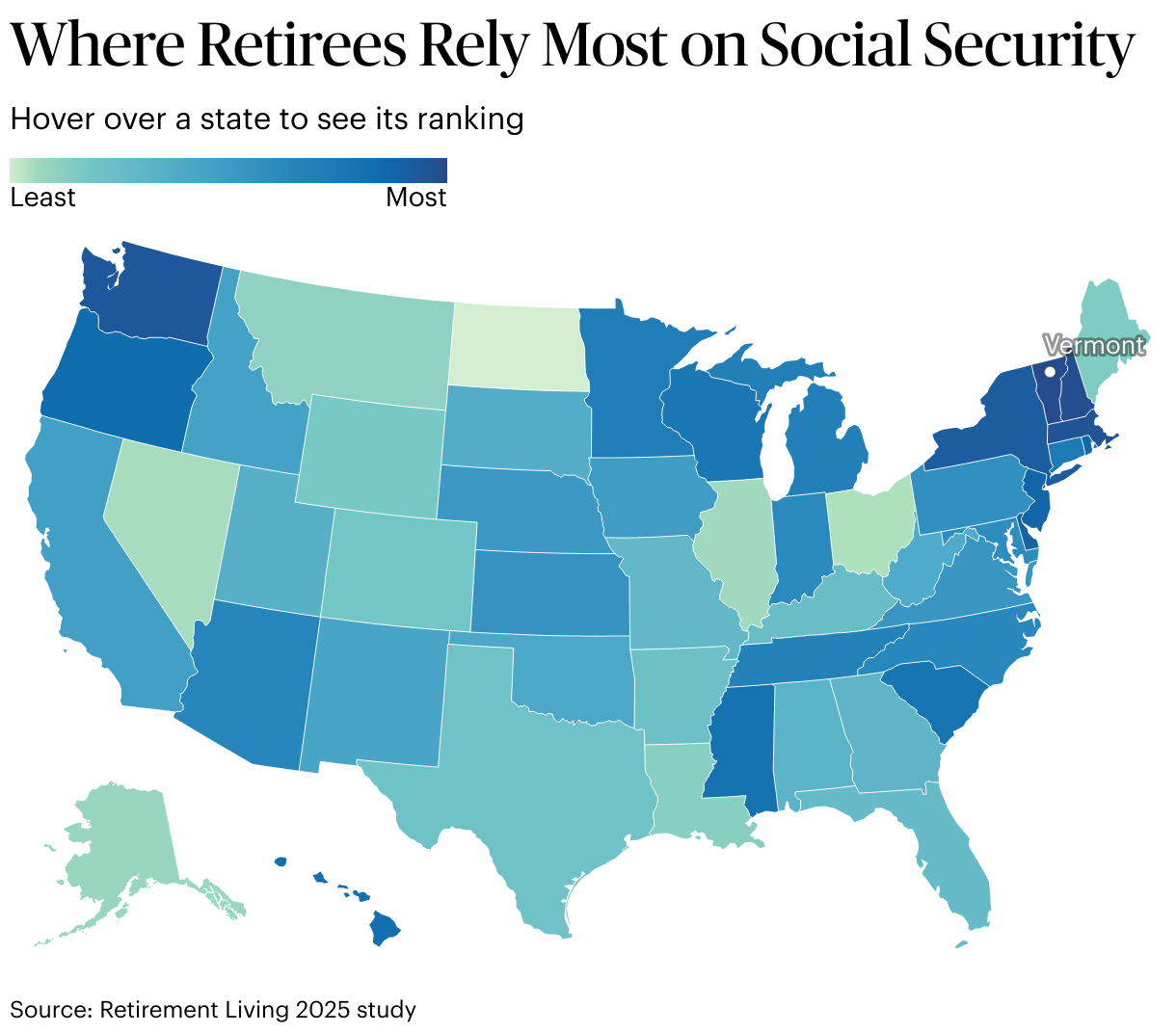

Seniors in states like Oregon, New Hampshire, and Vermont are among the most vulnerable to Social Security cuts in the country, according to research from Retirement Living.

The report, which identifies the top states where retirees rely most heavily on the benefit for basic living expenses, comes amid sweeping changes to the Social Security Administration (SSA) under the Trump administration.

Newsweek reached out to the SSA and House Speaker Mike Johnson for comment.

Why It Matters

Earlier this year, the SSA announced it plans to cut 7,000 staff members.

The changes came as part of efforts by President Donald Trump‘s Department of Government Efficiency (DOGE) to streamline government spending; however, critics argue that the cuts could delay or interrupt benefits for vulnerable retirees.

