Courtesy of Ann Miura-Ko, Enke Bashllari, Anne Dwane, Karin Klein, Varsha Rao, Ava Horton/BI

Early-stage investors take some of the biggest — and boldest — swings in venture capital.

Our Seed 40 list, in its fifth year, spotlights the women who have done exactly that: find breakout talent early, and work alongside these founders to shape the future of tech. This year’s honorees have placed bets across some of 2025’s hottest verticals, from AI to health tech.

Perhaps it’s no surprise that these investors are drawn to founders with similar characteristics. Mathilde Collin, one of the new members on this year’s Seed 40 and Seed 100, told Business Insider she seeks out “a delicate balance between humility, self-awareness, and self-confidence.” “Enough self-confidence to inspire people to be on the journey with them, enough humility to get people to help them, enough self-awareness to work on themselves,” she added.

This list is compiled using data analysis supplied by Termina, a software platform spun out of Tribe Capital. Read the full methodology behind the list.

1. Laura Rippy

Laura Rippy

Managing partner and board member, Alumni Ventures

Notable investments: Daydream, Rent App, Barnwell Bio, Atomic Supply, TRM Labs, Believer.gg,

City: Boston

Rippy says that when the world is chaotic, startups are the most nimble, which is why she’s excited for this year.

“The pattern of 2025 so far is highly talented teams tackling big opportunities,” she told BI.

Based in Boston, Rippy has built a large network of school-related founders and investors. She runs two school-centric funds, Green D at Dartmouth College and Yard Ventures at Harvard, and she’s also the managing partner of Alumni Ventures, one of the most active VC firms in the world. Alumni brings VC investing to individual investors’ portfolios and manages more than 650,000 members.

Prior to joining Alumni Ventures in 2017, Rippy spent 14 years at the private family office Ripplecreek Partners.

2. Shruti Gandhi

Shruti Gandhi, Courtesy of Array Ventures

Founder and general partner, Array Ventures

Notable investments: Capsule, Eventual Computing, Mozart Data, Placer.ai, Rad AI, Runway.team

City: San Francisco

Gandhi’s track record shows she gets results for limited partners. In under a decade, the solo capitalist has returned her first $7 million fund at a fivefold multiple, with more companies still waiting to exit. A stream of acquisitions has sped along those distributions, including Simility, a fraud-detection company which sold to PayPal in 2018, just two years after Gandhi invested.

As a one-time startup founder, Gandhi decided to raise a fund in 2016 because she saw a need for more investors who rolled up their sleeves at the seed stage. Her fund, Array Ventures, helps technical founders close early sales and develop their go-to-market sales strategy.

3. Anne Dwane

Anne Dwane

Cofounder and partner, Village Global

Notable investments: Commontools, P-1 AI, AirGarage, Cherry, Pave, Grow Therapy

City: San Francisco

For a career investor like Dwane, AI has represented a generational shift, which is creating an exciting time to evaluate startups and founders for new investment opportunities.

“The last year has been like no other,” she told BI. “AI’s impact is just beginning to show up in legacy industries, where the gap between what’s possible and what exists remains wide.”

Dwane added that the industry is also experiencing a revolution when it comes to software development, which she said will allow more people to build companies.

Across Village Global’s three funds, Dwane’s deals have a cumulative holding value of more than $16 billion. Before Village Global, Dwane cofounded the veteran-focused news site Military.com and later served as the CEO of Zinch, a university-recruitment startup acquired by the edtech company Chegg in 2011.

4. Meltem Demirors

Meltem Demirors

General partner, Crucible Capital

Notable investments: Double Zero, CentralAxis, Ostium

City: New York

Demirors has had a busy year launching her new firm, Crucible Capital, which invests in energy, compute, and crypto startups. Crucible ended 2024 with $36 million in committed capital from a $50 million target fund and is now oversubscribed, Demirors told BI. The firm also recently made its third investing hire.

For Demirors, Crucible Capital is the natural extension of her long career as an investor outside the traditional venture capital space. Rather than spinning out of a VC fund, she built investment firms and asset managers in crypto while she was angel investing. Prior to launching Crucible, Demirors was the chief strategy officer at the digital-asset investment company CoinShares.

At Crucible, her LPs are mostly builders, operators, and investors, rather than institutional investors or funds of funds.

“I feel like Crucible is a bit of an anomaly and it can be challenging considering how clubby venture can be sometimes,” she said.

