I-Hwa Cheng/AFP/Getty Images

Hello there! The warmer weather might mean some post-work festivities. But just because you’re off the clock doesn’t mean anything goes. An etiquette expert offered tips on what not to order when you’re out with work people.

In today’s big story, we’re previewing what to expect from Nvidia’s big earnings report after the bell.

What’s on deck

Markets: BlackRock’s bond chief shared some trades he’s eyeing.

Tech: General Catalyst’s leader is taking the VC down the road less traveled.

Business: Gen Z saw sex work as a shortcut to the American dream. Now they are in a nightmare.

But first, reporting for duty.

If this was forwarded to you, sign up here.

The big story

Brittany Hosea-Small/REUTERS

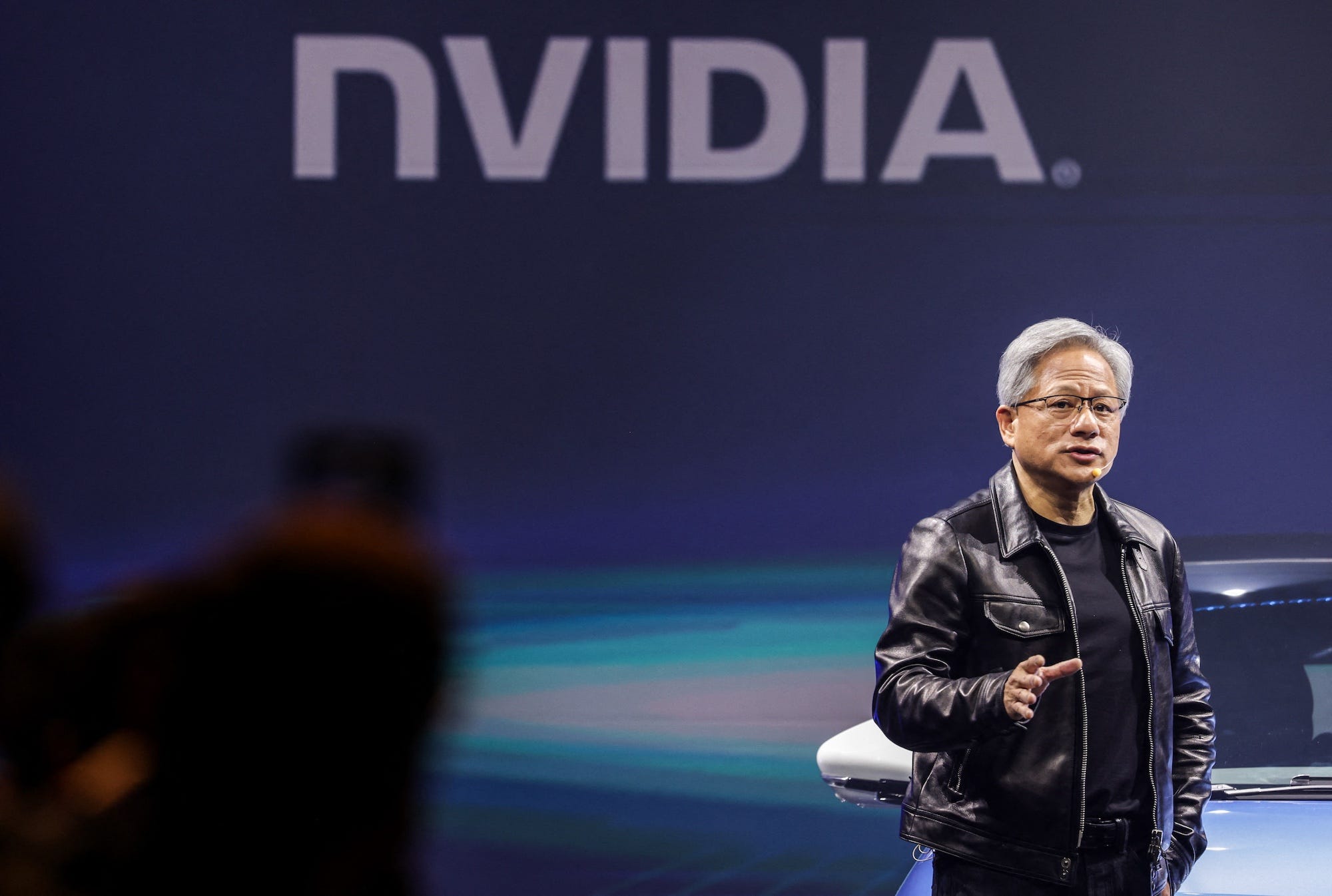

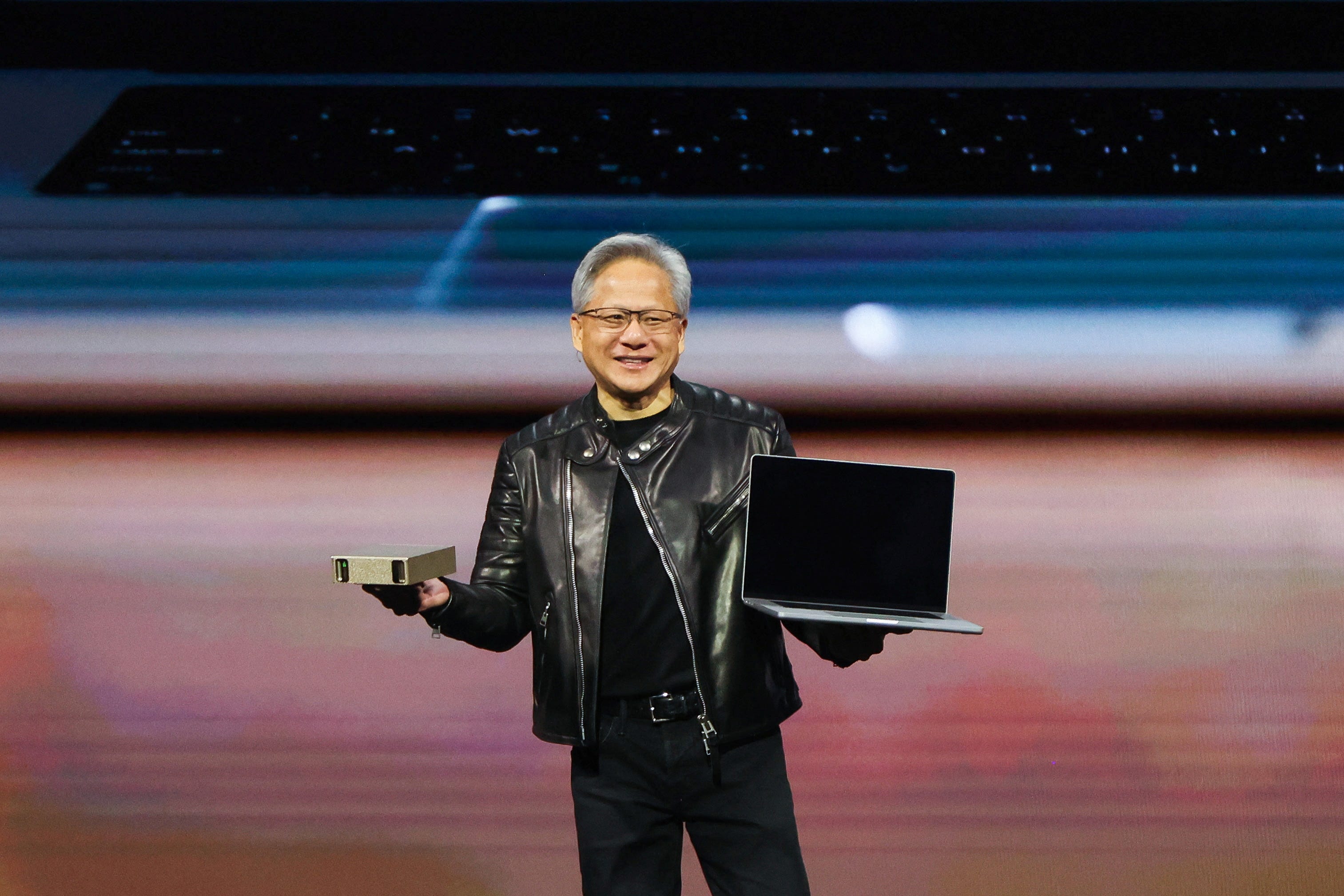

Unchartered territory

Nvidia reports earnings today from unfamiliar territory.

In previous quarters, the biggest question asked of the chip giant wasn’t if it would beat analyst estimates; it was how much it could surpass them.

Things are different now, as 2025 hasn’t been kind to Nvidia. The tech giant is up just 0.9% this year, trailing the Nasdaq 100 index, which is up nearly 2%.

BI’s Jennifer Sor has a rundown on what analysts are saying about Nvidia before it reports after the bell. Unsurprisingly, what’s got Wall Street concerned about Nvidia is what’s top of mind for almost every company these days: tariffs.

With so much of Nvidia’s business tied to China — CEO Jensen Huang recently said its market share there was roughly 50% — the threat of a trade war weighs heavily on the tech giant.

