip never went through, but Mathiesen’s bank statement said otherwise, the station reported.

“Who would ever?” Mathiesen reportedly said. “Like, $5,000? I don’t have that kind of money.”

The mother of two grown sons claimed she contacted her bank, Wells Fargo, 22 times, including calling them five minutes after leaving the store.

She was left frustrated for months to the point of tears before the bank recently stepped in after KGO reached out to them, the station reported.

The bank reportedly contacted Mathiesen and told her they would refund her the shocking figure, as well as interest.

Wells Fargo told People in a statement Friday that when it became aware of the problem, it worked to “resolve this situation.”

“We are committed to working with our customers to find solutions when they encounter issues,” the bank also said.

The Post has sought comment from Wells Fargo late Friday.

Meanwhile, a worker at the vape shop told KGO that ownership changed in January and had no comment.

The post Calif. teacher accidentally leaves $5K tip at vape shop appeared first on New York Post.