5. Mathilde Collin

Mathilde Collin, Courtesy of Front

Cofounder and executive chairperson, Front

Notable Investments: Retool, Mercury, Vanta, Copilot, Meter, Browser Use

City: San Francisco

Colllin cofounded Front, a customer service platform startup, in 2013 after working as a project manager at another startup. She served as Front’s CEO until October and is now its executive chairperson. Collin also angel invests in a variety of companies, which include the fintech banking startup Mercury and the tool-building platform Retool.

In founders, Collin looks for “a delicate balance between humility, self awareness and self confidence,” she told BI. “Enough self confidence to inspire people to be on the journey with them, enough humility to get people to help them, enough self awareness to work on themselves.”

6. Ann DeWitt

Ann DeWitt

General partner, Engine Ventures

Notable investments: Cellino, Bexorg, Matrisome Bio, Terragia, Anthology, Kano Therapeutics, Source Bio

City: Boston

DeWitt has spent her career helping companies build new transformative biotechnologies. She began in VC at the Massachusetts life sciences firm Flagship Pioneering, then moved to Sanofi, where she guided the pharma giant’s investments.

She joined The Engine, an MIT spinout, in 2018, two years after its launch. First as The Engine’s chief operating officer, then as a general partner, she supported the startup incubator and accelerator’s work with “tough tech” companies, offering an array of resources from lab space to capital for startups building in areas like climate and human health.

In 2023, DeWitt stayed on the investing side of the business when The Engine split its startup support operations from its venture arm. She highlighted Engine Ventures’ investment in Cellino, which announced in February plans to open a stem cell manufacturing facility on-site at Massachusetts General Hospital in partnership with the top health system Mass General Brigham’s Gene and Cell Therapy Institute.

7. Caterina Fake

Courtesy

Founder, Yes VC

Notable investments: Career Karma, Outschool, Public Goods, Jow, Running Tide

City: San Francisco

Fake is a serial entrepreneur, cofounding the photo-sharing service Flickr, which was acquired by Yahoo in 2005. She makes investments through Yes VC, her firm that invests in climate, AI, health and longevity, energy, and defense companies. She’s backed Etsy, Cloudera, Oura, and Adept.

She was also named to the VC firm Trac’s list of “SuperForecasters,” or people the firm considers “extraordinary” pre-seed and seed VCs. Fake has said that this ability to spot future unicorn companies, “plus strong networks and access, is an absolute requirement for angels and VCs.”

8. Trish Costello

Trish Costello

Founder and CEO, Portfolia

Notable investments: YourChoice, Bone Health Technologies, Canela Media, Eden GeoPower, Prime Roots, Lighthouse Pharma

City: San Mateo, California

Costello founded the venture fund Portfolia in 2014. The fund taps women investors to lead venture capital deals in areas such as women’s health, sustainability, active aging and longevity, and startups led by founders of color. Before that, Costello was part of the entrepreneurial ecosystem for more than two decades with her work as the cofounder of the Kauffman Fellows program, an education and leadership program for venture capitalists.

Costello told BI that while many venture firms slowed their investing pace last year because of market conditions, Portfolia closed 27 investments, adding to its more than 100 investments in the past five years. “Over the past year, we determined that the smartest trend was to stay consistent and disciplined and keep putting our money to work,” she said.

9. Julia Hartz

Stefan Wieland

Cofounder and CEO, Eventbrite

Notable investments: Doppler, Mmhmm, Nooks, Oliver Space, Socket

City: San Francisco

Hartz is the animating spirit behind Eventbrite’s mission to create a closer world through live experiences. She’s also an ardent supporter of early-stage companies.

Her angel investing portfolio includes Socket, a startup focused on helping companies secure open-source software, and Nooks, which is developing a fully autonomous sales assistant.

Before Eventbrite, Hartz helped develop television shows for MTV Networks and FX Networks.

10. Kirsten Green

Forerunner Ventures

Founder and managing partner, Forerunner

Notable investments: Chime, Faire, Hims & Hers, Daydream, Balance

City: San Francisco

For a seasoned consumer investor like Green, a visionary founder is only part of the equation — when she’s evaluating a potential startup investment, she’s also looking for which business models are going to make for knockout consumer experiences.

“The strongest businesses don’t just have a great product or compelling branding — they are structurally designed to scale in a way that enhances the customer journey, accelerates inevitable behavior shifts, and creates self-reinforcing business advantages over time,” Green told BI.

