Getty Images; Matt Rourke/AP Photo; Alyssa Powell/BI

Last November, only six days after his father was elected president, Donald Trump Jr. made a career move that, on the surface at least, seemed a bit odd. He became a partner in a small investment startup called 1789 Capital, which is based in Palm Beach, Florida, 2 miles from Mar-a-Lago. At that point, 1789 was a microscopic player in the world of venture capital. It had raised less than $200 million, and it hadn’t made many investments beyond leading a group that put $15 million into Tucker Carlson’s new media company. Its goal, according to its founders, is to create a “parallel economy,” investing in “anti-woke” businesses that align with MAGA values.

Ever since Trump joined 1789, its portfolio has begun to blossom. Despite its tiny size, the firm has been granted shares in several coveted offerings, including Elon Musk’s SpaceX. The shares, which are widely viewed as an almost certain home run, are essentially an insider deal: To participate in the offering, you typically have to receive an invitation from someone already in the club. In addition, 1789 has invested in Musk’s artificial intelligence company, xAI, as well as a handful of startups that have received or are vying for contracts from the Defense Department. Almost overnight, a VC firm involving the president’s son has become a significant beneficiary of the federal bureaucracy long derided by President Trump as “the swamp.”

There’s nothing wrong with an investment company making bets based on its connections — that’s an integral part of the VC game. And there’s no evidence that any of 1789’s deals break laws prohibiting favoritism to individual contractors. But given their potential for creating a conflict of interest, the firm’s investments have alarmed Washington insiders familiar with the process. What’s more, the Trump administration’s lack of transparency — particularly around moves being made by Musk and DOGE — makes it impossible to tell if the president’s family is improperly making money by funneling government business to the companies it invests in.

“This certainly raises serious concerns about the appearance of corruption, because Trump’s family is benefiting,” says Laura Dickinson, a law professor at George Washington University who has served as special counsel for the Defense Department. “And when you look at this in the context of arbitrary cuts to other programs, it raises questions about whether preferential treatment is being given to family and others who curry favor with Trump.”

It’s not just legal experts who have concerns about the money flowing to Don Jr. One veteran Wall Street investor, who has personally reviewed 1789’s deals, says they enable the president’s son to profit from the administration’s actions, even if no contractors are given preferential treatment. “It’s a way for Mar-A-Lago to get paid,” says the investor, who spoke on the condition of anonymity for fear of retribution from the Trump administration. (Both the Trump Organization and 1789 declined requests for comment.)

