JPMorgan Chase CEO Jamie Dimon has warned that the worst fallout from President Donald Trump’s tariff policies is yet to come.

The markets celebrated earlier this month after the U.S. and China announced a 90-day cooling-off period in their escalating trade war, with both sides temporarily reducing their tit-for-tat tariffs while they negotiate a longer-term solution.

During the pause, the U.S. will reduce its duties on Chinese goods from 145 percent to 30 percent, while China will lower its tariffs on American products from 125 percent to 10 percent.

Trump has also paused the “reciprocal” tariffs he announced April 2 on products from dozens of countries, though he kept a universal 10 percent tariff plus several sector-specific tariffs in place.

Dimon told investors on Monday that even with the pauses, the current tariff levels are “pretty extreme.”

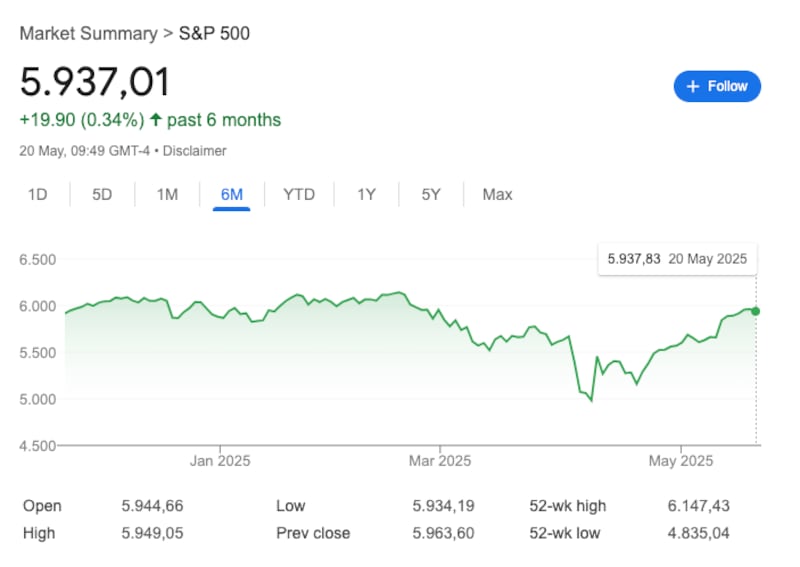

“People feel pretty good because you haven’t seen an effect of tariffs,” he said. “The market came down 10 percent, it’s back up 10 percent. I think that’s an extraordinary amount of complacency.”

The 69-year-old banker—who has helmed JPMorgan Chase for more than 19 years and is known for his measured analysis—also said he thought the risks of inflation and stagflation were higher than other analysts are saying. Stagflation occurs when high inflation is combined with poor growth and weak employment.

“I think you’re going to see the effect even if these [tariff] levels stay where they are today,” he said, citing rising costs and uncertain trade flows.

“You also don’t know how countries are going to respond, and they are responding,” he added. “They’ve already started cutting trade deals with other people.”

The Trump administration originally said that other countries would foot the bill for the tariffs, which a form of import tax paid by American companies with the added costs typically passed on to consumers.

Officials have since alternated between warning American companies that they’d better eat the costs of the tariffs, telling American consumers they need to tighten their belts for a while, and assuring voters they will find savings in other areas—even when the math doesn’t add up.

The administration has said the tariffs will help bring manufacturing back to the U.S., but even if that’s eventually true, the markets are being overly optimistic in the short term, Dimon said Monday.

“Even if you wanted to bring all that manufacturing back, it takes three to four—at minimum, to build a real manufacturing plant—years,” he said.

Last week, Dimon said there was still a very real chance the U.S. economy could enter a recession as consumer confidence hit near-record lows.

Retailers such as Walmart–which analysts view as a bellwether of U.S. consumer health—have said they can’t absorb the extra costs of the tariffs, and that customers would see higher prices by the end of the month.

The post America’s Top Banker Raises Alarm About Trump’s Latest Tariff Plan appeared first on The Daily Beast.