Green founded Forerunner in 2012 and has spent more than a decade investing in early-stage consumer companies such as the fintech Chime, the vision juggernaut Warby Parker, and the healthtech company Hims & Hers.

11. Varsha Rao

Varsha Rao

CEO, Zeal AI

Notable investments: Athelas, Grow Therapy, Sanas AI, New Lantern, Observo AI, Candid Health

City: San Francisco

Rao’s Zeal AI, an AI-powered restaurant scheduling platform that launched in November, is her latest venture in a storied career at consumer-focused companies. She first founded and co-led the e-commerce beauty site Eve.com, which Idealab acquired in early 2000 for $110 million. She’s held leadership roles at Airbnb, Gap’s Old Navy, and LivingSocial, which was acquired by its rival Groupon. Before Zeal, she was the CEO of the reproductive health platform Nurx, which merged with the telehealth company Thirty Madison in 2022.

She’s also an executive partner at the healthcare-focused VC firm Flare Capital Partners, primarily advising new and existing investments. She’s using her experiences as a founder and an investor to keep Zeal AI lean and focused on driving meaningful consumer growth, even amid market volatility. “Now is a really awesome time to build if you can manage your burn because there is going to be less competition,” she said.

12. Aileen Lee

Cowboy Ventures

Founder and managing partner, Cowboy Ventures

Notable investments: Branch, Dollar Shave Club, Drata, Ironclad, Guild, Mutiny Software

City: Palo Alto, California

It’s been over a decade since Lee coined the term “unicorn,” the once-rare feat for startups worth over $1 billion. She left Kleiner Perkins in 2012 to start her own firm, Cowboy Ventures, to invest in pre-seed to later-stage startups. Since then, a few of Lee’s notable exits include Dollar Shave Club, which sold to Unilever for $1 billion in 2019, and Trendyol, which Alibaba acquired for almost $750 million in 2018.

Lee told BI that she loves meeting founders who are “learning animals” and have a keen desire to build relationships, absorb information, and grow quickly.

“We don’t require product market fit or even a fully built product to want to invest in a team. We look for a unique insight into an underestimated category, and also pedigree, or a vision, for a way better solution to an existing huge problem,” she said.

13. Ling Wong

Founder, CEO, and general partner, Highbury Group

Notable Investments: Anacor Pharmaceuticals, Visterra, Slack, Guardant Health, Singular Genomics, ScienceIO

City: Seattle

Wong founded Highbury Group in 2013. She invests in science-driven startups, though she has backed some major SaaS players, such as Slack, as well.

Her technical background helps her assess some of the most technical startups. Wong got her masters and a doctorate in applied sciences, bioengineering, entrepreneurship, and global health from Harvard University and bachelor’s degrees in chemical engineering and biology from the Massachusetts Institute of Technology.

14. Sara Deshpande

Sara Deshpande

General partner, Maven Ventures

Notable investments: Hello Heart, Daybreak Health, Medeloop, Wildtype, Carrot Fertility, Gondola AI

City: San Francisco

Deshpande has been building Maven Ventures alongside its CEO, Jim Scheinman, since 2014. At Maven, she makes seed investments in companies capitalizing on emerging consumer trends, from areas like fertility care (Carrot Fertility) to sustainable seafood (Wildtype). She said she’s known for her “tough love” approach with founders. “I try to be the most honest voice they can have about the risks and opportunities related to the company they’re pursuing,” she said.

Deshpande is also a board observer at Daybreak Health and Medeloop. Beyond her day job at Maven, she helps teach a course at Stanford Graduate School of Business called Startup Garage, where students devise and stress-test new business ideas. In fact, she invested in Medeloop after its founder got the idea for the AI-powered medical research platform based on Deshpande’s advice during the course.

15. Gale Wilkinson

Gale Wilkinson

Managing partner, Vitalize Venture Capital

Notable investments: Elevate K-12, Groundfloor, Placer.ai, Upwage, Upwards, Statusphere

City: Chicago and Nashville, Tennessee

Wilkinson invests in companies working to change how we work. That focus paid off big time during the pandemic as companies moved dramatically toward digital channels. To date, she’s invested in over 100 companies and deployed more than $70 million in capital.

One of Wilkinson’s portfolio crown jewels is Placer.ai, a startup that turns location data into market research for companies. Last year it crossed $100 million in annualized revenue.