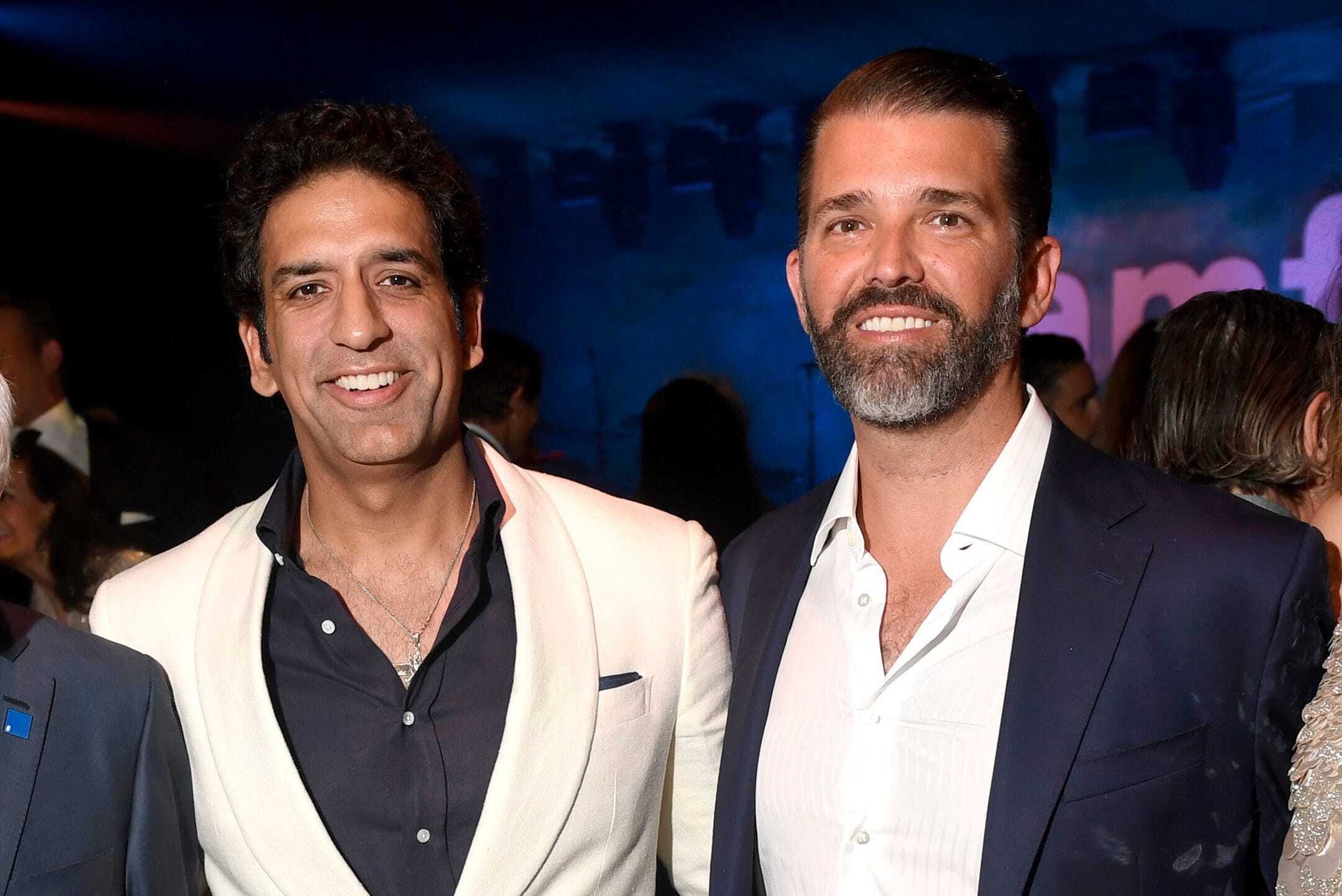

Ryan Emberley/amfAR/ Getty Images

One of 1789’s biggest bets in its push to monetize MAGA has come courtesy of Musk. According to Bloomberg, the firm has invested more than $50 million in SpaceX and xAI — the kind of opportunity usually reserved for deep-pocketed insiders, not tiny funds with no track record. The move comes at a time when the Trump administration — which has empowered Musk and DOGE to redirect vast swaths of federal spending — has reportedly been moving to channel billions in taxpayer dollars to SpaceX for the use of its Starlink satellite system. In addition, the company has been awarded a $5.9 billion contract from the US Space Force to launch critical national security payloads. The deal, announced April 4, makes SpaceX the Pentagon’s leading launch provider, surpassing an industry rival owned by Boeing and Lockheed. That means as SpaceX benefits from government contracts, 1789 — and the president’s son — stand to share the wealth.

1789 is also investing in other companies being awarded lucrative defense contracts. Anduril, a highly regarded defense technology firm, is now raising up to $2.5 billion. The backers of the new fundraising round have not been revealed — but I was able to confirm from multiple sources that 1789 is among the investors. Anduril has thrived under the Trump administration: In February the company won a $22 billion defense contract to provide soldiers with augmented reality goggles. A few weeks later, it beat out nine competitors to win a $642 million contract to build a network of anti-drone defenses for military bases. Given the company’s prospects, investors have been fighting to get shares in the company.

Axiom Space — a Houston company that is seeking a contract with NASA to build a successor to the International Space Station — has been in discussions with 1789 to raise at least $100 million in fresh equity. And in January, 1789 led a $60 million fundraising round for Firehawk Aerospace, a Dallas tech company focused on supplying the military with 3D printed rocket fuel. In April, Firehawk landed a $1.25 million defense contract to conduct a study of its manufacturing systems. That month, the company posted a photo on LinkedIn of its founder posing with Gen. James Rainey, the leader of Army Futures Command. With them was the founder of Aeon Industrial — another defense contractor in 1789’s portfolio — who had just received a weapons contract from Rainey’s command.

“It creates a very complex ethics situation,” says Scott Amey, the general counsel at the Project on Government Oversight, a leading watchdog group. “If the son of the president is benefiting from these deals, even if there’s a few degrees of separation, is there a level playing field? We just don’t know.”

Don Jr.’s investments are a long way from the days when Washington got worked up over Jimmy Carter’s brother marketing his own beer brand. “I’m old enough to remember when it was completely shocking that the president’s brother was selling Billy Beer,” says Nell Minow, the vice chair of ValueEdge Advisors, who has served as a government attorney at the EPA, the Office of Management and Budget, and the Justice Department. “Back then, there was no suggestion of a connection to access or policy or contracts — it was just considered unseemly.” With 1789, she adds, “We’ve gone to a whole new level: This is a flashing red light of a conflict.”

Don Jr. is far from a passive bystander in 1789. According to Politico, he and his fellow partners at the investment firm have launched an invite-only club called the Executive Branch that will cost more than half a million dollars to join. Located in Georgetown, the high-end club will enable business and tech moguls to schmooze with administration insiders behind closed doors — and simultaneously creating a source of potential deals for 1789.

Even some insiders who have worked closely with Trump and his family see such efforts as improper. “What they’re doing is selling access to the president via the back door,” says someone who knows the Trumps well. “Imagine for one second if Hunter Biden had opened this club while Joe Biden was president. The Republicans would be screaming not just for his head, but for a complete and total dismemberment of his body. It’s beyond hypocritical.”

Don Jr.’s involvement in 1789 bears an eerie resemblance to what Trump blasted Hunter Biden for doing: trading on his father’s name to win lucrative business deals with countries like Ukraine and China. During the 2020 campaign, Don Jr. offered to debate Biden, insisting that Hunter’s nepotism far outstripped his own. “I’m not going to say I haven’t benefited from my father’s last name, just like Hunter Biden did,” Don Jr. told Axios. “That’d be foolish to say that. But I haven’t benefited from my father’s taxpayer-funded office.”

Now, as a freshly minted venture capitalist, Don Jr. is explicitly gearing up to cash in on the next four years of his father’s presidency. In the three months since Trump was inaugurated, 1789 has raised some $500 million. According to Bloomberg, the firm is aiming to collect $1 billion for its first fund by the middle of this year, and another $3 billion to $5 billion for a second fund next year. Whatever the legality of 1789’s investments, it appears the president’s eldest son stands to profit handsomely from the federal contracts his father’s administration is handing out. Even if there’s no pro quo involved, there’s still plenty of quid.

Bethany McLean is a special correspondent at Business Insider.

The post How Donald Trump Jr. is cashing in on his dad’s presidency appeared first on Business Insider.