Tariffs’ uncertainty and volatility haven’t always been bad for Nvidia. After taking a serious tumble following President Donald Trump’s “Liberation Day,” the stock is up 44% from recent lows.

Today, all eyes will be on Nvidia’s guidance and how confident, or pessimistic, the company will be about its future projects while dealing with an unknown trade policy.

Michael M. Santiago/Getty Images

Despite the uncertainty, Wall Street still seems mostly positive on Nvidia’s future.

Bank of America said Nvidia’s second-quarter guidance could be “messy,” and Piper Sandler even expects the company to miss on revenue. Both firms, however, still believe the stock has upside.

Betting on Nvidia’s resilience might be the best move. After all, the tech giant has successfully responded to what some have previously positioned as major threats to its business model.

This February, there were concerns over the Chinese startup DeepSeek. In November, all the talk was about demand for its new Blackwell chip. And last August, Nvidia had to address whether tech companies were rethinking the ROI they were getting from their AI bets.

Each time, Nvidia answered the bell. Which raises the question: Why should tariffs be any different?

3 things in markets

d3sign/Getty Images

1. Goldman Sachs thinks tariff-induced inflation could be a one-time thing. Companies are raising prices amid tariff news, but Goldman thinks an inflation blip is only fleeting, the bank said in a note. Here are its three reasons.

2. BlackRock’s bond chief weighs in on the market swings. Rick Rieder spoke to BI about the investing opportunities that have arisen in the bond market during a wild few months. Among his favorite current bets is short-duration Treasurys. “One of the great things about investing in this environment is it’s not static,” Rieder told BI.

3. Trump Media stock swings on plans to raise $2.5 billion for crypto. The stock surged 15% in premarket trading before tumbling as much as 12% on Tuesday. The company’s announcement is President Trump’s latest move into crypto.

3 things in tech

Sam Barnes/Sportsfile for Collision via Getty Images

1. General Catalyst is not like the other VCs. Under Hemant Taneja, GC has acquired stakes in unusual venture-capital assets like hospitals and accounting firms. Taneja is pushing the firm beyond the typical VC playbook, laying the groundwork to go public and baffling the rest of the industry in the process.

2. For tech CEOs, it’s win-some/lose-some with Trump. Tech billionaires from Jeff Bezos to Mark Zuckerberg lined up to support Trump at his inauguration. For their time and money, Trump is helping them on some things, but fighting them on others.

3. Europe’s EV boom is leaving Tesla behind. Tesla’s European sales collapsed by 49% last month, even as the overall EV market in Europe grew by nearly 28% in the same period, data from the European Automobile Manufacturers’ Association shows.

3 things in business

Ayesha Kazim for BI

1. The Gen Zers feeling stuck in sex work. For some graduates, sex work was a shortcut to financial freedom in the face of a brutal job market. But now that their clients are pinching pennies, sex workers are making far less than they used to — and some don’t see a way out.

2. What really happened at an “anti-woke” crypto conference? Solana’s Accelerate conference took a strong position on the culture war in a trailer for the event. The vibe of the actual conference was much different, though. It also lacked the spectacle of past crypto conferences. That’s probably a good thing, BI’s Katie Notopoulos writes.

3. Trump wants to make it easier to dump government employees. The administration revived a push to reclassify federal workers as at-will employees, making it much easier to fire them with little to no notice. Critics say it could undermine apolitical government jobs and face legal challenges.

In other news

- DOGE’s ‘5 things’ emails are dying a slow, quiet death.

- You need a ‘resentment audit‘ to help set healthy boundaries at work, says this executive coach.

- No, AOC is not worth millions of dollars.

- Read the memos The Washington Post sent staff offering voluntary buyouts as the Bezos-owned paper restructures.

- Elon Musk says Trump’s spending bill ‘undermines’ DOGE’s work.

- Google CEO reacts to OpenAI’s big hire: ‘Jony Ive is one of a kind.’

- AI hallucinations in court documents are a growing problem, and lawyers are responsible for many of them.

- Trump says it would cost Canada $61 billion to get protection from his ‘Golden Dome.’

What’s happening today

- Vice President JD Vance speaks at Bitcoin 2025 in Las Vegas.

- Macy’s reports earnings.

-

Federal Open Market Committee meeting minutes published.

The Business Insider Today team: Dan DeFrancesco, deputy editor and anchor, in New York. Hallam Bullock, senior editor, in London. Grace Lett, editor, in Chicago. Amanda Yen, associate editor, in New York. Lisa Ryan, executive editor, in New York. Ella Hopkins, associate editor, in London. Elizabeth Casolo, fellow, in Chicago.

The post Nvidia’s earnings report means another big test for the chip giant appeared first on Business Insider.