16. Elizabeth Weil

Elizabeth Weil

Founder and managing partner, Scribble Ventures

Notable Investments: Whatnot, Stoke Space, Omni, Certn, Lemi, Streamline AI

City: San Francisco

A former Twitter exec and partner at Andreessen Horowitz, Weil cofounded Scribble Ventures in 2020. But she’s been investing for well over a decade, making over 100 angel investments across all stages, including in Slack, SpaceX, Figma, Coinbase, Superplastic, Gusto, Tipalti, Envoy, Daily, and Carta. At Scribble, Weil invests in pre-seed and seed rounds and will write initial checks of up to $1.5 million.

The rocket developer Stoke Space, one of Scribble’s early investments, is preparing its initial launch plans at Cape Canaveral in Florida after being awarded the launchpad space by the US Space Force. The startup also just announced a $260 million Series C round in January, with the launch site to be ready by the end of the year. “We dig in with our founders on product, hiring, and go-to-market because these are the two most precarious — and pivotal — elements of early-stage success,” Weil said.

17. Juliana Garaizar

Juliana Garaizar

Venture partner, Porfolia and ClimaTech Global Ventures

Notable Investments: Cemvita Factory, Syzygy Plasmonics, Canela Media, Kauel, Suma Capital, Portfolia

City: Houston

Garaizar invests with ClimaTech Global Ventures, a firm that invests in early-stage, cross-border startups using AI in the climate tech space. She’s also a partner at Portfolia, a firm based in San Mateo, California. Previously, Garaizar was the chief development and investment officer at Greentown Labs, a climatetech startup incubator. One of her investments, Cemvita Factory, is a biotechnology startup that converts carbon dioxide into compounds to make products like oil.

When asked about the future of her portfolio, Garaizar was enthusiastic about its opportunities for overseas expansion: “I am very excited about the international expansion of my portfolio companies such as Cemvita Factory in Brazil, Canela Media in Latin America and Spain, and Kauel in Europe,” Garaizar told BI.

18. Rudina Seseri

Rudina Seseri

Founder and managing partner, Glasswing Ventures

Notable investments: Basetwo, Reprise, Ship Angel, Telmai, Verusen

City: Boston

Seseri and her firm, Glasswing Ventures, know how to cut through the hype and find companies designed with artificial intelligence at its core, not as an afterthought. She leads the firm’s investments in startups harnessing this tech to drive measurable value and enterprise growth.

She also sits on boards including Basetwo, a low-code platform for manufacturing engineers, and Reprise, an Iconiq Growth-backed startup that helps companies create software demos.

Seseri spent her early career at Credit Suisse and Microsoft, where she was a senior manager in corporate development and led several successful acquisitions.

19. Enke Bashllari

Enke Bashllari

Founder and managing director, Arkitekt Ventures

Notable investments: Mural Health, CertifyOS, Paradromics, Nanite, Cofertility, Handspring Health

City: New York

Bashllari launched Arkitekt Ventures in 2017 to back early-stage startups advancing human health. A neuroscientist by training, she’s invested in dozens of startups across healthcare and biotech, from the egg donation startup Cofertility to the gene delivery company Nanite to the brain implant maker Paradromics. She’s an advisor for Harvard Business School’s dual MBA and Master of Science life sciences program, having received multiple degrees herself — an MBA from Harvard and a Ph.D. from Columbia University.

She said evaluating founder-market fit is particularly critical in life sciences investments. “These legacy industries have deeply entrenched structures and complexities — it’s crucial for founders to truly understand the nuances of the space, the market dynamics, and stakeholder incentives to successfully build and scale their company,” she said.

20. Lan Xuezhao

Lan Xuezhao

Founder and managing partner, Basis Set

Notable investments: Quince, Sakana, Workstream, Ergeon, Rasa

City: San Francisco

Xuezhao studied the human mind for her doctorate in psychology at the University of Michigan. Little did she know that studying psychology would be useful for investing in AI, which is programmed to mimic how a human brain works.

Xuezhao is something of a sage when it comes to AI investing. When she started her firm, Basis Set Ventures, in 2017, few other venture capitalists focused on the field. She’s among the early investors in startups including Quince, Sakana and Workstream. Before getting into venture capital, Xuezhao built out the corporate development strategy team at Dropbox, using her years of experience at McKinsey helping tech companies with their growth strategies.