The closure of field offices and internal departments also complicates access for the elderly and individuals with disabilities.

What To Know

For over 40 percent of Americans aged 65 and older, Social Security now serves as their sole source of retirement income, making benefit stability a matter of life and death for millions.

Seniors in certain states are at heightened risk, not only because of high dependency but also owing to challenging cost-of-living conditions and limited local services.

Vermont ranked as having the most vulnerable Social Security beneficiaries due to its high cost of living index, the eighth highest in the U.S., contending with a senior poverty rate of 9.6 percent, and a high rate of Social Security fraud.

Retirees in Massachusetts, which ranks third, also struggle to make an average monthly check of $1,979.84 last in a state with the second-highest cost of living index and the 20th-highest senior poverty rate.

Top 10 States Where Seniors Rely Most on Social Security

The Retirement Living rankings reflect several factors, including the state’s percentage of seniors dependent on Social Security, the cost of living, the senior poverty rate and the state’s social security fraud reporting.

- Vermont: 90.9 percent of seniors receive Social Security; the average check is $1,949.07; the cost-of-living index is 114.4.

- New Hampshire: 91.6 percent of seniors; $2,087.54 average check; cost-of-living 112.6.

- Massachusetts: 82.8 percent of seniors; $1,979.84 average check; cost-of-living 145.9.

- Washington: 90 percent of seniors; $2,003.81 average check; cost-of-living 114.2.

- New York: 83.1 percent of seniors; $1,922.40 average check; cost-of-living 123.3.

- Delaware: 90.1 percent of seniors; $2,085.16 average check; cost-of-living 112.6.

- New Jersey: 85 percent of seniors; $2,087.95 average check; cost-of-living 114.6.

- Rhode Island: 88.4 percent of seniors; $1,963.73 average check; cost-of-living 112.2.

- Oregon: 92.7 percent of seniors; $1,909.85 average check; cost-of-living 112.

- Hawaii: 83.9 percent of seniors; $1,895.23 average check; cost-of-living 186.9.

Max Richtman, president and CEO of the National Committee to Preserve Social Security and Medicare, warned last month that DOGE cuts to the SSA were harmful and “have already hindered our members and supporters (mostly seniors, people with disabilities, and their families) from collecting the benefits they have paid for.”

A recent survey also found that even future recipients are concerned that the Trump administration’s changes could impact their Social Security benefits, with 59 percent of working-age Americans concerned that it will be gone by the time they retire.

What People Are Saying

A spokesperson for RetirementLiving told Newsweek: “Our research shows that many retirees rely on Social Security as their financial lifeline, not just a supplement. That’s why older adults in some states are more at risk than others. In places with higher economic vulnerability, a large portion of the senior population simply can’t afford to lose any part of their benefit.”

Alex Beene, a financial literacy instructor for the University of Tennessee at Martin, told Newsweek: “The reoccurring theme of states with residents who rely more on Social Security is a higher cost of living. States primarily in the Northeastern United States provide a significant strain on benefits, due to higher costs and more common fraud. Cuts to the program could provide substantial challenges for seniors as they struggle to maintain the same standard of living with less.”

Michael Ryan, a finance expert and the founder of MichaelRyanMoney.com, told Newsweek: “You know the saying ‘actions speak louder than words?’ Well, Trump’s crew is putting on the biggest magic show in Washington. They’re waving one hand, saying ‘we’ll never touch your Social Security,’ while the other hand is quietly dismantling the whole thing, piece by piece.

“West Virginia, Mississippi, Arkansas are more than just red dots on a map (barely…). Places where nearly one in 10 dollars in the local economy comes from Social Security checks. That sounds like the difference between keeping the lights on and going dark.”

Kevin Thompson, the CEO of 9i Capital Group and the host of the 9innings podcast, told Newsweek: “It is worth noting that many retirees in those states may also have additional income sources, whether it be pensions, investments, or rental income. So while the strain would be real, some individuals may be in a better position to absorb the blow compared to retirees in lower-cost states who rely more heavily on their monthly benefit.”

What Happens Next

The prospect of further cuts at the SSA remains unclear, and several advocacy groups have launched legal actions seeking to reverse DOGE-ordered changes.

“When Social Security spending disappears from these communities, it’s not just individual families that suffer,” Ryan said. “Think of the ‘trickle down.’ Grocery stores, pharmacies, the small businesses that survive on that steady monthly flow of federal dollars.”

The post Map Shows States Where Seniors Are Most Vulnerable to Social Security Cuts appeared first on Newsweek.