21. Ann Miura-Ko

Floodgate

Cofounding partner, Floodgate

Notable investments: SmarterDx, Roo, Hebbia, Nooks, Thinkful, Studio, Emotive

City: Menlo Park, California

Miura-Ko, who has a Ph.D. from Stanford and is a lecturer there, has been dubbed “one of the most powerful women in startups.” As the cofounding partner of the seed-stage VC firm Floodgate, Miura-Ko and the firm made early bets on Lyft, Twitter, Twitch, and Okta. Her passion for technology started when she was a child, inspired by her father’s work as a rocket scientist at NASA, and continued during her studies at Yale, where she took part in robotics competitions around the world.

Her recent early investments are gaining traction. In the past year, the AI document search startup Hebbia has raised $130 million in a funding round led by A16z. As for what Miura-Ko is interested in investing in, she told BI: “We’re excited about founders that are willing to look beyond immediate efficiency gains and instead envision entirely new ways of working, collaborating, and creating value through AI.”

22. Jenny Lefourt

Freestyle

General partner, Freestyle

Notable investments: Discord, BetterUp, Crexi, Artera, Narvar

City: San Francisco

Lefcourt is a two-time founder (WeddingChannel.com and Bella Pictures) and a partner at Freestyle, an early-stage venture firm that’s sector agnostic and leads seed rounds with funding between $2 million and $4 million.

As one of the few women to ascend to the highest ranks of venture capital, she cofounded All Raise, a nonprofit dedicated to increasing diversity in tech.

In the past year, she invested in Payman, which enables AI agents to move money safely, and Keebler Health, which specializes in AI-driven solutions for healthcare providers.

“Given how quickly AI is evolving, I look for founders who are constantly learning and can react fast to harness AI for maximum impact,” Lefcourt told BI.

23. Yun-Fang Juan

Yun-Fang Juan

General partner, Brighter Capital

Notable investments: Creatify, Little Otter, Expo, Chowdeck, Reddit

City: Cupertino, California

Juan was one of the first 150 employees at Facebook, where she co-created Facebook Ads. She then worked at several startups, including Khan Academy, before she took the ultimate entrepreneurial plunge and founded Fundastic, which looked to provide small businesses with information on funding options.

Juan previously told BI that even though Nav bought her company in 2015, the windfall wasn’t massive, and she considered it a failure. But she said she gained valuable perspective from the experience that had helped her guide other startup founders as an investor.

Juan said she really admired what the AI startup Perplexity was doing and wished she were an investor. “I am basically looking for founders who are like the Perplexity team, and I will just give them the money and have them figure things out,” she said.

24. April Underwood

April Underwood

Managing director and cofounder, Adverb Ventures

Notable investments: Particle, Untold, Shotsy

Location: San Francisco

Underwood is the embodiment of a builder VC, having held product, partnership, and engineering roles at Slack, Twitter, Google, and Intel. While at Twitter, Underwood started investing in startups through #Angels and personally backed companies like Color, Cue Health, and Carta. She also sits on the boards of Zillow Group and Eventbrite.

In 2023, Underwood teamed up with her fellow Twitter alum Jessica Verrilli to form Adverb Ventures, a $75 million fund focused on early-stage investments. One of Adverb’s recent investments, Shotsy, a GLP-1 companion app, breezed past $1 million in subscription revenue in under nine months on the market, Underwood said. As for what she looks for in a founder, Underwood said: “Founders who roll up their sleeves and just start building before waiting for permission get me excited.”

25. Leah Solivan

Leah Solivan

General partner, Fuel Capital

Notable investments: Pacaso, Upwards, Collaborative Robotics, MiSalud

City: San Francisco

Solivan founded TaskRabbit in 2008 and was CEO of the online marketplace for freelance laborers for nearly eight years before it was acquired by Ikea in 2017. That year, she joined Fuel Capital, where she has helped fund Pacaso, a vacation coownership company, and Upwards, formerly known as Weecare, one of the largest childcare networks in the US.

“I look for founders who are obsessed with solving a specific problem because he or she has a personal connection to it,” Solivan told BI. “We call it founder-market fit.”

26. Emily Kirsch

Emily Kirsch

Founder and CEO, Powerhouse

Notable Investments: Amperon, Pearl Street Technologies, Terabase, Presto, ThinkLabs, Tyba

City: Oakland, California

Kirsch has been interested in climate policy for nearly two decades. She began her career working for the Ella Baker Center for Human Rights, where she worked with local California businesses on the state’s Energy and Climate Action Plan. In 2018, she founded Powerhouse Ventures, which works with global corporations such as Google and The Rockefeller Foundation to back climate-focused, seed-stage startups working on decarbonization efforts.

In 2019, she was elected a Young Global Leader by the World Economic Forum and began serving on the advisory board for the New York State Energy Research and Development Authority, which supports the development of clean tech innovation and programming in New York.

When assessing founders, Kirsch opts for those with strong technical prowess and a differentiated approach to a major bottleneck. Her biggest win so far in 2025 has been the energy SaaS company Enverus’ acquisition of the automation interconnection solutions company Pearl Street Technologies, Kirsh told BI. “Their CEO David embodies exactly the kind of founder we love to back — understated, brilliant, and deeply technical.”

27. Noramay Cadena

Noramay Cadena

Managing partner, Supply Change Capital

Notable Investments: FoodReady, Cargologik, Hyfé, Michroma, Canela Media, Terrantic

City: Los Angeles

Cadena is an engineer turned investor. She studied engineering at the Massachusetts Institute of Technology and began her career at Boeing, eventually leading a team that coordinated support for 400 mechanics on one of the first 787 airplanes. At Supply Change Capital, Cadena invests in environment, health, and diversity-focused startups, according to its website.

“This is a critical time to invest in technology across the food supply chain as a driver for health, consumer preference and efficiency,” Cadena told BI. “Food safety, nutrition, and cost of goods are top of mind for all stakeholders and Supply Change Capital invests in infrastructure technologies to improve the flow of data and goods.”

28. Alice Zhang

Alice Zhang

Cofounder and CEO, Verge Genomics

Notable investments: Osmind, Asher Bio, Arpeggio, Encellin, Multiply Labs

City: San Francisco

Zhang has spent the past decade building the biotech startup Verge Genomics to use AI for better, faster drug discovery. Since then, Verge has raised $180 million from top firms including BlackRock, Merck Global Health Innovation Fund, and Y Combinator. The startup also notched a deal with the pharma giant Eli Lilly in 2021 to develop drugs for the neurodegenerative disease amyotrophic lateral sclerosis, or ALS.

As an angel investor, she’s backed the immunotherapy-focused biotech startup Asher Bio, which raised a $55 million Series C in April 2024, and the biopharma robotics startup Multiply Labs, which notched an $85 million contract with the Sam Altman-backed Retro Biosciences in May 2024.

29. Lu Zhang

Lu Zhang

Founder and managing partner, Fusion Fund

Notable Investments: Otter.ai, Proscia, Subtle Medical, You.com, Vectara, Lepton AI

City: Palo Alto, California

Zhang’s Fusion Fund, which invests in healthcare and enterprise AI startups, celebrated its 10th anniversary this year and closed a $190 million fund, roughly $40 million oversubscribed, bringing its total assets under management to more than $500 million. “It’s a key milestone that reflects our decadelong commitment to backing technical founders building transformational companies,” Zhang told BI.

Zhang sold her healthcare startup, Acetone, which made medical devices for testing type 2 diabetes, and founded Fusion Fund by the age of 25. In 10 years, Fusion Fund has invested in at least five unicorns, such as the food tech startup GrubMarket and the DNA analysis company Element Biosciences, as well as cutting-edge AI startups including You.com and Otter.ai.

30. Linda Xie

Linda Xie

Cofounder, Scalar Capital

Notable investments: Farcaster, dYdX, StarkWare, Zora, Sardine, Pulley

Xie invests in crypto companies alongside working her day job as the developer ecosystem lead at Farcaster. One of Xie’s early bets, Sardine, recently raised $50 million in Series B funding. Xie highlighted her in-depth experience in the crypto industry as helping her as an investor.

“I’ve been working in crypto full time for 11 years, so have seen a lot and found that I’m often able to help founders most as a sounding board, share what else I’m seeing out there, and help make connections to others in the ecosystem,” Xie said.

31. Jana Messerschmidt

Courtesy of Jana Messerschmidt

Founding partner, #ANGELS

Notable investments: Vanta, Anchorage, Roam, Lovevery, Daydream, Ashby

City: San Francisco

Before becoming a venture capitalist, Messerschmidt worked in tech at companies including Netflix and Twitter, now X, where she spent six years as its vice president of global business development and platform. A few years after leaving Twitter, she joined Lightspeed Venture Partners as a partner.

In 2015, she cofounded #ANGELS, a venture capital firm founded by former female tech execs that works to close the gender gap among investors and founders.

32. Julie McDermott

Julie McDermott

Startup investor and advisor

Notable investments: Hazel AI, Queen of Raw, Kernal Biologics, Orda, TomoCredit, Conekta

City: New York

After a decadelong career on Wall Street as a bond trader, McDermott decided to turn her attention to the tech startup world. She’s since become known as an advocate for female founders and an active angel investor. She was an early backer of Maven, a women’s digital-healthcare company last valued at $1.7 billion in 2023. (McDermott sold her stake in 2020.)

McDermott has focused on other investments in sustainability, biotech, and fintech, such as the startups Conekta and Eggschain. Later this year, she plans to turn more attention to ocean tech startups, which she sees as a “huge opportunity.”

“I often look for companies that are moving the needle in an impactful way for society,” she told BI.

33. Caroline Casson

Caroline Casson

Seed investor

Notable investments: AllVoices, Elevate K-12, Lunch, Placer.ai, WorkMade, Zingtree

City: Madison, Wisconsin

Casson bets on founders with big ideas about how the workforce can work better. Her portfolio includes WorkMade, a fintech helping freelancers keep track of their earnings and pay taxes, and Elevate K-12, an edtech company working to address the nationwide teacher shortage.

Casson cut her teeth as an investor at GE Ventures, where she helped incubate and operate a startup in the drone space. Then she went to IrishAngels, an angel network of Notre Dame-affiliated investors, before settling in at the seed-stage venture fund, Vitalize Venture Capital.

She recently left Vitalize after over six years to pursue a new, unannounced opportunity.

34. Serena Williams

Serena Ventures

Managing partner, Serena Ventures

Notable investments: Chatdesk, Daily Harvest, Esusu, MasterClass, Rebel

City: Jupiter, Florida

When Williams took a step back from tennis in 2022, she jumped into investing with both feet. The tennis champ raised a massive $111 million fund, a testament to her relationships and competitive edge. Williams invests in consumer brands and software companies that positively impact “the everyday lives of everyday people,” she said during an event late last year.

Her firm stands apart from traditional investors because it focuses on underestimated founders. According to a spokesperson, around half of the portfolio companies were founded by women.

35. Cyan Banister

Founders Fund

Cofounder and partner, Long Journey Ventures

Notable investments: AtoB, Roadster, Forge, IRL, ClassPass

City: San Francisco

Banister has been seed investing for more than a decade and has backed SpaceX, Uber Technologies, and DeepMind. She was previously a partner at Founders Fund and worked at AngelList. She recently raised a $181 million fund with Arielle Zuckerberg for their firm, Long Journey.

Banister told Bloomberg that Long Journey aims to “look for those magically weird people and to find them before it becomes consensus.” “There’s always a pocket of dreamers and weirdos. You just have to know where to look,” Banister said.

36. Maria Salamanca

Maria Salamanca

Partner, Ulu Ventures

Notable investments: Parfait, Career Karma, Maximus, Pine Park Health, KaiPod

City: San Francisco

Before joining Ulu Ventures in 2022, Salamanca was a partner at Unshackled Ventures, where she focused on seed investing in teams with immigrant founders. From 2015 to 2022, Salamanca helped make more than 75 seed investments at Unshackled. She was also an early team member at FWD.us, an immigration lobbying group founded by Mark Zuckerberg, Bill Gates, and other tech leaders.

When asked what she looks for in a startup before she invests, Salamanca said she assesses how they will use time, not money. “I look for speed of execution, relentless prioritization, and the ability to define the toughest problems that must be solved to de-risk and unlock the next phase of the company,” Salamanca told BI.

37. Holly Liu

Holly Liu

Cofounder and managing partner, PKO Investments

Notable investments: Crypto Art House, Jadu, Lootex, NZXT, Playhouse, Quidd

City: San Francisco

Liu founded the mobile game company Kabam in 2006, and she grew the startup for more than a decade until it was acquired for $1 billion in 2017 by South Korea’s NetMarble Games.

Since 2021, Liu has been running PKO Investments, the VC fund she cofounded that focuses on early-stage startups at the intersection of tech and entertainment in sectors including the metaverse, Web3, crypto, the creator economy, gaming, and social media. So far her fund has raised more than $27 million from over 370 investors, and written checks to 33 startups, including Roboto Games, Lovo, and Pixels.

38. Karin Klein

Karin Klein

Founding partner, Bloomberg Beta

Notable investments: Anagram, Atolio, Bluefish, Campus, MelodyArc, Shield AI

City: New York

Klein is the founding partner of Bloomberg Beta, the venture arm of Bloomberg. Before helping to launch the firm, she led several initiatives at Bloomberg.

She previously worked at SoftBank, leading the division that reviewed new investments; MC Group, a communications agency; and the education company Knowledge Universe.

Bloomberg Beta has been at the forefront of AI, investing in the space long before it was in vogue. She continues to be excited about this area. “As a firm that has been investing in the future of work since 2013 and AI since 2014, it’s rewarding to see new opportunities continue to emerge that make work better,” Klein told BI.

She highlighted startups such as Bluefish, which helps brands navigate the new world of LLMs, Folio, which enables employers to hire job-ready students, and Synaptic, which uses AI agents to optimize Salesforce integrations.

39. Nisha Dua

Nisha Dua

Cofounder and managing partner, BBG Ventures

Notable investments: Spring Health, SuperCircle, Starface, Millie, HopSkipDrive, Nara Organics

City: New York

Dua tried on many hats throughout her career before settling on venture capital. She spent six years as an M&A lawyer at the Australian law firm Blake Dawson before moving to Bain & Co. as a management consultant, and then to the internet provider AOL, where she managed its pop culture website Cambio.

At AOL, Dua created Built by Girls, a software platform that connected young women with tech professionals. Then, backed by AOL, she cofounded BBG Ventures, using that acronym to invest in companies with one or more female founders.

BBG Ventures spun out of AOL in late 2018. The firm now invests at the pre-seed and seed stages in often overlooked founders tackling areas like healthcare, education, and financial security. Spring Health, which Dua first backed in 2018, raised a $100 million Series E round at a $3.3 billion valuation in July.

40. Hayley Barna

Hayley Barna

Partner, First Round

Notable investments: Mirror, Caper, Alma, Studs, Arbor, Brellium

Location: New York

After a stint in management consulting at Bain, Barna cofounded the subscription company Birchbox in 2010. She moved over to the investing side in 2016 to join First Round Capital to lead its New York office, where she has focused on commerce, supply chain, climate, and healthcare.

“Right now, I’m most excited about a wave of seed-stage companies (still in stealth) applying AI to transform healthcare operations and patient experience,” Barna told BI. “These founders are tackling real-world pain points with potential for outsized impact on cost and quality of care.”

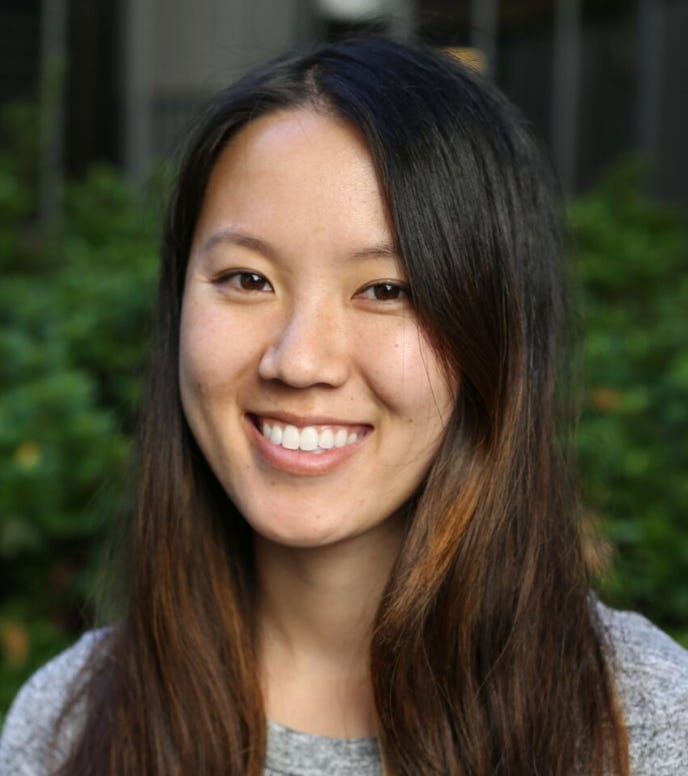

Interactive development by Annie Fu and Randy Yeip.

The post The Seed 40: The best women early-stage investors of 2025 appeared first on Business Insider.